5 Best Niches For Financial Advisors"I like sports" is vague.

Which sports? Soccer, baseball, cricket? "I like basketball." Cool. There's high-school basketball, college basketball, the NBA and more. "I like the NBA." Now we're getting somewhere. Which team? "I'm a Lakers fan." THIS is why it's important to drill down on a specific niche. In this example, it would be difficult (and expensive) to run a marketing campaign based on "sports". Targeting "Lakers fans" would be much easier and your dollars could be spent more effectively. If you're a financial advisor without a niche, you are making things WAY harder than they need to be. The riches are in the niches. Ignore this advice at your own peril. Top financial advisors are finding riches every day by targeting certain niche markets. If you are an advisor who tries to please everyone, you’ll end up pleasing no one. Think about it this way – if you were having heart trouble, would you feel more comfortable visiting a general practitioner or a cardiologist? Many years ago, clients might have had someone to handle everything from investing to planning and insurance, but those days are long gone. You can niche down into almost any category, but I’ve tried my best to list the ones that make the most sense to me. If you think of any more, feel free to share them, especially if you’ve been successful. Here's what you'll learn in this article:

Now, let's start with the best niches for financial advisors... 1. Occupation NicheThis is my personal favorite, and it also seems to be the category that meshes the best with my private clients. Some financial advisors are career-changers; they enter the financial services arena after many years in another career. Most of the time it’s a no-brainer to pursue people within the former career. After all, as a career-changer, you have two distinct advantages:

If you’re not a career-changer, you can still niche down to a particular occupational group. Here are a few questions to help you brainstorm

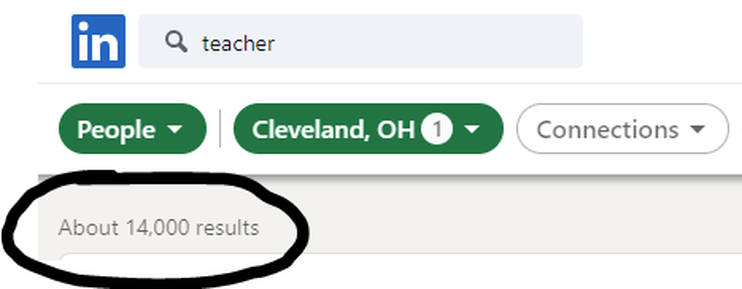

If you want to do a quick test to see how many people are in your niche, do a search on LinkedIn. Once upon a time, I had a financial advisor from Cleveland, Ohio tell me that there weren't enough teachers (his desired niche) in his area. So, I went over to LinkedIn, typed in "teacher" and refined my search to Cleveland. Guess what I found... More than 14,000 results. Which means I validated his niche marketing idea in a few minutes. Occupational niches are also my favorite niches to target because you can easily find podcasts, YouTube channels, blogs, and more about specific occupations. They can be perfect collaboration opportunities for smart financial advisors.

Let's continue with the teacher niche.... A quick Google search for "best teacher podcasts" tells me that there are currently about a dozen big podcasts geared toward teachers. All you have to do is send a message to the podcast hosts presenting your case for why you would make a good guest. If you want to maximize your effectiveness, record a personalized video to prove that you can be a good guest and that you have a decent microphone. 😄 2. Specific CompaniesWho are the largest employers in your area? When you find this out, you have a clear idea of the largest markets in your area. In Delaware, some of the largest employers are the University of Delaware, Christiana Health Care System, and Dover Air Force Base.

If I was someone who specialized in working with UD faculty and you were a generalist, I would crush you in that market. Here is how I would do it:

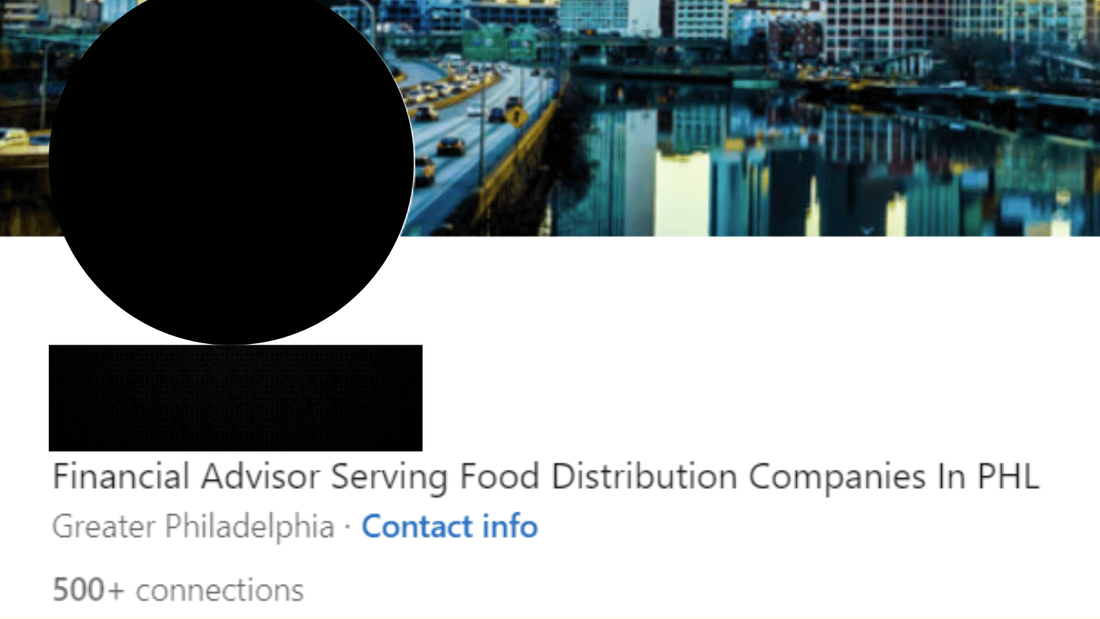

University of Delaware has over 3,500 employees. Even if I only converted 3% of the people there, that’s still 105 clients – nothing to sneeze at. If you’re in Atlanta, you can do the same with Coca-Cola. If you’re in Orlando, go after Disney. Figure out the largest employers in your area and carve out your niche. You can make a name for yourself by offering to do free workshops for them and networking where their employees network. Once you get the ball rolling, you can deliver great value to your clients and get co-worker referrals. A few of my Inner Circle members have specific companies as their niches. For example, here is a financial advisor targeting food distribution employees. Food distribution is one of Philadelphia's largest industries. 3. Specific ProductsIf you are a cardiologist, you’re not going to have people coming to you for eye surgery. But that’s just fine because you’re an expert on the heart. Whenever anyone needs something heart-related, you’re the go-to person.

This same idea applies to financial services. You can create a niche out of almost any financial or insurance product you can think of – annuities, life insurance, long-term care, mutual funds, you name it! If you can marry your name to a particular financial product, you will have a tremendous position in the marketplace, which allows you to deepen the public’s perception of you as an authority on that product. Once you do that, doors will start opening for you. One example of a company with a "specific products" niche is Safeguard Advisors. This company specializes in self-directed IRAs and Solo 401(k)s. 4. Life TransitionsMajor life transitions often require financial advice. Financial advisors stand to benefit from focusing on clients getting married, divorced, widowed, having a child, and many other life events.

I’ve seen several advisors become very successful this way, especially within the divorce niche. Divorces can get messy, and they bring a lot of distress into peoples’ lives. If you can be the person with tons of resources to make the process as smooth as possible, you will be a godsend to your clients. Your number-one goal should be to secure a healthy financial outcome for your client, but you can also provide books and other literature to help find peace in an otherwise stressful situation. Due to the nature of divorce, you will likely know about every bank account, brokerage account, insurance policy, and piece of real estate. The natural choice for the client is to move assets under your management post-divorce. 5. "Money In Motion"Financial advisors stand to benefit whenever there is “money in motion”. This could be retirement, inheritance, changing jobs, or selling a business. In The Ultimate Financial Advisor’s Guide to Getting More Clients, I spell out exactly how to find business owners who’ve just sold their businesses. This has allowed several advisors to find people right after this majority liquidity event.

It has never been easier to find money in motion. I can literally hop on the internet and skim a dozen industry newsletters in an hour. I can find names of people who are getting recognized in their field and send “congratulations” letters their way. I can hop on LinkedIn and find out who is changing jobs and/or getting ready to retire. I can also canvass real estate records for sales within the last week or so. Most states have a statewide database that you can access from your home computer. You can easily generate a few extra leads each week, but one “money in motion” client is generally well worth the effort. This definitely isn’t a comprehensive list of niche markets for financial advisors, but it should be enough to get the juices flowing. Also, I want you to know that when you choose a niche, you should be prepared to invest your time and energy in it. Go all in. Your investment in a niche should involve you reading about them in publications they're reading, digging deep into their demographics, talking with them, joining the organizations, and more. One financial advisor from Texas decided he was going to work with studio musicians. He ended up calling studio musicians and explaining to them that he was a financial advisor who wanted to learn more about them in order to build his business around them. He was completely transparent and told them there was absolutely no pressure to become a client. A few musicians agreed to let him pick their brains and the information he got as a result has been priceless. The reason this approach is so effective is because you can literally find out about your niche market's biggest fears and worries. You can learn what's important to them and see if there are any patterns. If so, make sure to include it in your marketing. You want to make sure you're literally speaking your niche's language. The Most Lucrative, Overlooked Niche For Financial Advisors...“I’m all set, thank you.” You’ve heard this objection from prospects more times than you can count, but did you know you make a huge mistake each time you believe them?

On an episode of the “Financial Advisor Marketing” podcast, I armed listeners with this critical piece of advice: the most overlooked niche is people who already have financial advisors. If you’re surprised, look at it this way: these prospects have demonstrated a propensity to do business with you, and they understand the importance of financial advisors — i.e., you don't have to waste precious time and resources trying to convince them of that. Wouldn’t you rather find someone who knows your value than chase a prospect who’s skeptical about your advantages? That’s why it's in your best interest to keep following up if you reach prospects through the strategies running in your marketing machine who say they already have an advisor. At the very least, keep them in the loop and add them to your email list. Keep in mind this isn’t about poaching clients from another advisor — never cross that boundary. Don’t attempt any illegal methods, and I don’t recommend you try to persuade clients to leave their advisor. However, statistically, some of those prospects will decide to switch advisors. Financial services constitute a relationship-oriented business, and this strategy requires patience. Don’t push — the idea is to build and grow relationships so the prospect knows you're there when they want to make a change. Your job is to continue educating them and stay in touch to position yourself as a strong second choice. That's it. With this marketing strategy in your toolkit, the potential payoff is massive. Check out these statistics: 📈 Households with $100,000 in assets have a 13% chance of leaving their advisors during any given year. 📉 According to a PriceMetrix study, the average financial advisor loses between 5% and 10% of their business per year. Let’s paint a picture with these figures. If you have 100 prospects in your pipeline who all have financial advisors, five to 10 of them are likely to leave their advisor in the next 365 days. Similarly, if you target 100 prospects who all have $100,000 in assets managed by an advisor, the stats say 13 of them will leave in the next year. Assuming you get all 13 clients, that's a potential $1.3 million in assets you can add to your business in one year from this strategy alone. And if you've positioned yourself as a strong number two, don't you think they'll consider you? Use this marketing strategy alongside others, and let them strengthen your ability to be there for the clients who will leave their financial advisors in ways that best reach them. Deep down, you have to know prospects are better served with you overseeing their portfolios. If you 100% believe in yourself and what your business offers, you’ll know you can do a better job than any other advisor ever could. Without that rock-solid belief, this strategy might not work for you. 7 Reasons Why Financial Advisors Need a Niche (Yep, That Includes You, Skippy...)“Cast a wide net – the more people you prospect, the more business you’ll get.”

This oft-repeated advice has circulated among financial advisors for years. Advisors fear that if they pick a particular target market they won’t get as many clients. Their fears keep them from committing to a specific target market and getting more business. According to CEG Worldwide research, 70% of top financial advisors (those earning $1M or more annually) focus on a particular niche. Why does focusing on a target market improve an advisor’s chances of success? Here are some reasons: 1. You'll Actually Get More Clients.At first glance, casting a wider net to get more business seems like a good idea. You think that if you just double the number of people you speak to, you will double your income. While that may be true, you will also be working twice as much. Is that really the goal?

Choosing a particular niche allows you to convert a higher percentage of the people you prospect, because you will have a stronger connection with them. If your prospect is a doctor and has to choose between a generalist (who works with everybody) and you (who only works with doctors), it’s an easy choice. Having a clear focus on a certain target market will ensure that once you get in front of people in your niche, the fit will be so obviously perfect that the likelihood of converting is much higher. The whole point of having a niche is to be so clearly differentiated in the marketplace that working with you is the only right decision. 2. You'll Work Smarter, Not Harder.When you focus your business on a particular niche, you soon discover that people within your chosen group are very similar. Since people in a particular niche share the same hopes, fears, and financial concerns, you will soon know every objection, problem, and concern that your target prospects have. Eventually, you can design systems, including prepackaged solutions, to help deliver your services more efficiently, further increasing your income.

One of my consulting clients was having great difficulty in finding the time to prospect for new business. When I told him he should spend at least two (preferably four) hours per day prospecting, I thought he was going to have a panic attack. Trying to calm him down, I asked what he did all day. Do you know what he told me? Research. He said he did research all day. He dug himself into a hole and was desperate to get out. All of his clients had different circumstances and problems, so he was constantly spinning on a hamster wheel, trying to keep on top of their changing needs. Wouldn’t it be so much easier if the bulk of your clients were in the same industry, with the same goals, the same concerns, the same investment products, and the same service needs? When you do this, you save precious time that you can use to scale your business. If you're a financial advisor with the dream of working less and earning more, you need a well-defined target market. From a financial planning perspective, specialist financial advisors have tremendous leverage. They don't have to know everything - all they have to do is become an expert in one area. When explaining this idea to financial advisors, I tell them it's like trying to become an expert in shoes. It would be incredibly difficult to become an expert in all shoes because you would have to learn about boots, high heels, sneakers, sandals, and more. However, it's much easier to become an expert in slip-resistant work boots. Plus, all you have to do is find the people who want those boots... or have them find you. 🙂 3. Prospecting Becomes Easier.80% of a typical salesperson’s time is wasted talking to poorly qualified or unqualified prospects. When you target a particular group, you can spend most of your time talking with highly qualified prospects who have clear potential to become clients. After all, you will be positioned as the go-to person for that particular industry.

If you only work with educators and your put that on your business card, your website, and all of your marketing materials, you will attract educators. This is the “client attraction” type systems that advisors dream about. When you become clear on your goals, the path to achieve them usually becomes clearer as well. Rather than trying to get leads from anywhere and everywhere, if you only focus on a particular group, you will instantly make your list that much more qualified. Is this person a doctor or not? Is this person a corporate executive or not? And because your conversion rate will probably be higher (tip #1), your prospecting time will become much more productive. 4. You'll Get More Referrals.When you specialize, word of mouth spreads a little faster. People within your target market will feel special that they’re working with you because of your reputation in the industry, and they will start to share it. And guess who they’re going to share with? Other people just like them!

If you work with physicians, guess who physicians spend time with? Other physicians – they go to trade shows, hang out at the same country clubs, and even work in the same building. Plus, asking for referrals becomes way easier. Your client won’t have to do any mental gymnastics to refer you because he/she will quickly qualify friends/family based on your target market. 5. You'll Have Less Competition.Once you have a niche, you become known as the go-to expert in that area. I told you that word of mouth spreads a little faster to get you more referrals, but this also builds your reputation as the trusted resource. Your competitors simply won’t be able to compete once you’ve positioned yourself so well.

Simply by narrowing your focus, you will reduce your competition because there will be fewer people offering the same thing. There are tons of generalist financial advisors. They work with anybody with a pulse. On the other hand, there might only be a dozen advisors in your state who work with your niche. I’d rather compete in the smaller space because it allows me to have fewer overall competitors and keep a close eye on the competitors that I do have. 6. You Can Integrate Case Studies In Your Marketing.Case studies create the most powerful marketing stories, especially during a presentation. In 37 Sales Tips for Financial Advisors, I talk about how to make your prospects feel like they’ve already shopped around. Service industries don’t usually have a “try before you buy”, which causes a lot of uncertainty and resistance. Case studies are the best way to give potential clients the sense of having taken a test drive.

The best way for people to understand how you can help them is to hear a story about someone just like them. Once you have a niche, crafting this story becomes much easier. You can tell your prospects a story about how you helped someone in their niche. If they like what you did for the person in your story, they’ll ask if you can do the same for them. A case study makes it easier for prospects to do business with you. 7. You'll Have More Fun.Your business should serve you, not the other way around. Ideally, your niche should arise from your interests and passions. When this happens, you will be doing more of what you love. Your goal should be to build your business by design. Picking a niche is a big step in that direction.

Whether your business serves only your niche or a niche among others in your book of business, the idea is the same. You want to find a small pond in which you can become a big fish. If you pick an area to focus on, you can concentrate your efforts and stand out in your market. Final Thoughts: What Every Financial Advisor Needs To Know...💡 The key to marketing is integration.

Marketing powers the engine of your business, so you should never view your marketing strategies as either/or — instead, always seek to add and integrate tactics, but not just for the heck of it. To strengthen your marketing efforts, add purposefully. For example, one effective and easy option is to snowball content into well-paying clients. Here’s what I mean: if you share a piece of content online, some people will be more likely to consume the rest. Once you get them to your website through a blog or social media post, that’s where the magic happens. A percentage of those visitors will engage with all your other articles, white papers, webinars and case studies. They’ll opt-in to your email list, and just like that, you've got them in your marketing machine. From there, you can follow up, then eventually set an appointment. Easy, right? Every technique you use should complement and strengthen your big-picture strategy — if you use LinkedIn to optimize your email marketing, then use email marketing to bolster LinkedIn. You have the content, so share it! Whether you email subscribers urging them to connect with you on social platforms or to catch recent podcast episodes, some people want to learn more and stay in touch. And just like the most overlooked niche, many of them will be folks who’ve purchased a similar product. Remember: people who have already proven they’ll take an action are more likely to do it again. As counterintuitive as it may seem, it actually makes perfect sense. If you sell watches, would you rather advertise to people who don't own any or people who already have a few? You may think the prospect without a watch displays a need, but keep your eye on the prize: demonstrated value. In my business, I’ve noticed as soon as someone becomes an Inner Circle newsletter member, they start to buy all my other products. After they apply my advice to their businesses, they realize how valuable it is and come back for seconds, thirds and fourths. Because these members seek value to invest in themselves, I get to help them in the best way I can. Plus, I know it’ll expose them to my other products and give them even more results. 💡 Prioritize client retention. Do you know how much it costs to acquire a new customer? It’s way more expensive than it costs to retain your current customers, I can tell you that. Landing new clients is integral to business growth, but it won’t help if your current clients leave at the same rate. You don't want to be the financial advisor who loses clients — you want to be the one who gets and keeps them. So, when advisors reach out to me and they have a solid book of business, one of my first questions is, “How can we make your existing book of business stronger?” When you lose clients, the price you pay is much higher than the revenue you lose. You have to factor in all the resources it took to get them and what you’ll need to replace them. That’s why the big idea with financial advisor marketing is to get a net increase. You want more clients and more money, but only if it's above what you had before. If it costs $1,000 to acquire a customer and you have a client who nets you $10,000 a year, you’ll wind up losing $11,000 or more if they leave because of the cost to replace them. Before you go all-in on new clients, make sure you work hard to retain your current customers. Ask yourself, what does your service look like? Do you deliver on their needs and expectations? You don’t want to find out how much it matters before it’s too late. P.S. If you're a financial advisor who wants to get more clients from LinkedIn, make sure you check out How to Get Clients With LinkedIn: How Financial Advisors Can Set Appointments and Convert Prospects With LinkedIn

|