Financial Advisors: 4 Reasons Why Buying Leads Is Like Burning MoneyEvery so often I’ll hear from financial advisors who want to buy leads. They’re typically shocked when I tell them that buying a list of leads is perhaps the DUMBEST thing they can do.

Let me tell you why, but fair warning… This article isn’t “nice’. Nor will I pull any punches. I will probably offend a lot of people, especially the financial advisors who are addicted to leads like caffeine junkies are addicted to Starbucks. So, if you don’t think you can handle this… please STOP reading. I’ve also had major lead-generation companies reach out to me begging to become an affiliate for them. There are only a few I could see myself working with, but most are absolute trash. I tell you that to make it clear that I could make a LOT of money by shelling out lead-gen services to financial advisors. All I have to do is write an article like this, record a podcast episode, or send out an email with an affiliate link. All the “more leads!” addicts could click my affiliate link, gobble up the leads, and I could cash a fat check. I’ve also had individuals approach me and ask me if I would partner with them to build a leads company serving financial advisors. It would’ve been easy for me to form a brand-new company and leverage my existing audience of financial advisors to sell them leads.

But I didn’t. Why not? Because I’d rather tell financial advisors the TRUTH. And the raw, unadulterated truth is that, for the overwhelming majority of financial advisors, buying leads is like burning money. Here’s why… 1. You're Not In ControlThis is by far the biggest reason why financial advisors should not buy a leads list or any type of sales leads.

I don’t care how successful you think you are or how fast you’re growing. If you’re dependent on buying leads, you are NOT in control. It’s like riding in the bed of a pickup truck while someone else is driving. You’re subject to the harsh bumps and tire-bursting potholes while the driver rides comfortably in an air-conditioned cabin. Now, before people start whining and bellyaching, I want to point out that the key word here is DEPENDENT. Because if buying leads is a small part of your business and you’re consistently profiting from those bought leads, more power to you. But there are some financial advisors who desperately seek out leads like a zombie seeks out brains. “Leads… leads?? Do you have any leads?!” These advisors are a sad bunch because, with all the time (and money) they spend buying leads, they could build a business 10X the size of what they currently have. Instead, they’ll spend the rest of their days fulfilling their lead addiction while the smart financial advisors remain in control. Why? Because successful financial advisors know that the real money comes from CONTROL. Besides, what happens if your lead company goes out of business? Then what will you do? If you’ve hitched your wagon to their star, you’ll be screwed. You will never learn how to generate the leads yourself and you will always be dependent on buying leads. This is a “give a man a fish” problem because if you give someone a fish, that person will only eat for a day. However, if you teach that person to actually FISH, that person will eat for a lifetime. So, stop depending on stinky fish handouts and grab your reel. Finally, what happens if your preferred leads provider…

What would you do? These are all things that could victimize you, should you give up control of the lead-gen part of your business. ALSO READ: 15 Financial Advisor Prospecting Tips 2. Most Leads Companies Don't Have Your Best Interests At HeartOn paper, the idea of using a lead-generation company sounds like a good one.

After all, if they don’t send you good leads, they don’t get paid, right? Wrong. Some companies charge a fee simply to join their network and then make it their mission to generate as many “leads” as possible so they can send them to advisors in their network. I don’t blame them for doing this - they’re simply trying to grow their business. But… if the leads don’t convert, that’s not their problem. It’s yours. And to an extent, that’s true. It IS up to you to convert your own leads. However, the only way for lead-generation companies to grow their businesses is to sell more and more leads, which inevitably leads to poor quality. Here’s how the process plays out:

As you can see, nearly all lead generation companies are fantastic… when they first get started. Then, things start to go downhill faster than a skier sliding down a mountain of butter. 3. Not All Leads Are Created EqualIf you’ve ever bought leads, you know this is true. It’s related to the problem I just explained - lead companies constantly have to source new leads to feed the growing demand from financial advisors. In order to do that, they must seek out new audiences and new placements.

Besides, people who hire a financial advisor often do so by evaluating the advisor’s website and social media accounts first. Or they seek a referral from friends and family members. Very few high-net-worth individuals find their financial advisor as a result of being in a list of sales leads. And if you do somehow manage to find a list of high-net-worth individual leads, you’re going to pay for it, which can get expensive fast. For example, you could pay upwards of $200 PER LEAD for someone who SAYS he/she has investable assets of $1 million or more. Because a lot of these lead-gen sites are just contact forms where people can say whatever they want. It’s self-reported. Just because someone says he has a million dollars of investable assets doesn’t mean it’s true. And you’ll burn through a few Benjamins to find it out the hard way. Anyway, let’s assume you’re spending $200 per lead and they’re all 100% legit. Assuming you go through twenty leads to get one client, that means you’re paying $4,000 to get one client. If that’s profitable for you, then more power to you. But if you really want to succeed in business, you have to master capital allocation and, quite frankly, this isn’t the best use of your capital. ALSO READ: 4 LinkedIn Marketing Tips For Financial Advisors 4. Converting Purchased Leads Is DifficultESPECIALLY if the leads aren’t exclusive. If they are exclusive, expect to pay out the nose for them.

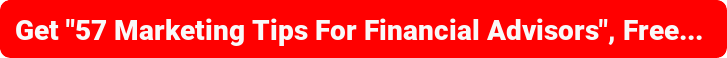

Most financial advisor leads are non-exclusive, which means by the time you make contact with your leads, you may find that two other financial advisors have already beaten you to the punch. And unless you work with a specific niche and you’re only buying leads in that niche, you won’t have any way to differentiate yourself from the others. Good luck fighting that battle, skippy. Also, a lot of lead companies will sell you the prospect’s phone number. This is notoriously unreliable because people don’t really answer the phone anymore. In fact, studies have found that nearly 90% of consumers don’t answer the phone for the following reasons:

In my own case, I made the grave mistake of giving my phone number to a lead generation company for contractors.

Holy smokes! They hound me more than anyone else I’ve ever seen. I absolutely despise them for it and I will NEVER do business with them because of that reason. Plus, you follow my advice about niching down, then buying a list of leads is essentially business suicide. You will be forced to take what you can get because the chances of your leads fitting your exact niche are slim-to-none. Which scatters your focus… and your profits. Why Financial Advisor Leads Companies Hate Me...Not too long ago, I had a lead-gen company reach out to me, asking to form a partnership.

I said no. Why? Because they were selling leads for approximately $50-200 each. Then, they told me that the average conversion rate for those leads was about 5%. This means if you’re drop-dead average, it will cost you between $1,000 and $4,000 to acquire a client. Is it possible to be profitable with those numbers? Absolutely. I’m not saying it’s not possible… but you can get SO MUCH MORE for the same $4,000 and have a much higher conversion rate. You see, most lead-generation services work like this:

This means not only are you paying more money to get these leads than you should be, but they’re usually sent to multiple people. If you do this, congratulations! You’re making a stupid business mistake. It’s no exaggeration to say that you can do everything that lead-generation companies do. For example, some companies will advertise on Facebook and charge you for people who register for your seminar. Why not run the ads yourself and cut out the third party? ALSO READ: 9 Actionable Seminar Marketing Tips For Financial Advisors And if you are running online ads, here’s a little tip for you: put your phone number in the ad itself. That way people can call your number without clicking the ad, which means you won’t get charged. This lets your marketing dollars stretch even further. The Better Alternative: Do It Yourself...There’s literally no excuse for not being able to generate your own leads anymore.

For example, if you type “financial advisor near me” into a search engine, the results are domination by crappy lead-generation companies whose sole purpose in life is to extract data from consumers. You, on the other hand, could rank for this term by providing valuable content for people. Once visitors get to your site, a certain percentage of them will reach out to you (not some third-party company) for more information. Your website should be generating leads for you 24/7. It never gets sick, it never gets tired, and it does whatever you tell it to do. When people visit your website for information, they’re thinking of you as a source of advice (which is what you want). If they keep coming back and you finally tell them about the services you offer, what do you think are the chances of them listening to you? A LOT better than buying leads. It’s better to generate your own leads because you can put your own contact information out into the world so people can contact you directly. Plus, when you build your own marketing machine, you are building a system that will work for you throughout your career. Once you buy a lead from a lead generation company, the transaction is over. You have no real “equity” in the deal. Another way you can generate leads yourself is by using LinkedIn. As I mentioned earlier, lead-gen companies want to generate as much traffic as possible, sometimes irrespective of the quality, so they can sell the leads to financial advisors. When you do it yourself through LinkedIn, you are better able to control the quality. This is because you can see your potential prospect’s location, education, background, etc. Let’s say you work specifically with teachers - with LinkedIn, you can see whether or not someone is a teacher. Getting into my client-getting LinkedIn tips is well beyond the scope of this article, so if you’d like to learn more I encourage you to check this out: How To Get Clients With LinkedIn When you buy leads, you’re essentially playing the lottery. People don’t like it when I tell them that, but it’s true. Isn’t it better to spend your valuable time working on building a business in a way that’s sustainable and repeatable? I just want you to realize that you can do everything that lead-generation companies do. In essence, you can cut out the middleman and grow your own marketing machine that works solely for you. |