10 Of My Favorite Productivity Tools For Financial AdvisorsThis article contains affiliate links.

As the founder of this site and the host of the Financial Advisor Marketing podcast, I’ve found that financial advisors have a keen interest in becoming more productive. If that’s you, who can blame you? As a financial advisor, your income is closely tied to how productive you are. The more time you can spend in front of prospects and clients, the bigger the impact you can have on their lives and yours. That’s why I’m not surprised some of the most common questions I get from advisors revolve around productivity. More often than not, these questions ask me to recommend my favorite productivity tools — so I finally am. Here's what we'll cover in this article:

First, I want to dig deeper into productivity. Improving your productivity is one of the best things you can do for yourself, and making more money faster and easier is just a major bonus. Think about it: If you make $40 an hour and you get an extra 10 hours of productive time each week, that's $400 more in your pocket. But here’s where you’ll go wrong: being busy for the sake of productivity isn’t what I’m talking about when I tell you you can accomplish more by doing less. Being Busy Is The New Stupid & The Curse of Toxic "Productivity"...I’m sure that sounds crazy, but hear me out. Administrative tasks are important; they have to get done — but you don’t have to be the one who files all the paperwork and does the bookkeeping.

If you’re caught up with busywork, you could easily outsource to an assistant, you won’t have time to prospect or grow your business. And that’s the opposite of productivity, right? Now we’re on the same page. I recently read about an old war general who categorized his officers into four types: Lazy And StupidThis person doesn’t do any harm; they’re just cruising. If asked to do something, they likely make a good effort, but they’re lazy and stupid because they don’t seek growth. An advisor who fits this category is one who goes home after work and watches Netflix for the rest of the night, for example.

Rather than do or even watch something enriching, your queue proves you’d rather be entertained than educated. Kudos to you if you invest in yourself, because the truth is many advisors don’t bother to show interest in improving themselves. (This category might be overflowing.) Hardworking And CleverAccording to the general, these people made good officers, because they ensured everything ran smoothly, and they worked hard to get the job done.

If you’re a hardworking and clever financial advisor, that means you’re smart enough to prioritize the business-building work you can’t delay, plus you can get work done faster than your peers. Hardworking IdiotThe last thing you want to be is a hardworking idiot. Luckily, this list of productivity tools will help reduce that possibility, but the idea is not to waste time on pointless tasks.

The allure of busyness is vapid, because you could be so busy and hard at work… on the wrong dang tasks. What’s the use of having a nonstop day-to-day if what keeps you busy doesn’t lead to a growing bottom line? If you saw yourself in my previous example about doing administrative work when you can outsource it, it’s not too late to not be this kind of “productive” financial advisor. Lazy And CleverThis is the sweet spot. The word “lazy” might throw you off, but a lazy and clever advisor will always look for the easier way to get the job done. The general was fond of this kind of soldier, because they were too lazy to do unnecessary work.

While the hardworking idiot does every pointless task in front of them, whether or not it puts money back into the business, the lazy and clever person only wants to do what’s essential. And that’s how it should be. 😜 If it’s not a core task, either delegate or eliminate it. It’s a simple philosophy, but it’s one that’ll only be impactful if you truly want to maximize your productivity. My Top 10 Productivity Tools For Financial AdvisorsNow, with great pleasure, I give you my 10 favorite productivity tools that help me level up in my own life.

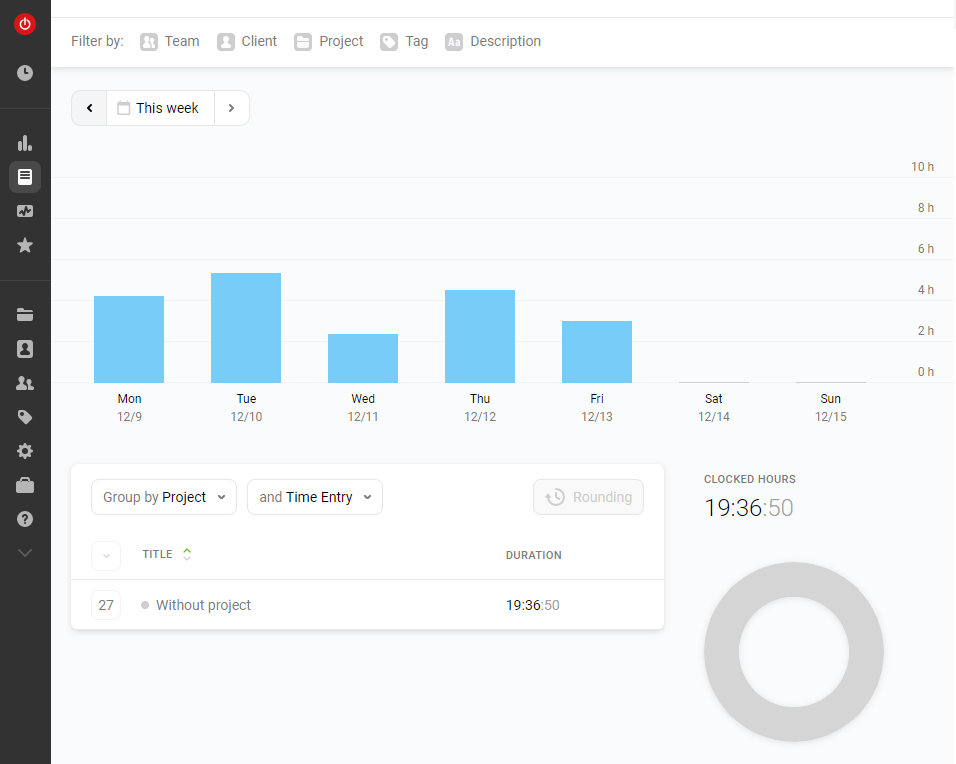

1. Time Tracking SoftwareI’m obsessive about tracking my time with Toggl. Every time I work on a high-value task, I hit the one-click timer and the clock starts ticking.

In my experience, tracking your time is one of the most important things you can do if you want to become more productive. Tracking your time for a few days (or weeks) allows you to get a baseline measurement upon which you can improve. Many financial advisors have talked to me about how much they work, only to find out they only spend a few hours per week on high-value tasks. It’s certainly eye-opening. If you’re competitive (like I am), you will find yourself trying to beat your previous “high score”. For example, if you spend three hours prospecting today, you’ll try to prospect for at LEAST that amount of time tomorrow. I like using Toggl because it lets you easily filter your time tracking data. You can even add tags and categorize your tasks into various projects. This means if you want to go back six months and see how much time you spend in a certain category compared to now, you can. 2. To-Do List AppHaving the same to-do list app across multiple devices is another “quick win” I can give financial advisors. Here’s why…

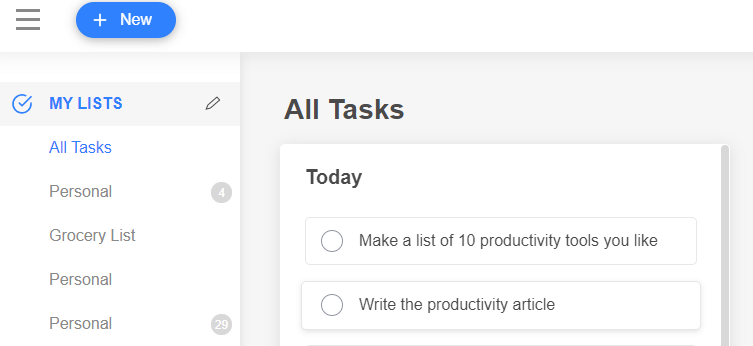

I use Any.do and I have the app on my phone, my tablet, and all of my computers. However, I must admit I’m not a power user - the only thing I use is their to-do list. Yet, having the same app installed across all of my devices means I can check what needs to get done no matter where I am. I even have it integrated with my Amazon Alexa, allowing it to create a separate grocery list. I also use Any.do as an idea bank. Whenever I get an idea for something I want to do or someone I’d like to collaborate with, I write it down in the app. Right now, I’ve got a list of hundreds of things I’d like to accomplish. When I sit down at night to create my to-do list for the next day, I simply pick ideas from this master list. This means I always have a full calendar and I’m always getting things done - just how I like it. One of the reasons financial advisors love Any.do is because it can sync with their calendar. It can also set one-time and recurring reminders to make sure critical things don’t get forgotten. ALSO READ: 7 Traits Successful Financial Advisors Have (That Others Don't) 3. Email ClientI’ve tried a bunch of email clients over the years. Seriously, a bunch. The one I’ve settled on is eM Client and I’m happy with it.

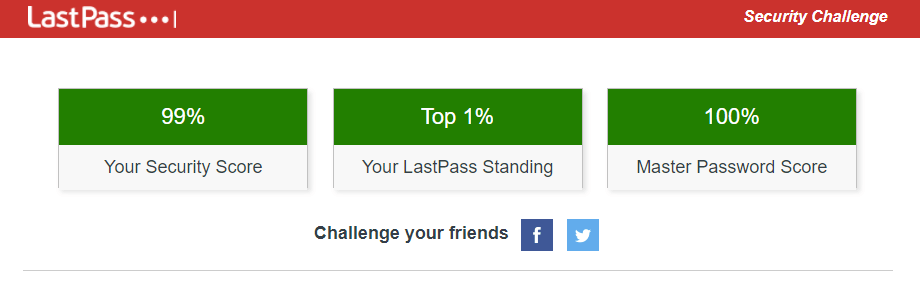

Email clients aren’t exactly exciting to talk about but the one you use for your business can make a dramatic difference in your personal productivity. I like having all of my email accounts in one place, where I can categorize and organize them however I please. Perhaps my favorite feature of eM Client is the ability to create a task from a message. All you have to do is right-click and click “Create Task From Message” and you can set a date and time to do the task. You can even set an alarm to remind you. For me, this is amazing because I have my assistant check my email first thing in the morning. She goes through everything and, if there’s anything I need to do, creates tasks for me to complete. When I check my email later in the day, I know exactly what needs to be done. Oh, and this can sync with Google calendar, too. This means you can source tasks from all of your email accounts (both personal and professional) and send them to one calendar. Your spouse sent an email to your personal account about dinner reservations? Boom, add to the calendar. Your client emailed your professional account about wanting to call you next week? Boom, add to the calendar. It feels so good making email so easy. You can check out eM client here: eM Client | The Best Email Client For Windows And Mac 4. Password ManagerThere are a bunch of password managers out there on the market - Dashlane, Keeper, Bitwarden, 1Password, etc. - so take your pick. If you get nothing else from this article, please listen to me here: start using a password manager.

If you’re curious, the password manager I use is LastPass and I can’t recommend it enough. Most people use very weak passwords and reuse them on different websites. In order to be secure online, you should use unique, strong passwords on every site. But how are you supposed to remember all those passwords? That’s where a password manager comes in… Think of a password manager like a book of your passwords, locked by a master password that only you know. Assuming you’ve chosen a strong and unique (but memorable) master password, it’s a near-perfect way to protect the rest of your passwords online. Plus, password managers can generate these secure, random passwords for you and store them in your vault. LastPass also offers a variety of two-factor authentication options, which makes it even more secure. You can pair LastPass with an authentication app, which means even if a hacker gets your master password, he/she will still have to enter the code from the authentication app. After installing your password manager, you will likely want to start changing your passwords around the web to more secure ones. LastPass offers the LastPass Security Challenge, which identifies your weak and duplicate passwords that you should change immediately. ALL financial advisors should be concerned about online security. Without taking the proper protective steps, you’re putting yourself at risk.

I also love using LastPass because it allows you to share your login credentials for any website without the other person ever seeing your password. This is a godsend for employees and assistants who need to access various accounts. For example, I have my assistant access my QuickBooks account so she can upload receipts and categorize information. LastPass allows her to gain access without ever seeing my password. I can also revoke her access at any time through the app. If you’ve never heard of this before, you may be wondering how it all works. What you’re basically doing when you share a password is sending a virtual “key” to the other person. When the other person accepts the “key”, he or she can click through to access the account. It’s like magic. 5. Social Media Automation ToolJust like with many of the tools mentioned on this list, there are plenty of options to choose from. For social media automation, there are Hootsuite, Buffer, MeetEdgar, CoSchedule and much more. All of them let you schedule your social media posts, and all of them have their pros and cons.

There are three big reasons financial advisors should consider using a social media automation tool:

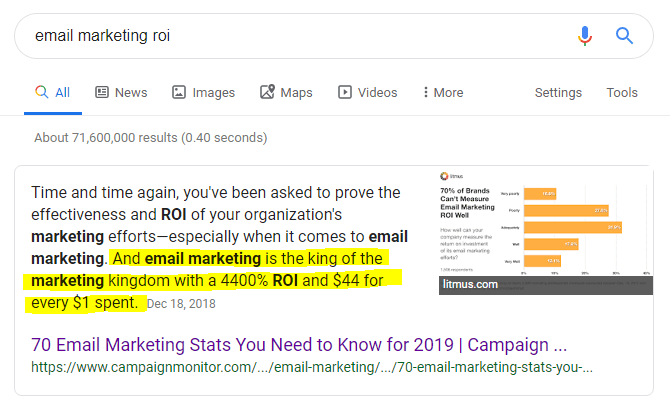

I use Buffer’s social media management software. It’s easy to use and has an intuitive interface. I’ve recommended it to several people in my own network and all of them have loved it, too. ALSO READ: 7 Easy & Actionable Social Media Tips For Financial Advisors 6. Email AutoresponderEmail is king when it comes to getting financial advisors more clients.

According to McKinsey, it’s literally 40X more effective than Facebook and Twitter combined. There are so many statistics about email marketing’s effectiveness that I’d be here all day if I tried to list them all. And perhaps the best part is that it can all be automated. Yep, you can use an email autoresponder service to deliver your emails in a predetermined sequence and frequency. Many financial advisors I’ve helped have seen a lot of success with a simple two-week autoresponder sequence. In my case, I email every single day. I have an email autoresponder sequence designed to email my subscribers every single day. I have about thirty emails in my initial autoresponder sequence designed to take subscribers through a specific “indoctrination” sequence. After they’ve been through that sequence, they move on to my broadcast emails, which are the ones I’m actually typing and sending every day. When it comes to autoresponders, I use Drip. However, I’ve found that the majority of financial advisors use MailChimp, followed by Constant Contact. I have experience with all three of them and they’re all great. If there’s one type of automation I wish I could implement in every financial advisor’s business, it would be an email autoresponder because it’s a drop-dead easy way to set more appointments on autopilot. Don’t be intimidated by the process either - many email software websites have tons of resources and guides to walk you through the process. Plus, they typically have live chat and/or solid customer support teams. Remember, they don’t get paid unless they help you successfully set everything up, so don’t be afraid to put them to work! :-) 7. Sleep SystemThis isn’t some sexy app or software but having a sleep system in place can make a huge difference. I’m talking about engineering your life in such a way that you get the best sleep possible. Because if you aren’t sleeping well, you aren’t operating at 100%.

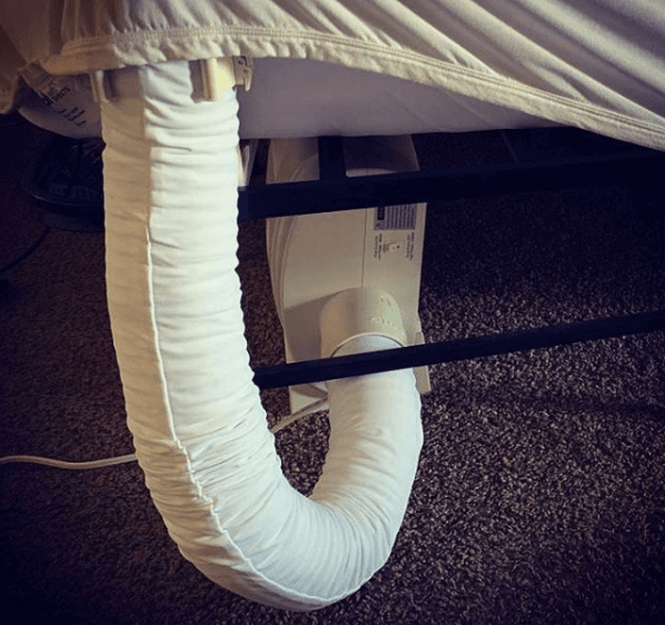

I encourage you to read this article I wrote about proper sleep hygiene here: 10 Sleep Hygiene Tips To Help You Get A Good Night’s Sleep One of the best investments I’ve made in terms of sleep is a BedJet. It’s a climate control system for your bed. Here’s how it works - you take the BedJet and stick the hose in your sheets. It pumps hot or cold air (your choice) into your bed, ensuring you sleep comfortably. Professional athletes use the BedJet and it’s recommended by physicians all over the country. It has definitely allowed me to sleep better and operate at a higher level. If you’re someone who demands the absolute best out of yourself, then don’t skip getting a BedJet. 8. Speed Reading SoftwareI like to read… a lot. I recently let a friend borrow my Kindle for vacation and he was shocked to discover that I had hundreds and hundreds of books on the device.

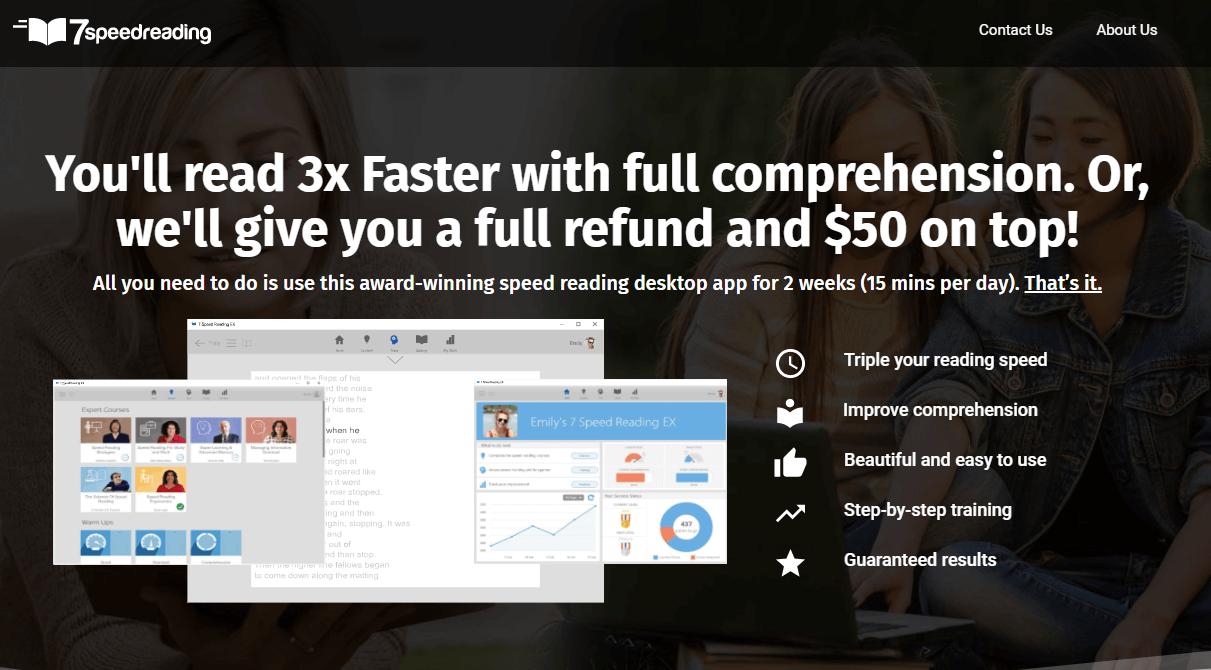

What’s my secret? Well, it’s partially speed reading. According to Pew Research, the median American has read four books in the past twelve months. Because I used to read one book per week, I read 13X more than the typical American. However, I used speed reading software to triple my reading speed. Which means I’m now reading 39X more than average. It’s an insane upgrade to my life. I’m still blocking out the same amount of time and maintaining my daily reading habit but I’m practically INHALING information now. It’s an incredible feeling. How did I do it? I used speed reading software. When I started, I could read 370 words per minute. Not too shabby but not excellent, either. Two weeks later, after going through the training, I was reading 1,135 words per minute with 90% comprehension. 👉 Don’t believe me? Here’s proof: How I Tripled My Reading Speed In Two Weeks… And Why I Think You Can Do It Too… The specific software I used was 7 Speed Reading and I was encouraged to try them based on their bold guarantee, which is: “Read 2.9X faster, with full comprehension, or we’ll give you a full refund, and pay you $50 on top. All you need to do is use our award-winning speed reading software for only seven minutes a day - for two weeks. That’s it.” So, they’ll put an extra fifty bucks in your pocket if you don’t get results. Meaning you win either way. It’s the ultimate risk-reversal and I salute them for it. The more you read and grow, the more knowledgeable you will be. Plus, you’ll become way more productive because you’ll be able to breeze through all of the material that comes your way every day. Don’t skip over this skill because it can change your whole life. Check out 7 Speed Reading here: My Favorite Speed Reading Software 9. NootropicsIf you’ve been following me over the years, you’ve been privy to my experiments to enhance my brainpower. I’ve tried a bunch of different tips, tricks, and strategies over the years but nothing has worked as well as supplementing with nootropics.

Nootropics are supplements that work to improve cognitive function, particularly executive functions such as memory, creativity, motivation, and more. Please keep in mind that I am NOT a doctor or a medical professional of any kind. I’m merely sharing my personal experience and, in my experience, Mind Lab Pro was the nootropic that finally helped me get to the next level in my life. I’ve been helping financial advisors with their marketing for years. This involves juggling several complex projects, ranging from my products to my newsletter to my podcast and more. In order to manage all of these things, I needed a way to increase my focus, creative energy, and concentration. So, like all inquisitive people, I began researching online… That’s when I noticed several extremely successful people - including a highly paid hedge fund manager - mentioning an obscure nootropic that gave them an edge over everyone else. It was Mind Lab Pro. And if you’re interested, I wrote an entire review of my experience with it here: How I Gained An Unfair Advantage By Unlocking My Brainpower One thing I noticed within a few days of taking this nootropic was that my brain fog was gone. If you’ve ever suffered from brain fog, you know how crappy it feels. Eliminating my brain fog was a huge step forward in making me more productive. All I do is take two capsules in the morning (which is what they recommend). I take them on an empty stomach with a big glass of water and then read for about twenty minutes. By the time the twenty minutes is up, my mind is raring and ready to seize the day. If you’re curious and want to give them a try, they offer a risk-free, “empty bottle” money-back guarantee. This means you could take all the pills, decide they don’t help you at all and send everything back for a full refund. I’ve always appreciated companies that put their money where their mouth is and I wouldn’t feel comfortable recommending something that’s not backed by a guarantee anyway. You can check them out here: Mind Lab Pro Universal Nootropic 10. Meal Delivery ServiceI think I’ve experimented more with the food-related part of productivity more than anything else on this list. Because, if you think about it, a LOT of our time revolves around food. Plus, what we put into our bodies affects how well we perform during the day.

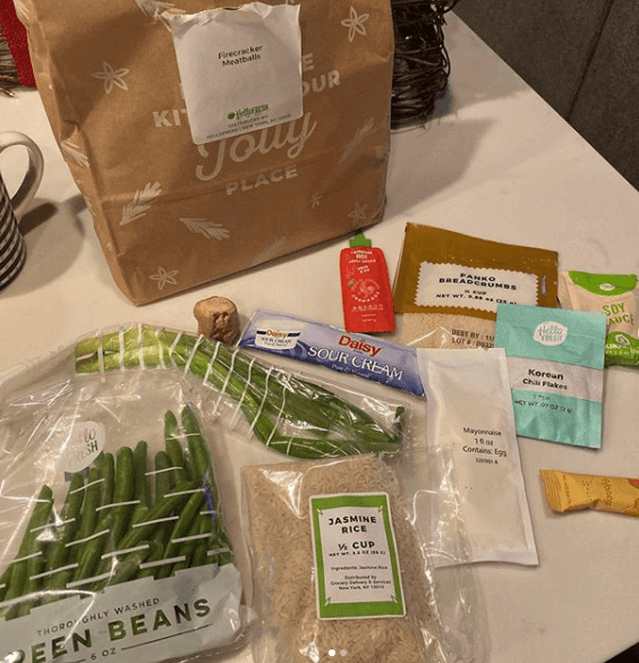

Also, decision fatigue is a real thing. Imagine you’re at the end of a strenuous exercise routine and you can’t push your body to do any more. You’re feeling fatigued and your strength has been depleted. The same concept applies to your mental abilities. People struggle with their choices after making too many decisions. The term “decision fatigue” describes the deteriorating quality of decisions made by an individual after a long session of decision making. So, if you can figure out what you’re going to eat, that’s one less decision you have to make. I tried meal prepping… but wasn’t a fan of all the leftovers and eating the same thing over and over. Then, I tried getting my groceries delivered. However, I was still stuck figuring out which recipes I wanted to try and then organizing all the ingredients. Plus, the grocery delivery services charge premiums and fees out the wazoo. That’s when I found HelloFresh and it’s been a game-changer for my personal productivity. It’s the #1 meal kit delivery service in the country and I can see why. Their food is fresh, their recipes never get boring, and you can customize which meals get delivered to you each week. You can also skip weeks if you’d like and cancel at any time. HelloFresh doesn’t break the bank, either. Depending on how many meals you get delivered, each meal can cost less than eight bucks a pop.

Do You Use Any Of These Tools? Let Me Know!I would love to hear if you use any of these tools or if you have any recommendations for tools I can try. Send them over to [email protected].

I look forward to hearing from you. Stay productive! BONUS: Financial Advisor Productivity Tips From Bill GatesOne of the most popular episodes of my "Financial Advisor Marketing" podcast is titled, "Financial Advisor Productivity Tips From Bill Gates". You can listen to that episode by using the above player.

Show highlights include:

While we're on the subject of Gates, I'll let you in on some of the wisdom I shared about him in this podcast episode... What Would A Lazy Person Do? 🤔Mega billionaire Gates said, “I will always choose a lazy person to do a difficult job because a lazy person will find an easy way to do it.”

Here’s another example: when Charlie Rose interviewed Warren Buffett and Bill Gates, Buffet pulled out his calendar, and there were only three or four entries in the entire month. The key to productivity is (selective) laziness, folks. Yup, it sounds counterintuitive — but in reality, the hardworking idiot who doesn’t find easier ways to reach goals will fall behind. You’re not a billionaire with a full staff, so don’t expect to operate on a similar schedule right away. The takeaway from how one of the richest people in the world stays productive rather than busy is controlling your time — not to be confused with managing your time. The difference between time control and management is when you control your time, you decide which tasks are more important than others. For you, that could be prospecting, marketing, or setting and attending appointments. No matter what those business-building activities are, that's what you need to be doing, and they should occupy most of the real estate on your calendar. You still have to stay on top of following up with clients and taking calls, but you can become much more productive by doing a lot less — as long as you work on the right tasks. If you want to be successful as a financial advisor, you have to step back and look at the picture. That’s where the money is made. Aim to be lazy and clever, folks: the clever part is figuring out the right activities to prioritize, and the lazy part is doing just that and not anything else. 💡 If you want to work smarter, not harder, start by clearing your calendar of pointless tasks, Then download Peak Productivity for Financial Advisors: How You Can Get More Done In Less Time. Will you double your productivity overnight? No. I won’t sell you a pipe dream — but you will increase your productivity enough to have my video training paid for itself. About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |