How To Overcome Objections As A Financial Advisor (The Right And Wrong Way)WARNING: What you are about to read flies directly in the face of traditional “sales” advice. My methods are not for everyone, and that's okay. However, if you are a financial advisor and you are having difficulty handling objections, I suggest you read this article in its entirety and give the concepts serious consideration.

In a business scenario, objections are barriers that exist between a prospective client's problem and your proposed solution. For example, someone may object to hiring a financial advisor because of a belief that an advisor is too expensive. These barriers may be either spoken or unspoken. They may also exist at any point in the sales process. The problem with the traditional sales approach to handling objections is that it only helps you deal with objections when you're with a prospective client. There's virtually nothing to help you overcome objections before they hinder your meetings.

On the surface, this makes sense. Many sales books were written for face-to-face (or over-the-phone) businesses, which could answer questions directly. They were never intended for financial advisors, who have several objections to overcome before ever meeting with a prospective client. So, how can you overcome objections as a financial advisor? Find out what you need to know in this article:

Now, consider this… Most Financial Advisors Never Hear The REAL Objections...Because potential clients never make it to the point where they’re talking to the financial advisor in the first place.

For instance, according to an AARP survey, 45% of U.S. adults aged 45 to 59 say they’d rather see the dentist than meet with a financial advisor. Also, according to an online survey conducted by Harris Poll on behalf of McAdam, 71% of Americans say they’re afraid of some aspect of talking to a financial advisor. Millennials fare even worse; 82% of them admit to being scared of talking with an advisor.

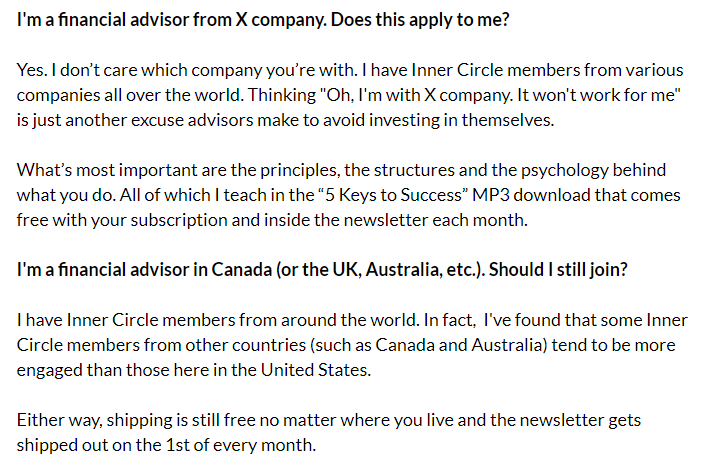

In other words, prospective clients aren’t even reaching financial advisors in the first place because of these unspoken barriers. Traditional objection handling advice assumes someone is already in front of you, but to grow your business as a financial advisor, you must overcome objects well in advance. You must anticipate them. This is the reason why content marketing is so effective for financial advisors. The content eases fears and educates people on why they should reach out to you in the first place. Imagine having a piece of content titled, “10 Reasons Physicians Should Meet With A Financial Advisor (And 10 Reasons They Shouldn’t)”, and you address these fears. Your content would make your niche - physicians, in this case - more comfortable with meeting with you because you anticipated the objection and handled it in advance. I even take my own advice. On the sales page for my Inner Circle newsletter, I have an FAQ section where I address several so-called “objections”, as seen below. A common fear advisors have is thinking the newsletter won’t be as valuable to them because they work with a restrictive company. That’s why I explicitly say: “I don’t care which company you’re with. I have Inner Circle members from various companies all over the world.”

I also realized that international advisors were hesitating to join because they thought it wouldn’t be as applicable to them. However, once I addressed this question in the letter, advisors from countries such as Canada and Australia started joining in record numbers. That’s the power of addressing objections in your content. 😎 Now, let’s discuss some of the most common objections financial advisors receive and how to deal with them… Common Objections Financial Advisors Receive...I want to begin this by explaining that receiving a few objections is perfectly natural. However, if you’re getting inundated with objections, you have screwed up somewhere along the line. Either you haven’t explained your process well enough or you aren’t qualifying prospective clients as much as you should. If that’s the case, I suggest you read this: 7 Reasons Why Most Financial Advisor Sales Training Completely Fails

Perhaps the most common objection is this one… “I already have a financial advisor.” This is a common objection and one approach I’ve seen companies recommend goes something like this: “Well, doctors and other professionals recommend getting a second opinion on things, so don’t you think this is worth a second opinion?” Lol. I throw up in my mouth when I hear stuff like this. Another response to this objection is something like, “Nobody has a monopoly on good ideas." Yeah… let me know how that works out for you. When people tell you they already have a financial advisor, they EXPECT to hear all the reasons why it doesn’t matter and why they should meet with you anyway. The key to handling this objection is to avoid playing into the expectations. In my experience, hearing that someone already has an advisor is a great thing because it demonstrates that the person understands the value of financial advice. You want to position yourself as a strong number two. You can put the person in your CRM and keep in touch. According to a study done by PriceMetrix, financial advisors lose 10% of their clients every year, on average. Households with $100,000 in assets have a 13% chance of deflecting from their advisors every year. This means if you have a list of 100 prospective clients who already have financial advisors, 10 to 13 people will likely consider you in the coming year. (By the way, I did an entire podcast episode on what to do when someone already has a financial advisor. It’s called “The Most Lucrative Overlooked Niche For Financial Advisors” and you can find it by searching for the “Financial Advisor Marketing” show wherever you listen to podcasts.) If you’d like a more direct approach to handling this objection, here’s one: Prospect: I already have a financial advisor. You: I was hoping you’d say that. Prospect: Why? You: Most of my clients are people who come from traditional firms and they were looking to reach the next level. Prospect: What do you mean? You: Well, let me ask you a question… what would moving to the next level mean in your world? Depending on what the person says, you can qualify him/her and move to the next step or thank him/her for the time and move on. ALSO READ: 5 Financial Advisor Follow-Up Tips (That Won’t Annoy Prospects) “I don’t have enough money/I don’t make enough money.”

Depending on your business model, this may be a deal-breaker for you. If so, it’s a good qualifying mechanism that will allow you to move on. Because if you have a $250K minimum, someone saying he/she only has $100K isn’t an “objection” per-se, it’s the reality. However, if it’s not a dealbreaker for you, you can share facts and statistics which prove this isn’t a big deal. For example, The National Study of Millionaires, conducted by Ramsey Solutions, found that one-third of millionaires never had a six-figure household income in their entire working lives. Only 31% of them averaged $100,000 household income, and only 7% averaged over $200,000 household income. This means even if your prospective clients have relatively low household incomes, there’s still a chance for them to retire with millions in investments. All they need is the consistency and discipline to make it happen… along with a little advice and cheerleading from you, of course. And if you’re a financial advisor who gets paid via a monthly retainer, hourly rate, or flat rate, you should put it front-and-center in your marketing. Make it known that people don’t need to meet sky-high thresholds to work with you. I’ve even seen some advisors offer “office hours” where people can book phone calls or video conferences to discuss questions and get some actionable insights. For people who can’t afford to shell out several thousand dollars for a comprehensive financial plan, it could be worth doing. Who knows? They may eventually become full-fledged clients. “Call me back in X days/weeks.”

When hit with this objection, old-school sales books will tell you to counter with something like, “It won’t take long” or “I’ll keep it brief”. DON’T DO THAT. Be honest and tell them that it will take some time to explain and to make sure they’re a good fit. If they can’t handle it, that’s okay. Filter them out and move on. In my opinion, if someone can’t set aside an hour or so to talk about one of the most important topics in life (money), then you probably don’t want that person as a client. If it’s someone you really want as a client and he/she gives you this objection, you can send a video or even something in the mail to stand out from everyone else. Twenty or thirty years ago, this would’ve been bad advice. There’s even a saying for it: “If you mail, you fail.” Yet, times have changed. When people stall, it’s typically because they feel as if they don’t have enough information to make an informed decision. It’s your job to provide them with that information. “I need to think about it.” This is another common objection people give financial advisors. It can come in many forms…

You know, the standard objections. The prospect is afraid. Anxious. To you, hiring a financial advisor isn’t that big of a deal. To your prospect, it’s intimidating and scary. 😬 (Remember those stats from earlier? Most people are afraid of meeting with a financial advisor.) The key to handling this objection is to reframe the fear and nervousness as being a good thing. Because feeling a little nervous is a sign that something is important to you. If you’ve gotten married, were you nervous at the altar? Probably. If you have children, were you nervous in the final weeks leading up to their births? Probably. It’s a natural response. In fact, if you weren’t nervous at all, it’d mean you were a psychopath. I’ve discovered that explaining this to prospective clients sometimes gets them off the fence because it shifts their perspective on the fear they feel. Addressing the lack of urgency in seeking financial planning is a common challenge for financial advisors. It requires not only highlighting the importance of early and proactive planning but also connecting the concept of financial planning directly to the client's personal goals and immediate concerns. It's crucial for financial advisors to educate potential clients on the compounding benefits of early financial planning. This can be achieved by presenting real-life scenarios or case studies that illustrate how early intervention can lead to significantly better outcomes compared to delayed action. Advisors should clearly explain concepts such as the time value of money, compound interest, and the impact of market fluctuations on long-term investments. By providing concrete examples, clients can better understand how postponing financial planning can result in missed opportunities and increased risks. Financial advisors should strive to make the concept of financial planning more relatable and personalized. Instead of focusing solely on retirement, which may seem distant to some clients, advisors can discuss immediate benefits and short-term goals. This could include budgeting and debt management, saving for a child’s education, or planning for a major purchase like a home. By aligning financial planning with the client's current life stage and immediate concerns, advisors can create a sense of relevance and urgency. Another effective strategy is to conduct a "what-if" analysis to illustrate the potential risks of inaction. By discussing various scenarios, such as unexpected medical expenses, job loss, or economic downturns, advisors can help clients understand the protective value of early financial planning. This approach can turn abstract concepts into tangible concerns that prompt immediate action. Financial advisors should emphasize the ongoing nature of financial planning. It’s not a one-time task but a continuous process that adapts to life’s changes. By getting started sooner, clients can ensure their financial plans evolve with their changing needs and circumstances. This can be particularly persuasive for those who perceive financial planning as a static activity only relevant to retirement. Addressing the lack of urgency may also involve breaking down barriers to getting started. Financial advisors can offer to start with a simple, no-commitment financial review or an initial planning session. This low-pressure approach can help clients take the first step without feeling overwhelmed by a long-term commitment. By addressing these aspects thoughtfully and empathetically, financial advisors can effectively counter the lack of urgency some individuals feel towards financial planning, guiding them towards timely and informed decisions about their financial futures. How Financial Advisors Can Overcome Objections...Look, I could write an encyclopedic collection of scripts and ways to respond to specific objections down to the letter. But none of that would help you. Because the truth is there is no cut-and-dry approach. You have to figure out what works for you and your personality.

I know that isn’t a popular answer and it doesn’t fit nicely into a “do this, not that”, tactics-driven mentality, but it’s the truth. Personally, I run such a tight ship that objections don’t come up often for me. I have so much content in the form of blog posts, podcast episodes, and daily emails that by the time a financial advisor gets to me, he or she is likely already committed and ready to go. You should strive to run your business the same way. If you get nothing else from this article, get this: the best way for financial advisors to overcome objections is to overcome them in their marketing, long before the initial meeting. A big benefit of operating your business this way is that, because people are ready to do business, you can be much more productive. Instead of having three separate meetings to take someone from prospect to client, you may only need one. This gives you more time and energy to invest back in your business. I hope this helps you. I wish you nothing but the best! 😄 P.S. There is a fine line between handling objections and desperately chasing prospects. Let me explain… Back in 1953, a movie came out called “Shane”. It’s a western about a gunslinger (named Shane) in a small Wyoming town. The most famous scene is the last one where Shane is riding off into the sunset and the little boy, Joey, is chasing after him yelling… “Shane! Come back! Shane!” What does that have to do with financial advising? Everything. Because it’s a perfect demonstration of what NOT to do. You should NEVER chase prospects. You should have so many people in your pipeline that it doesn’t hurt to let a few walk away. If someone truly isn’t interested, so what? Move on. If someone honestly can’t set aside thirty minutes to learn about how to protect his/her retirement, so what? Move on. It’s a terrific approach to business, and it’s one of the best “sales” tips I can possibly give you. Because when you chase after prospects, you actually repel them. The more you chase, the more they run away. Yet, there are a few things you can do to ensure they come running after you, which I explain here: 37 Sales Tips For Financial Advisors About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |