9 Inbound Marketing Strategies For Financial Advisors That Are Working Right Now (With Proof)Does inbound marketing work?

Well, you’re reading this article right now and it’s a form of inbound marketing. 😉 So, settle in and let me give you some inbound marketing ideas you can use in your business. But first, let me explain… The Difference Between Inbound Marketing And Outbound MarketingOutbound marketing is like pushing while inbound marketing is like pulling.

Outbound marketing is when you initiate the conversation and send your message out to an audience. It includes things like cold calling, seminar marketing, direct mail, and so on. Inbound marketing allows prospective clients to find your message. It includes things like blogs, podcasts, eBooks, opt-in emails, and more. In my experience, financial advisors tend to approach these two marketing types as “either/or”. They will do one or the other. For example, one financial advisor may tell his associates to “just pick up the phone and dial!” while another advisor may smile and proclaim that hasn’t made a cold call in years. But here’s the truth… 💡 You should use both. My marketing philosophy is built around the idea that you should do things to get clients today (outbound marketing) while building the machine that will get you clients tomorrow (inbound marketing). Plus, you can have inbound marketing materials but use outbound methods to promote them. For example, I can cold message people to start a conversation (outbound) and tell them about my Financial Advisor Marketing podcast (inbound). In this case, the inbound marketing strategy will do the heavy lifting for me, but it wouldn’t be effective without outbound marketing. Make sense? Here’s another example… Many financial advisors are sold this pipe dream that they can do nothing but post content to LinkedIn and get clients. Can this work? Sure, but it is SLOW. If you want to speed up the process, simply sprinkle some outbound marketing in the mix. What does this look like? Well, instead of posting content twice a day and doing nothing else, you can post your content and begin building your network by connecting with people and messaging them. After all, LinkedIn IS a social network, so be social. 😆 As people interact with you and you build relationships, some will naturally engage with your content. Big takeaway: outbound can pour gasoline on the inbound fire. Plus, according to HubSpot’s “State of Inbound” report, 76% of marketers use inbound marketing as their primary strategy. Oh, and that report came out in 2017. I imagine that percentage is even higher today. Either way, you want to zig when everyone else is zagging. There are so many financial advisors who buy into this idea that outbound marketing is icky and should be avoided. If YOU can be the one to combine both outbound and inbound marketing while everyone else only does one, you’ll be rewarded. Again, the “secret” is that you can have inbound marketing materials but use outbound methods to promote them. The inbound strategy will do the heavy lifting for you, but you have to get eyes on your marketing in the first place. Now, let’s get into… My Favorite Inbound Marketing Tips For Financial Advisors...Rather than throw a random hodgepodge of recommendations at you, I’m going to break down these ideas into three main inbound marketing categories. They are:

I’m a huge fan of the 80/20 rule, which states that 80% of your results come from 20% of your efforts. And if you’re a financial advisor interested in inbound marketing, these three categories will likely be responsible for the bulk of your results. Let’s begin… Social MediaAccording to “The Putnam Social Advisor Survey” - which surveyed 1,021 financial advisors about their social media habits - found that 92% of financial advisors say that social media helped them gain new clients.

Plus, the amount of investable assets gained through social media is trending up. For example, in the 12 months preceding the survey, the average asset gain was $1.4 million. So, if you’re not using social media as an inbound marketing strategy, you’re leaving money on the table. ALSO READ: 7 Easy & Actionable Social Media Marketing Tips For Financial Advisors #1: Amplify Your Message With Paid AdsHere’s a screenshot from my personal Facebook Ads account…

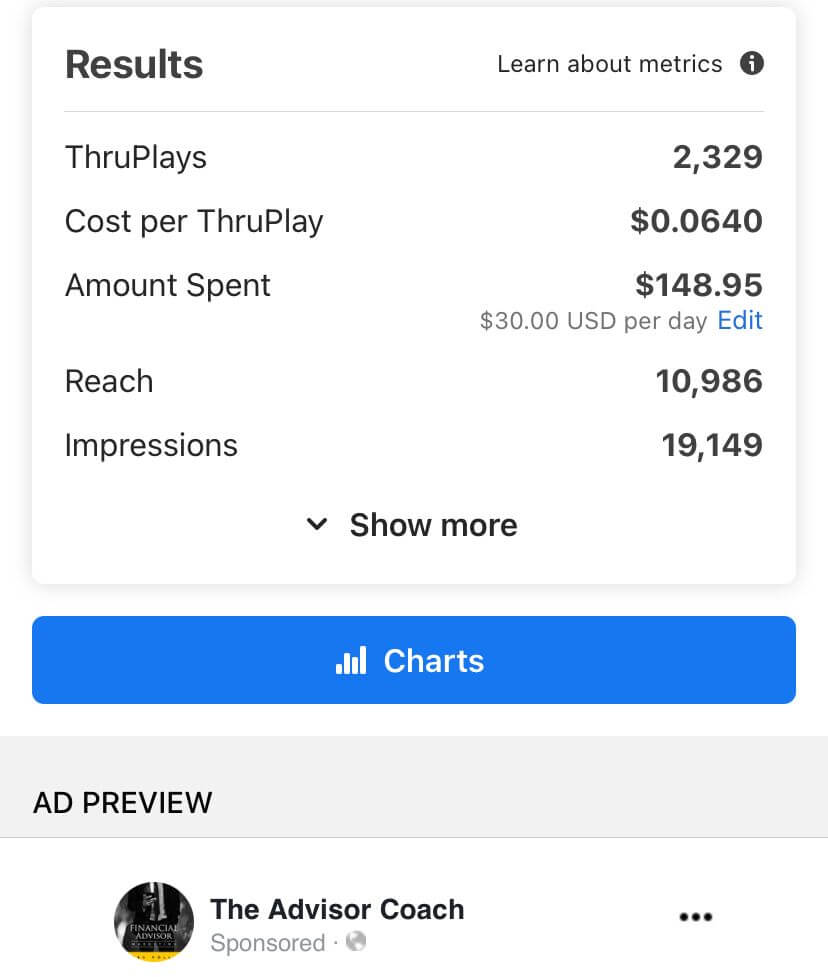

This is a video ad that I recently ran, and you can see that it received 2,329 ThruPlays for $148.95.

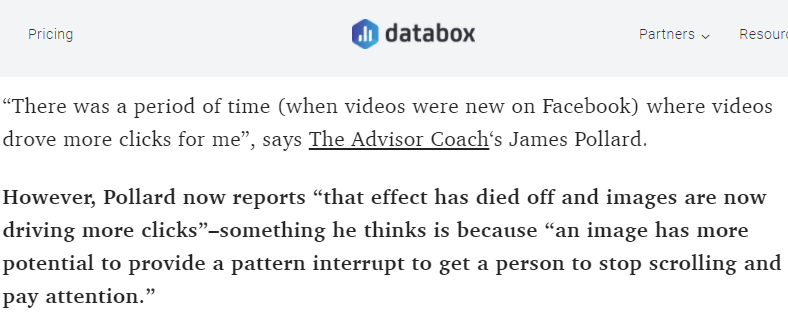

In case you’re not familiar, a ThruPlay occurs when someone watches your video for 15 seconds (or watches the entire video if it’s less than 15 seconds). What can you get done in fifteen seconds? A LOT. In the first fifteen seconds, I will say something like this: “Hi, my name is James Pollard. If you don’t know me, I’m the founder of TheAdvisorCoach.com and the host of the ‘Financial Advisor Marketing’ podcast.” Then I will get into the content of the ad. I do this because I want to know exactly how many people were exposed to that quick introduction. I want to know - down to the penny - how much I’m spending to tell someone who I am and what I do. How much could your business change if you got your elevator pitch in front of thousands of people for a few hundred bucks? Even better… Video ads aren’t even my most effective ads. 🤯 I do a lot better with image ads. I was even quoted in Databox explaining how images drive more clicks for The Advisor Coach. This means if you’re hesitant about making video, you can still have a lot of success with image ads. And if you want even more specialized help on running online ads, I recorded an entire 42-minute video titled “How Financial Advisors Can Run Profitable Online Ads”, which you can watch here for FREE:

How Financial Advisors Can Run Profitable Online Ads Yep, free. You don’t even have to opt-in or anything. Just click the link and watch. And before you scoff at the idea of using paid advertising, know that research from the Content Marketing Institute found that 91% of top-performing content marketers use paid distribution channels to promote content. #2: Find What's WorkingLet’s assume you’re a financial advisor and you work specifically with police officers.

Instead of playing the social media game by posting endless content to see what sticks, you can take a stroll over to your favorite police-centric social media page and see what they’re doing. To show you how this works, I searched for police-themed pages on Facebook and found a page called “Support Law Enforcement”. One of the more popular posts was this one: To be clear, you should NEVER copy-and-paste their content. I have been the victim of such swiping and stealing (primarily by other financial advisor “coaches” and marketing “experts”) and I can tell you it’s not fun. Your goal should be to see which style of content works best, such as photos vs. video, personal stories vs. facts, and so on.

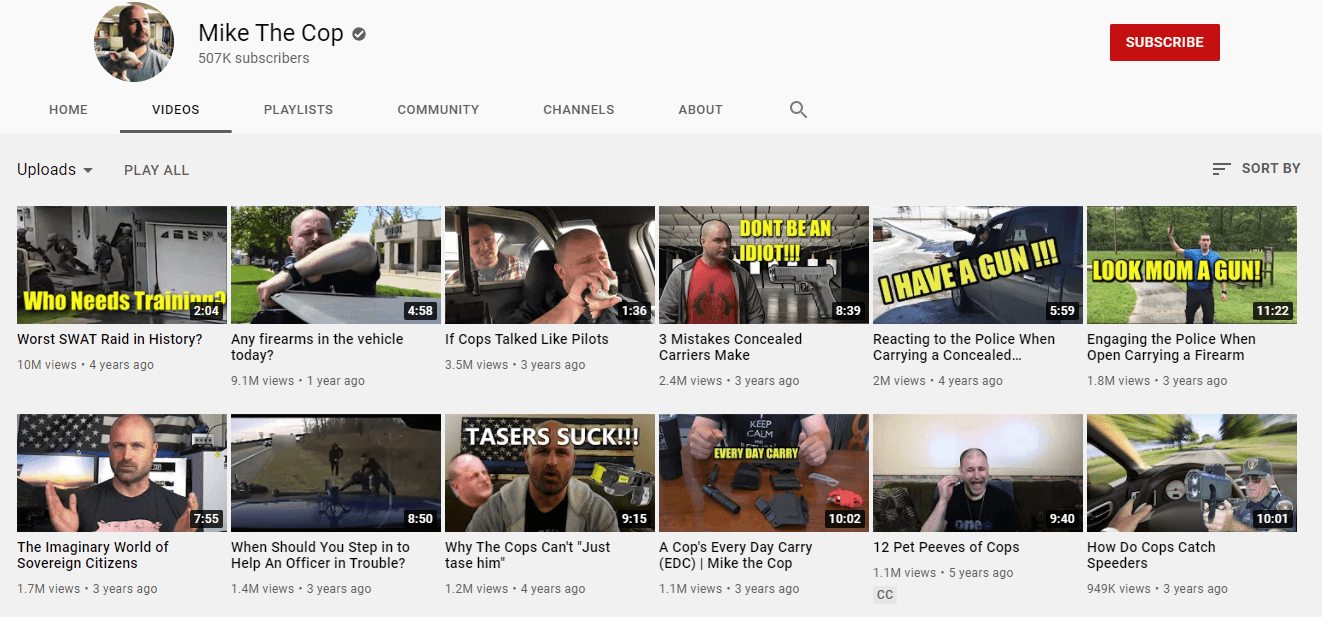

This could also be a content marketing tip because you can use blogs, podcasts, and YouTube channels to get inspiration for your own content. Continuing with our police officer example, I found a channel called “Mike The Cop”, which has tens of millions of views. I went to his page and sorted his videos by “Most Popular”, which you can see here: These videos are content GOLD.

One of his most popular videos is “12 Pet Peeves of Cops”. You can take this and transform it into an email where your subject line is, “Police Pet Peeves vs. Financial Advisor Pet Peeves” where you talk about the similarities between the two. Another popular video is “A Cop’s Every Day Carry (EDC)”. You could share a similar video or photo on your social media/website with your own version of your own EDC. You could even get cute with it and show a calculator, financial planning software, your smartphone, and a notepad. #3: Message People Who Engage With YouAccording to the same “Social Advisor Survey” referenced above, 94% of advisors seeing success on social media (aka getting clients) are using direct messaging capabilities.

This isn’t my opinion. This isn’t some suggestion I pulled out of my butt. This is hard, factual evidence and numbers don’t lie. At its core, your social media activity is a way to get people to acknowledge your existence and engage with you. When that happens, your chances of converting those people into clients are dramatically higher if you send them a message to follow up. ALSO READ: 5 Financial Advisor Follow-Up Tips (That Won’t Annoy Prospects) The right way to get clients with social media is to use your content to strengthen your direct messages…. To engage with people to drive direct messages… And to use other people’s content to break the ice… in direct messages. Because the money is in the mailbox. EVERYTHING you do should be done to either increase the chances of having a conversation or to make the conversation better when it happens. Content MarketingI want to preface this section of the article by saying this…

If you’re going to get content marketing advice from someone, make sure that person or company actually DOES content marketing. If you want to check my stats, here’s a quick rundown:

I could go on, but you get the point. Here are my tips about content marketing… ALSO READ: 10 Awesome Content Marketing Tips For Financial Advisors #4: Choose Quality Over QuantityI throw up in my mouth every time I see someone tell financial advisors that they “must!” blog every two weeks to get results. Or post on social media every day. Or create a video every week.

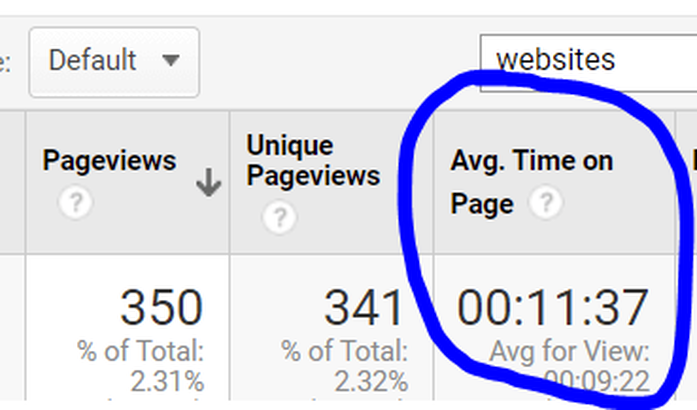

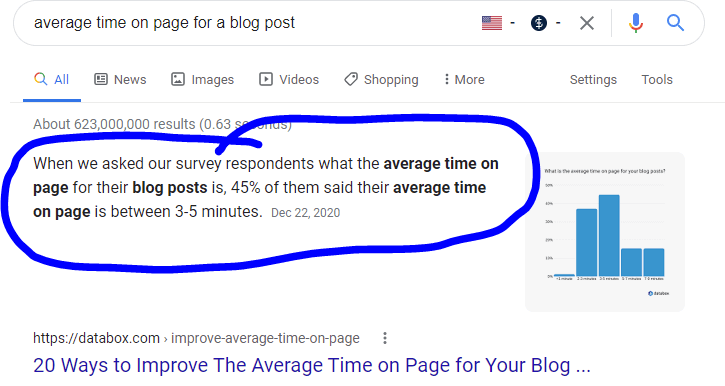

Dude, do what works for you. If it takes you two months to create an amazing blog post, take every bit of those two months, you blog-writing rock star. But never, ever, ever… PUT OUT CRAP! Unfortunately, that’s what happens when financial advisors operate under the assumption that they need to be content-producing machines. Take a look at this… this is the average time on page for one of my recent blog posts (this one, if you’re curious)... Do you know the average time on page for a blog post? It’s somewhere between 3-5 minutes.

That means visitors are spending 2-4X more time on my page than they would spend elsewhere. I don’t want to toot my own horn too much, but that’s because I create quality content. I don’t create skimpy, 500-word blog posts with no substance. I give real examples to inform you while sprinkling in some personality to keep you entertained.

#5: Create A Content Idea BankOne of the biggest challenges financial advisors have with respect to content marketing is coming up with ideas. So, I’d like to share some questions you can ask yourself to come up with content ideas. Here they are:

Here are some more ways to come up with content ideas:

As you go through these things, write down any ideas that come to you. I don’t care how or where you keep them - they could be in your phone’s “notes” app or on an old-fashioned piece of paper. Just keep them somewhere and reference them whenever you’re at a loss for what to create. #6: Use This Lazy Content Creator's MethodHere’s what to do:

First, identify a topic your audience is dying to learn about. Then, interview an expert on that topic. “BuT jAmEs, wHeRe dO i FiNd ExPeRtS?” Google. LinkedIn. Facebook. Email. The phone. These are all tools you can use, skippy. Use ‘em. After you’ve interviewed your expert, create an outline directly from that interview and turn it into a beautifully written piece. Email is by far the most effective appointment-setting strategy I’ve ever seen for financial advisors. Nothing else comes close.

Here are the pros of email marketing:

Here’s the con:

Fortunately, I’ve solved that problem with Appointments On Autopilot. Because only in that program do I reveal my entire strategy for getting prospects to set appointments with you, including done-for-you templates. This is something that has taken me years (and thousands of dollars) to perfect. But if you don’t feel comfortable getting the whole shebang right now, here are some tips to get you started… ALSO READ: 19 Financial Advisor Email Marketing Tips #7: Incorporate Emotion To Increase ConversionsIf you haven’t gone through my webinar about email marketing, I encourage you to sign up here:

3 Counterintuitive Ways Financial Advisors Can Get More Clients With Email Marketing In that webinar, I reveal a few secrets most financial advisors don’t even know exist. One of these secrets is that emotional content increases conversion. Have you ever heard the phrase that people “buy on emotion and justify with logic”? Well, it’s kinda sorta true. According to neuroscience, people make the bulk of their purchasing decisions (including hiring a financial advisor) unconsciously. Their subconscious processes an enormous amount of data and leads them to an intuitive feeling about whether they should say “yes” to a decision. Harvard Business School professor Gerald Zaltman goes as far as to say 95% of our purchase decisions take place unconsciously. However, most financial advisors attempt to appeal only to the rational, logical side of their prospective clients. Therefore, they struggle and can get frustrated. The “trick” is to integrate both emotion AND logic into your approach. In fact, the reason my email marketing system works so well is because I “sell” with emotion. This is contrary to what most financial advisors do. They load up their emails with cold facts, figures, and statistics which mean nothing to prospective clients. This is why stock-market commentary emails and boring “we published a blog post!” emails don’t work as well. Oh, and guess what? Neuroscientists have found that people with damage in the emotion-generating area of their brains are incapable of making decisions. Which means without emotion, it is literally impossible for your prospects to decide to work with you. Read that again. It is LITERALLY IMPOSSIBLE. So, the next time you fire up your word processor to write an email, incorporate one (or more) of these six basic emotions:

And you’ll find yourself setting more appointments than ever before. #8: Have A Way To Qualify Your Inbound LeadsA lot of people believe that prospecting and marketing is about casting a wide net and getting as many people into your pipeline as possible.

It’s not. It’s about finding the select few people who are perfect for you and your business. That’s why I tell financial advisors to specialize. Get detailed. Make it your mission to find a specific type of person you (and preferably only you) can help. It just so happens that email is perhaps the best qualifying mechanism that exists because people can read your email at their own leisure and, if they’re interested, take action on whatever call-to-action you provide them with. Yet, you shouldn’t stop there. You can embed several different qualification mechanisms throughout all your marketing, not just email. For instance, one of the dumbest inbound marketing ideas a financial advisor can receive this: “Keep your content short because some people have short attention spans.” Lol. 😂 Yes, it’s true that some people have short attention spans… but you shouldn’t cater to those people. Do you REALLY want to work with people with gnat-like attention spans? I don’t. If people can’t read an entire 2,000+ word blog post or even a simple email from start to finish, they’re likely tire-kickers who will do nothing but waste your time. #9: Read This ArticleI don’t know anyone else on the entire planet who has studied and scrutinized email marketing for financial advisors with my level of precision.

I’ve been tracking email metrics for years. This gives me an advantage nobody else has. Because while other people may have “theories”, I have proof, and lots of it. And I wrote an entire article detailing the things I’ve learned from sending millions of financial advisor emails. You can read it here: 4 Things I’ve Learned From Sending 3.2 Million Financial Advisor Emails I hope this helps you, and best of luck to you. Share this with someone if it helped you. 👍🏻 About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |