5 Reasons Why Hiring A Financial Advisor Marketing Agency Is A Bad Idea (Read This Before Hiring One)You’ve probably heard some of these claims before...

“We have custom content you can use to attract ideal clients.” “We’ll do everything for you.” “Let us handle your marketing so you can focus on what really matters.” Lol. 😆 I can’t even get online anymore without seeing ads from these so-called “agencies” who claim to help financial advisors get more clients. Look at this Facebook ad I saw a few days ago… Sigh.

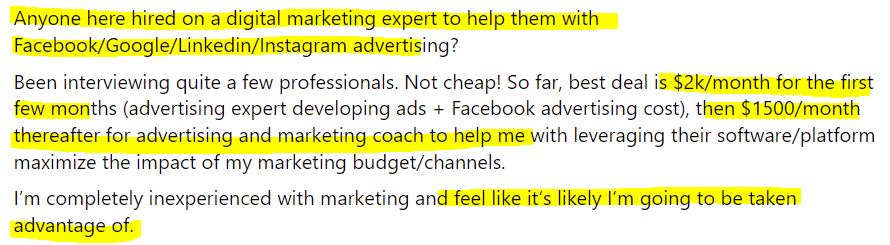

The sad part is this doesn’t even faze me anymore. There are so many fly-by-night “consultants” and “coaches” in the financial advisor space who all claim to help financial advisors get eight billion new clients in six nanoseconds or less. Even worse is that there are some financial advisors who fall for these people. Because I see financial advisors ask questions like these: Look, I get it. I really do. Most financial advisors aren’t natural marketers. But this idea that you can outsource your marketing to someone else and have everything be unicorns and rainbows is a pipe dream.

Here’s why… 1. Insufficient Knowledge Makes You Vulnerable.Read the last sentence from the above photo: “I’m completely inexperienced with marketing and feel like it’s likely I’m going to be taken advantage of.”

Bingo! This is not just a passing concern; it's a significant red flag waving furiously in the wind. When you admit to a lack of marketing expertise, you’re not just stating a fact; you’re opening the door to potential exploitation. I’ve heard outlandish tales of agencies charging outrageous sums of money for things like:

Now, let's dive into the nitty-gritty. The issue isn't just about the ease or difficulty of tasks like installing a Facebook pixel – which, for the record, is astonishingly quick if you're familiar with your website's backend. The real problem lies in the fact that agencies can, and sometimes do, exploit this knowledge gap. They're aware that terms like "Facebook pixel," "SEO optimization," and "conversion rates" can sound like a foreign language to someone not versed in marketing. This isn't just an inconvenience; it's a vulnerability. It's like walking into a car dealership and admitting you know nothing about cars. Suddenly, everything has an added 'complexity' and 'necessity'... for a price. And those “setup fees”? They’re often just an arbitrary barrier to entry, designed to pad the bill rather than offer any real value. Imagine if every time you walked into a fast-food joint, they charged you just for stepping up to the counter. Sounds absurd, right? Yet, when it's wrapped in the guise of specialized service, it becomes surprisingly easy to justify. Regarding the creation of online ads: if you’re the one providing the content, what exactly are you paying the agency for? To click a few buttons? The real skill in advertising comes from understanding the market, knowing the psychological triggers of your audience, and crafting messages that convert – not just filling in a template. And let’s talk about those content libraries. The whole point of content marketing is to establish your unique voice and offer valuable insights that resonate with your target audience. But if you're using the same stock articles and posts as hundreds of other advisors, you're not standing out; you're getting lost in the noise. It's like showing up to a professional networking event wearing the same generic 'business suit' as everyone else. Sure, you'll fit in, but will anyone remember you? This all circles back to the original point: lacking knowledge in marketing makes you vulnerable to being oversold, underserved, and ultimately disappointed. It's not just about the money wasted; it's about the lost potential, the clients you didn't reach, and the growth that never happened. Before you consider handing the reins of your marketing over to an agency, take a step back. Educate yourself just enough to understand what you’re paying for. This doesn’t mean you need to become a marketing guru overnight, but understanding the basics can transform you from an easy target into an empowered partner in your marketing efforts. Remember, in the world of business, knowledge isn't just power – it's profit. It reminds me of this classic quote: “Everybody wants to be a bodybuilder, but nobody wants to lift no heavy-ass weights.” - Ronnie Coleman If you want to become a better marketer, you have to lift your metaphorical heavy-ass weight.

Here’s another quote, this time from Gary Halbert, one of the greatest marketers of all time: “If you are in need of truly world-class copywriting, you’re probably going to have to learn to do it yourself. You see, the few of us who really can do it, write copy that sells, are so much in demand, you can’t even think about hiring us unless you’re willing to spend an arm and a leg. Even then you’ll still have to wait in line.” The truth is that there are few skills as valuable as marketing. Learning to do it yourself means you can increase your productivity (and therefore your income) at will. 2. Nobody Will Care As Much As You.Here’s a dirty little secret marketing agencies don’t want to admit:

They work best with proven processes. Many business owners have this dream that a marketing agency can come in and scale them to seven figures and beyond without any existing assets or systems. It’s as if they believe the marketing agency can wave a magic wand and presto! Create a seven-figure business. It doesn’t work that way. If you want to hire an agency, you will get the best results by having the following:

And yes, you need all three. Let me explain why… You could have the best business in the world with the right message, but if you’re targeting the wrong audience, it won’t matter. It would be like trying to sell steak to vegetarians. (If you want my help choosing a niche, read this article: 5 Best Niches For Financial Advisors.) Likewise, you could have the best business with the right audience and have poor messaging. It would be like selling steak to meat-eaters, but promising veggies. Finally, you could have the right audience and the right message but have poor business practices that sabotage you. This is like selling steaks to ravenous carnivores but being unable to keep your promises. If you hire a marketing agency without having proven audiences and proven messages, the marketing agency will be experimenting, and you will be the one footing the bill. The best-case scenario is that you have already done the experimenting to figure out what works for you. That way all you have to do is give them a glide path to success. Having proven business systems is YOUR responsibility and you should NEVER hire a marketing agency until you have your client onboarding and fulfillment in shipshape. Efficiency improvements within your business directly impact your cost per client. For example, let’s say you pay a marketing agency $3,000 and they get you ten appointments. Yet, because you have a lackluster value proposition or fail to follow up, you only convert two people into clients. This means your cost per client is $1,500. However, let’s say you fix those problems and convert four people into clients. You have effectively decreased your cost per client to $750, which adds up to a huge difference over time. A man I admire is a copywriter named Gary Bencivenga. He wrote copy for more than 40 years and conducted more than $1 billion of marketing tests. Several people consider him to be the greatest copywriter of all time. He appeared to have a Midas touch because nearly every promotion he ever wrote made millions for his clients. 💡 Gary revealed that one of his success secrets was choosing proven products. He refused to write copy for products that weren’t already selling. He didn’t like to launch new products that hadn’t proven themselves in the marketplace. He wanted to be handed a working offer on a silver platter so he could scale it to the moon. THAT’S how good marketing agencies operate. If you want maximum results in minimum time, you must give them proven processes because you can’t scale a dud. 3. Nobody Knows Your Business Like You.Next, finding a good marketing agency is difficult because you must do two things…

First, you must find someone who knows how to market a financial advice business. There are tons of people who SAY they help financial advisors, but when you dig a little deeper you discover they also help attorneys, accountants, engineers, insurance agents, chiropractors, and restauranteurs. 🙄 Not to toot my own horn, but I’ve been helping financial advisors since 2015. I have more than 100 episodes of my Financial Advisor Marketing podcast. I’ve also been publishing the most prestigious financial services marketing newsletter for several years. I’m not one of those “here today, gone tomorrow” marketers. Next, you need someone who understands YOUR niche. This is next to impossible to find, and it’s a reason why financial advisors end up burnt out and frustrated after hiring marketing agencies. Financial advisors can target wildly different audiences. One advisor may work with divorced women in their forties, while another might focus on physicians fresh out of medical school. Each group will require distinct approaches. Any marketing agency that claims they can market to anyone and everyone is likely trying to fit a square peg into a round hole. You already know your niche. You know what they like and what they dislike. You know where they hang out. You know which podcasts they listen to and which YouTube channels they watch. Chances are, you know far more about how to reach your niche than any marketing agency out there. Since you already know these things, you will likely be better off hiring someone in-house or a virtual assistant to take specific tasks off your plate as you see fit. Here are specific examples of tasks you can outsource to a virtual assistant instead of hiring an agency:

4. You Give Up Control.I recently launched a product showing financial advisors how they can get more clients from their websites, and I’ve been deluged with questions like this:

“Do you think it makes sense to hire a website designer or should I use a template software and do it myself?” This is a tough question to answer because it depends on so many factors, such as your income, your productivity, your ability to manage other people, your goals for your website, and more. However, if I HAD to pick something that would be applied to all financial advisors, I would pick a drag-and-drop builder such as Wix or Weebly. (If you’re slightly more advanced, you buy a WordPress theme and customize it to your tastes.) I say that for a few reasons: ✅ Drag-and-drop builders are easy to use. Even if you’re not tech-savvy, you can hire a neighborhood kid or someone else on the cheap to design it the way you want. ✅ If you build your website, you will learn valuable skills that can be applied elsewhere. Maybe you want to start another business in five years. If so, you’ll know how to get a site up and running. ✅ You can save a boatload of money over the long term. Let’s do some math… One popular website option for financial advisors starts at $179 per month. We’ll assume you do that and have your website for five years. That tallies up to $10,740. The entrepreneur-specific plan from Wix is $18 per month at the time of this writing. Your domain might run you another $20 per year. Over the same five years, that’s $1,180. In other words, you would have enough money left over ($9,560 to be exact) to hire someone to work for many hours to tighten things up, should you need one. Even better, you can hire someone to document systems and processes for you so you know exactly what to do yourself. But the biggest reason why I recommend using a drag-and-drop builder is because… ✅ You’ll stay in control. If you stay in control, you can make changes to your website without consulting anyone. I’ve heard horror stories of financial advisors who depended on freelancers who quit, ghosted them, or went on vacation just in time for something to break. Being able to log in and fix things in a few minutes is a godsend. The same is true with marketing, where giving up control is generally a bad idea. If you keep your hands on the marketing reins, you can call the shots. You also don’t have to worry about your marketing agency shutting down your accounts if you terminate them (yes, I’ve heard of that happening, too). If someone else handles your marketing, you are NOT in control of your business. It’s like riding in the bed of a pickup truck while someone else drives. You’re subject to the harsh bumps and tire-killing potholes while the driver rides comfortably in the air-conditioned cabin. I don’t know about you, but I’d rather be in charge of my own destiny. 5. To The Marketing Agency With A Hammer, The Whole World Looks Like A Nail.A final reason why hiring a financial advisor marketing agency might not be the best move is the inherent biases that come with such agencies.

Marketing agencies typically specialize in certain areas—whether that’s social media, content creation, SEO, or email marketing. Their business model revolves around these specialties, which means they have a vested interest in promoting these specific services. It's natural; after all, they’re experts in their field and believe in the efficacy of their strategies. However, this specialization can lead to a tunnel vision of sorts. When you consult a social media marketing agency about increasing your client base, they're likely to recommend a strategy that leans heavily into social media, because that's their area of expertise and business. It’s not that their recommendations are deceitful; they’re simply viewing your needs through the lens of their own services. This is akin to visiting a barber and inquiring whether you need a haircut—the answer will more often than not be affirmative because that's the service they provide. Similarly, if you ask a content marketing agency how to attract more clients, they'll likely suggest ramping up your content production. While these might be valid strategies, they may not always be the most suitable or cost-effective ones for your specific situation. Acknowledging biases doesn't mean dismissing the services marketing agencies offer. Instead, it's about understanding that every piece of advice comes with a perspective, and that perspective is shaped by the advisor's experiences, expertise, and, yes, the services they offer. Now, about personal biases: it’s true, I have my own. Given my background, I'm a strong advocate for email marketing, and for good reasons. However, I'm also conscious of not falling into the trap of confirmation bias, where I might only seek out information that supports my pre-existing beliefs. To mitigate this, I consistently refer to third-party research and data, and I’m open to testing and questioning the effectiveness of various strategies, even those I favor. This is an important distinction: While we all have biases, recognizing them and striving for objectivity is key, especially when it comes to marketing strategies that can significantly impact your business's growth and reputation. Therefore, when considering the services of a marketing agency, it's crucial to step back and assess whether their recommended strategies align with your business goals, target audience, and budget. Remember, a tool is only as good as its relevance and application to the task at hand. By understanding and acknowledging these built-in biases, you can make more informed decisions that truly benefit your business in the long run. (If you’re interested in learning more about email marketing, check out this article: 4 Things I’ve Learned From Sending 3.2 Million Financial Advisor Emails) Yet, perhaps the most insidious bias a financial advisor marketing agency can exhibit is the inherent desire to keep you as a client for as long as possible. This isn't just about promoting their favorite marketing strategies; it's about their own business sustainability, which relies on retaining clients. Picture this: you've been in a partnership with a marketing agency for several years. Throughout this period, they've helped you build a solid marketing foundation. You've developed assets, streamlined your systems, and fine-tuned your procedures to the point where you're attracting more inbound leads than you can handle. Essentially, the role the agency has played has become redundant. Technically, it's time for you to take the reins completely, applying what you've learned and operating independently. But will the agency make this clear to you? Will they guide you towards this realization of independence? It's highly unlikely. It's not out of malice but rather a built-in survival instinct. Their business thrives on dependency; without clients, they have no business. Acknowledging that you've outgrown their services is counterproductive to their business model. This is not to say that all marketing agencies operate with a lack of transparency or integrity. Many are upfront and honest, focused on truly benefiting their clients. However, the business nature of such agencies can inadvertently lead to a situation where they're not incentivized to make you self-sufficient. They might continue to propose new strategies, services, or areas of improvement, not necessarily because you need them, but because it keeps the business relationship—and their revenue—alive. This dynamic can lead to a tricky situation for financial advisors. On one hand, the support and expertise of a good marketing agency can be invaluable, especially in the early stages of business development. On the other hand, there comes a point where the return on investment starts to diminish. Therefore, it's crucial for financial advisors to remain vigilant and critically assess their relationship with their marketing agency continuously. Are the services still providing substantial value? Are the strategies employed still in alignment with your evolving business needs, or are they just meant to prolong the partnership? It’s vital to periodically review the results of your marketing efforts and consult independent advisors or peers. This can provide a clearer picture of whether your current marketing strategies are still serving your best interests or if they've become more about serving the agency's interests. Ultimately, your goal should be to develop a marketing system that's efficient, sustainable, and, most importantly, effective in attracting your ideal clients. While a marketing agency can play a significant role in achieving this, remember that the ultimate aim should be to build your own capabilities, not become perennially dependent on an external entity. Am I Opposed To Hiring A Marketing Agency?Am I opposed to hiring a marketing agency? Not necessarily.

A marketing agency can indeed be a valuable asset for financial advisors, but there are specific conditions under which this partnership makes sense. If the agency has a proven track record of success with businesses similar to yours, it indicates they understand the unique challenges and opportunities within your industry. This isn’t about one-size-fits-all solutions; it's about tailored strategies that align with your specific business model and goals. Having systems in place is another critical factor. This means the agency doesn't just fly by the seat of their pants but follows a systematic approach to marketing. This can provide consistency, allowing for better planning and execution, and more predictable outcomes. It's about knowing that every action taken is part of a larger, well-thought-out plan. Then there's the budget. Effective marketing isn't cheap, and it shouldn't be. However, it should be cost-effective. This means having a healthy budget that aligns with realistic goals and expected outcomes. It's not about throwing money at every shiny new tactic but investing wisely in strategies that are likely to yield a good return. Patience is the final piece of the puzzle. Marketing, especially when cultivating a sophisticated market like that of financial advisors, requires time to bear fruit. Immediate results are rare, and expecting them can lead to frustration and hasty decisions. It's about playing the long game, understanding that building awareness, trust, and a solid client base takes time. However, here's the catch – most of the time, hiring a marketing agency does not make sense for financial advisors. Why? Because the unique nature of the financial advisory business often requires a more personalized approach than most agencies offer.Many financial advisors serve niche markets with specific needs and challenges, which generic marketing strategies can't adequately address. Moreover, the personal nature of the financial advisory relationship means that clients often expect a level of personal interaction and understanding that an external agency might not be able to provide. Trust is a huge factor in financial decisions, and it can be challenging to build that trust through third-party marketing efforts alone. Another point to consider is the return on investment. Marketing agencies can be expensive, and without a clear strategy and measurable goals, it’s easy for costs to spiral without corresponding returns. This is particularly true for financial advisors who are just starting out or who have a limited budget. Lastly, the issue of control. By outsourcing to a marketing agency, you may be ceding control over how your business is presented and communicated to potential clients. For some, this might be a relief, but for others, it can lead to a disconnect between their personal approach and the public image crafted by the agency. In conclusion, while there are scenarios where a marketing agency could be beneficial for a financial advisor, these instances are more the exception than the rule. Before making such a significant decision, it's crucial to weigh the pros and cons, considering your specific business needs, goals, and the unique dynamics of the client-advisor relationship. About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |