The Best CRM For Financial Advisors (CRM Software for Financial Services)

This post contains affiliate links. If you’re a financial advisor, you need a CRM. A CRM, or client relationship management software, is the best way to keep track of all the leads, prospects, and clients you have. I personally recommend Capsule and you can take advantage of their free 30-day trial here. Here’s what we’ll cover in this article:

How a CRM Doubled A Financial Advisor's Income

Let me introduce you to John (not his real name). John is a financial advisor with a financial services company and he sent me this email:

Your advice about setting up and using a CRM was what really did it for me. I know it was a small tip but I never used a CRM and was winging everything. Now that I am focused on my numbers, my income has essentially doubled. I love getting emails like this because it makes me feel good about what I’m doing. But I wanted to take the time to let you know that if you’re not using a CRM, it will be a game-changer for you. A CRM (customer relationship management) software allows you to track all of your interactions with prospects and customers. This means your emails, phone calls, voicemails, and in-person meetings. It does require some data entry and a little bit of a learning curve, but the time investment is well worth it. Those in financial services need to use a CRM because past a certain point, contact management becomes a burden. If you can’t keep track of your leads, prospects, and clients, you cannot grow or scale. Here's why John has reportedly doubled his income in four months: 1. He has access to all necessary data.

One of the biggest reasons John’s income doubled in four months is because his CRM allowed him to increase his productivity. For financial advisors, insurance agents, and many other financial professionals, income is closely tied to time/productivity. Spending precious time searching through an inbox or call log to get a prospect’s number or information is a huge waste of time. Because a CRM is a full, accurate record of your entire interaction history, you will never second guess yourself again. You literally just pull the CRM up and look at your data. A good CRM will record things like call history, calendars, appointment reminders, meeting notes, etc. Now, all John has to do in the morning is show up at the office and pull up his CRM. It will tell him who he needs to follow-up with, who he needs to send thank-you notes to, and so on. Having this data right at your fingertips can improve your productivity by showing you exactly what you need to do and when. Plus, he can see exactly how many prospects are in his pipeline at any given time. There's no more guessing and no more mistakes. He knows when should amp up his prospecting efforts to refill his pipeline. ALSO READ: 10 Of My Favorite Productivity Tools For Financial Advisors 2. He streamlined his entire process. When was your last follow up with Prospect A? Have you sent the necessary mail pieces to Prospect B? Questions like these become easily answered when you use a CRM. Without a CRM, it’s tricky to track activities in such a way that forms a coherent picture. CRMs keep your data entry uniform, allowing you to see the big picture and understand where you stand relative to your personal goals. In a nutshell, this is what John did with his CRM:

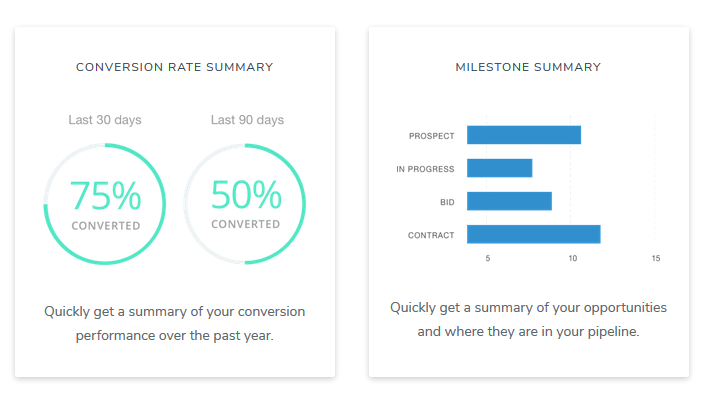

3. He has metrics that allow him to predict his future. When you have metrics, you have control. I’m pretty sure that in the process of reviewing his data, this “clicked” for John. He realized that if his current actions were making him $50K per year, a more productive route would easily make him double that. A CRM gives you a reasonable expectation of your future based on your past performances and past events. However, when you see that a particular “bucket” is responding well to a tactic, you can crank it up. Or if you see that one “bucket” isn’t responding at all, you cut out what you’re doing and do something more productive. Goal setting becomes much easier when you use a CRM because you can see your pipeline and get an accurate feel for how much business you can expect in the weeks and months ahead. One of the biggest "quick wins" a financial advisor can experience is to know his/her numbers in business. For example, if you know that out of every 100 contacts, you set 10 appointments, you can now reverse-engineer what you need to do to set the number of appointments you want. Once you know how many contacts it takes to set an appointment and how many appointments it takes to get a client, it's relatively easy to grow your business. The reason financial advisors should invest in a good CRM is because the CRM will put those numbers right in front of them, allowing them to make smarter business decisions. 4. He has room to scale. Back when John was manually tracking every interaction with his prospects and clients, he felt stressed out and felt as if he couldn’t possibly do more. A lot of financial services professionals feel this way – they feel like their income is capped because they just can’t “do more” in a day. With two, five, ten, or even twenty clients, tracking every interaction is possible. But think ahead. Don’t you want growth? Do you want to get more clients? Your ability to increase revenue is dependent on contacting the right prospects, at the right time, with the right information. You can’t do this effectively without a CRM. You might think that you can keep everything stored in that gigantic brain of yours, but it doesn’t always work as expected. Do you really want to limit your business by what you’re doing now? If you can only manage X clients successfully with your current system, you have stopped your business from growing any larger. With a CRM you can store and manage hundreds, if not thousands, or clients and let a computer handle the memory and recall. All John did was take advantage of current technology and use it for business success. A CRM's "Secret Weapon"...One of the biggest reasons why I encourage financial advisors to use a CRM is because a good CRM will allow you to optimize your marketing over time.

For example, let's say you send out a direct mail campaign and use a unique phone number so you can track it. Whenever a prospect calls that unique number, you can tag him or her as originating from your direct mail campaign. Another way to "level up" your business with a CRM is by integrating it with all of your other tools and software. I know several financial advisors who have integrated their email autoresponder with their CRM so they can see whenever prospects have taken action because of an email. Good CRMs can also integrate with accounting software such as QuickBooks and FreshBooks, so you can track the value of your clients over time. This means getting a clear view of your client's lifetime value can be as easy as a few clicks. The Best Financial Advisor CRM

When it comes to CRMs for financial advisors (and the financial services industry as a whole), I personally recommend Capsule.

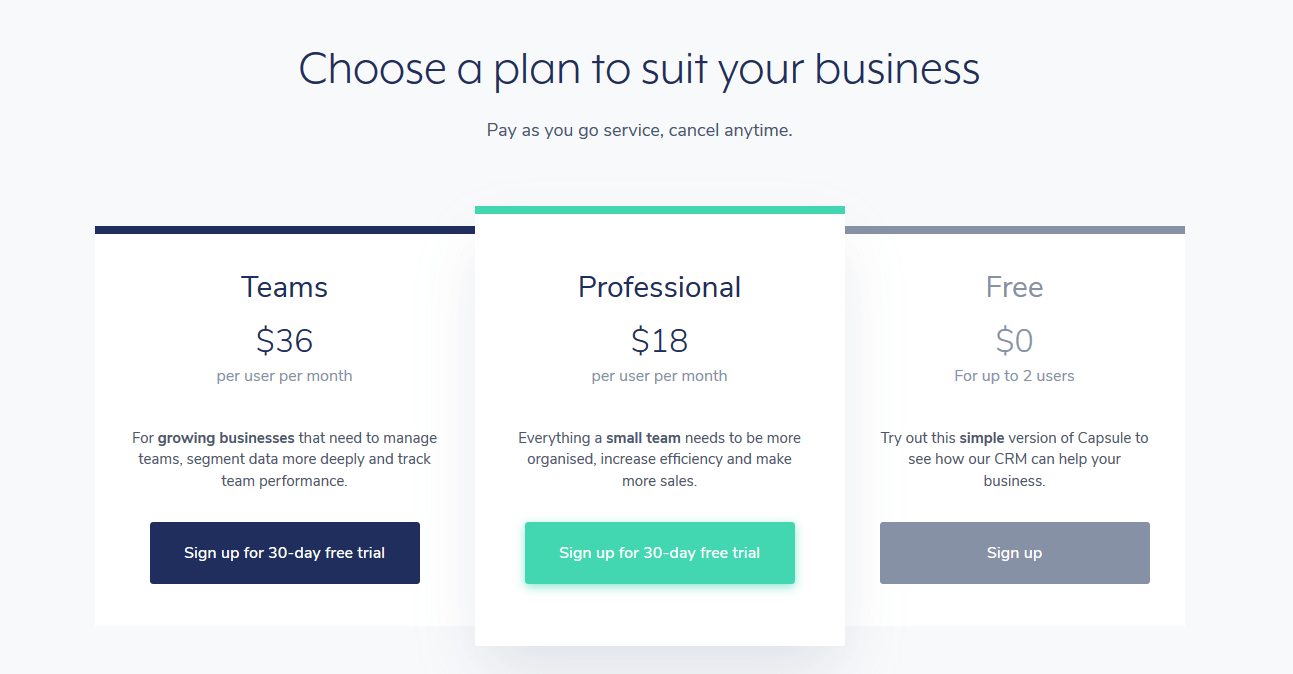

When I was looking for a CRM to recommend, I looked for something that was simple, easy-to-use, inexpensive, and had good customer support. Capsule has all of the above and more, which is why I think it's the best CRM for financial advisors. Capsule’s CRM comes in two editions – a free version and a paid version. The free version allows you to store up to 250 contacts, which might be all you need. In fact, I know a lot of financial advisors running their businesses using nothing but the free version. The paid version (called the "professional" plan) is approximately $18 per user, per month (which shouldn't break the bank for any financial advisor) and allows you to host up to 50,000 contacts and allows you to integrate a ton of third-party services, like Google Apps. They have a "teams" plan which is $36 per user, per month, but most financial advisors will be more than fine with the "professional" plan at $18 per month. In my experience, one of the best things financial advisors can do with a CRM is to integrate it with their online calendar. That way when a prospect or client schedules an appointment online, the information is automatically pushed to the CRM - no manual entry required. Capsule’s pricing is actually one of their biggest differentiators. Most CRMs have sliding pricing, with more functionality being provided as you go up the pricing ladder. It's incredibly cost-effective for all the functionality it offers. After all, CRMs like Salesforce can cost upwards of $300 per user. Plus, I've found that using these massive, fancy CRMs is like hunting rabbits with a shotgun. It's simply too much "firepower" - too many features and too many complications. Again, you want your CRM to be simple and easy to use so you actually USE IT. The best thing a CRM can do for financial advisors is to streamline everything - making it so simple that they use it on a consistent basis. Why? Because unless you actually USE the CRM, none of those fancy features matter one bit. Speaking of features, I love Capsule's features... Capsule CRM Features

Capsule’s paid plan allows you to:

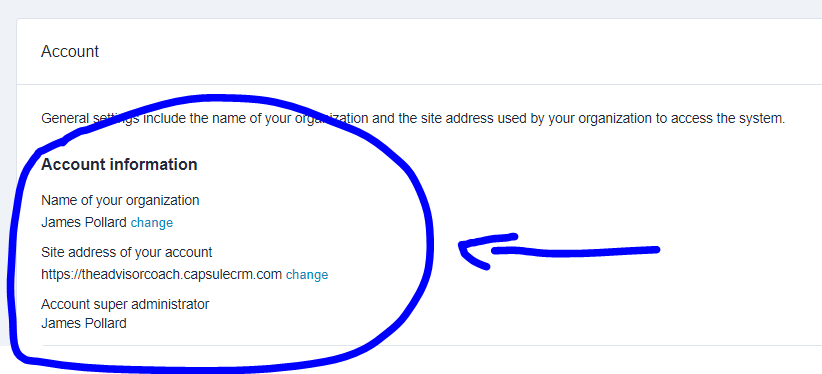

I Even Use Capsule Myself...

I know there are a lot of online "reviews" where people talk about products and just pitch them without ever using them to get an affiliate commission. That's why I've decided to include a photo of my actual account inside Capsule to prove to you that I ACTUALLY use it and recommend it to financial advisors. I figure proof trumps everything else. 😜

Why Financial Advisors Should Use This CRM

The biggest reason I recommend this CRM to financial advisors is because it is simple to use. Yes, it may be on the “basic” end of the CRM spectrum, but I’ve found that the more complex software rarely gets used. If it does get used, it’s hardly ever used to the full potential, which means money is being wasted.

Capsule CRM’s interface is clean and user-friendly. There are only 5 icons that you use to navigate around the various features. Once you learn these five icons, you are good to go. They are:

Unless you’re a complete technophobe, you shouldn’t have a problem using Capsule. There’s not much of a learning curve. I picked everything up in less than a day, and if I can do it, you can too. Because everything is so easy to set up, there's very little switching cost. All I had to do was export the information from my old CRM and then upload it to Capsule. Plus, the user experience of Capsule is superior to most of the CRMs out there. For example, one of the most common things financial advisors do within their CRM is add notes. Capsule makes it simple and intuitive to click on a person and add a note, rather than click through several screens to find out how to do it. How's Their Customer Service?I’m not going to name any names, but I have had HORRIBLE experiences with the customer service of a few big-name CRMs. Out of all the CRMs I have tried over the years, Capsule’s customer support is the best.

The Support section of their website is as clean and well-designed as their software. There’s auto-complete search navigated and a vast array of categorized articles answering common questions. Here are some ways you can get help if you need it:

I personally prefer emailing them. I contacted customer support once after hours and immediately got an automated response in which they promised to respond “within a few hours” by the next business day. I got a reply shortly after 9:00 a.m. the next morning, which had a comprehensive answer to my question. Between the stats, links, and direct answers, I got all the information I wanted – fast. Take Advantage of Capsule CRM's Free Trial

The best financial advisor CRM should be simple and easy-to-use. The bottom line is that using a good CRM can dramatically increase your income because it gives you an accurate report of your activity level and allows you to systematize your sales process. The problem is that when a CRM is too complex or time-consuming, financial advisors don’t use it. I just can’t see someone spending hundreds of bucks for a complex CRM that they’ll never use.

Here's my philosophy - if a CRM company won't let you try out their software for free, you should be wary. Fortunately for you, Capsule CRM allows you to "peek under the hood" and test drive everything for 30 days without paying a dime. For such a small amount of money, you can’t go wrong using Capsule CRM. But you don’t even have to pay anything right now – Capsule offers a 30-day free trial. You can try it out and if you don’t like it, you can downgrade to the free version or just stop using it entirely. You have nothing to lose - getting yourself organized and getting all of your leads/prospects in a systematized sales funnel is one of the best things you can do for your business. |