I Analyzed The Websites Of Barron’s Top 100 Independent Financial Advisors: Here’s What They Do Differently…Today, I’m going to show you what Barron’s Top 100 financial advisors do with their websites.

There are so many website companies and so-called marketing “experts” floating around out there, all claiming to know what is best for financial advisors. Yet VERY few of them provide hard data and proof to back up their claims. So, I thought to myself... “Self, what are the most successful financial advisors actually doing with their websites?” I didn’t want vague suggestions or abstract theories. I wanted solid, tangible data so I could help financial advisors make better decisions. Here's What I Did...I went to Barron’s Top 100 Independent Financial Advisors list and clicked through all the financial advisors.

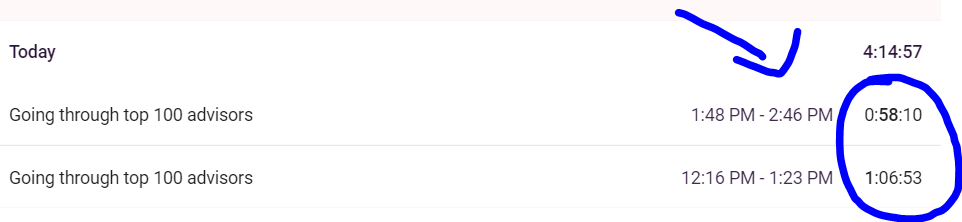

Here's the exact list I used, if you're curious. Every. Single. One. It took me a little over two hours, which you can see in my time tracking screenshot below, but I got it done. (The things I do for my beloved financial advisors...😆) Right away, I noticed the following:

I decided to remove them from my tabulations because I only wanted advisors with significant control over their websites. Not those silly cookie-cutter things. Sorry you guys, I love you, but this article is about REAL websites. Then, as I was going through the websites, I noticed:

This means despite having 100 independent financial advisors on the list, I only analyzed 69 websites. Nice. 😎 Also… I Only Looked At Their Homepages...Why?

Because I can't imagine how long it would take if I were given the Herculean task of evaluating every nook and cranny. Since it ended up taking me two hours to go through the homepages alone, I'm glad I made this decision. Of course, I ended up clicking a few call-to-action buttons here and there, but that was the exception, not the norm. Also, the homepage is the most commonly visited page of a financial advisor's website. I’ve had the good fortune of seeing behind the scenes of many financial advisors' websites, and the homepage almost always has the most traffic, followed by the "about us" page and then any resource pages (blogs, podcasts, webinars, etc.). This makes sense. Because, according to a study published by BNY Mellon & Pershing (titled Advisor Value Propositions), 41% of investors search for a financial advisor on Google, and 26% of searchers rank it as their most important source of information. In fact, Google is THE most common place used to search for financial advisors. Second after Google is LinkedIn. 27% of investors use LinkedIn to search for information, and 12% rank it as the most important. After that, you have sites such as:

Which investors rank in that order of importance. And guess what? ➡️ Most of the people who find you through these sources are going to click through to your website and land on your homepage anyway. ⬅️ That’s why I decided to put on my prospective client hat and stick to the homepage. My Hypotheses...Before I got started, I made a list of five elements that I believe make up a strong financial advisor website. I expected to see these elements on most of the websites in the top 100. They are:

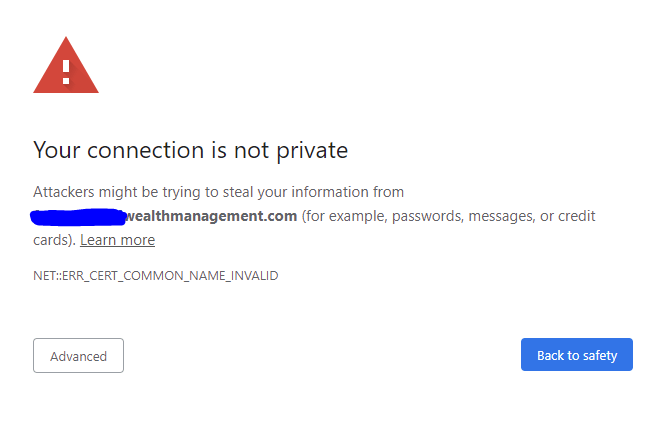

1. SSL CertificatesIf you have a website, an SSL certificate is no longer a luxury. It’s a necessity. Especially because browsers like Chrome will block you from accessing some sites without an SSL certificate.

When someone visits your website, they want to be able to trust that none of their information will be used for nefarious reasons.

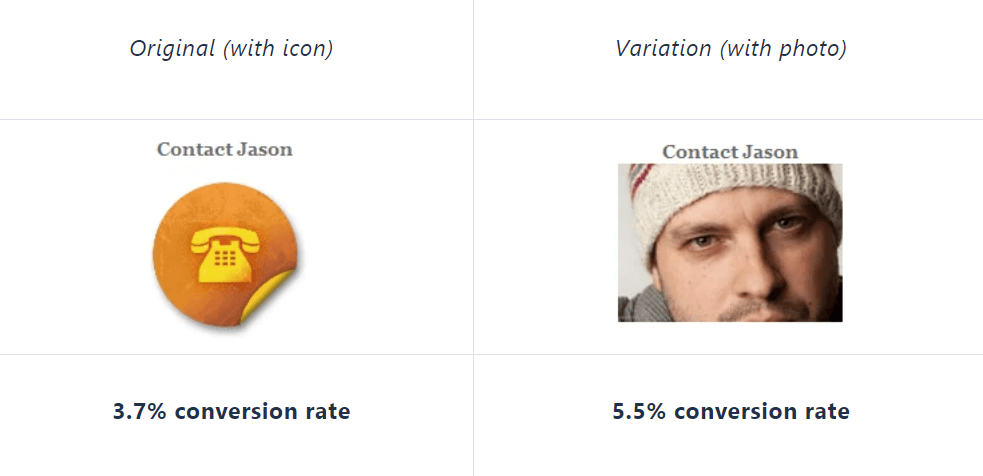

Plus, in 2014, Google made changes to its algorithm to give HTTPS-enabled websites an advantage. Various studies conducted by SEO experts have found a strong correlation between HTTPS and higher search engine rankings. ALSO READ: 5 SEO Tips For Financial Advisors 2. Photos And/Or Videos Of The AdvisorPhotos and videos help to humanize the financial advisor for prospective clients. Moreover, photos with human faces have been proven to boost conversion rates.

A/B testing company VWO ran a split test on one of their users' blogs to see if replacing a generic contact icon with his photo would lead to more people contacting him. Here’s a screenshot of the original and variation: As you can see, the version with Jason’s photo had 48% more conversions as compared to the icon.

Video also helps increase conversions. According to EyeView Digital, the conversion rate for their clients has increased with a video in almost every “video vs. no video” test they’ve run. In some cases, the conversion boost was over 80%. 🤯 Because of results like these, I expected to see tons of images and videos on the websites. ALSO READ: 11 Tips For Writing A Stellar Financial Advisor Bio (With Samples And Templates) 3. Clear NavigationA financial advisor can have the best content out there, but if visitors can't find what they’re looking for, they can't move forward. When that happens, it kills the chances of setting an appointment.

At minimum, I was looking for the websites to have a clear navigation bar at the top (like the one I have on this site). If they had that, I marked them down as having clear navigation. I figured nearly all of the advisors on the list would have this. Boy, was I surprised. 4. Clear Contact InformationI've done hundreds of website reviews for financial advisors, and one of the ways I’ve immediately helped them increase conversion rates is by including clear contact information at the top of their page.

Many financial advisors include contact information somewhere on their site. A large percentage of them have contact information on their homepage. But to qualify in this experiment, I was looking for websites to have contact information above the fold. “Above the fold” is the part of your homepage visitors see without scrolling down. Since this tends to be the most-viewed part of the entire website, putting contact information there can lead to more appointments set. So, I hypothesized that many advisors would do it. 5. Links To Social Media PagesOne of the things I stress in my Financial Advisor Marketing podcast and my Inner Circle newsletter is the idea that financial advisors should have multiple marketing strategies. With this simple philosophy, I’ve been able to help thousands of financial advisors get more clients. 💰

An easy way to leverage multiple marketing strategies is to have links from your website to your social media pages, and vice-versa. This is especially effective for financial advisors when you consider that most prospective clients will search either Google or LinkedIn when they begin their search. Why not make it easy for them? I figured about 80% or so of Barron’s Top 100 independent financial advisors would link to their social profiles. ALSO READ: 5 LinkedIn Tips For Financial Advisors The Results...As I went through the websites, I was impressed with the various approaches financial advisors used. I enjoyed seeing the different web copy, images, and ways advisors presented themselves and their companies.

Here’s what I found… 93% Of The Websites Had An SSL Certificate…

Only 5 out of the 69 websites I checked didn’t have an SSL certificate.

This finding wasn't surprising because, frankly, if you're listed among the top 100 financial advisors, investing in a secure website should be a given, a fundamental element of your online presence. But why is having an SSL certificate so crucial for financial advisors seeking to attract more clients? Firstly, let's understand what an SSL certificate does. SSL (Secure Sockets Layer) is a standard security technology that ensures all data passed between the web server and browsers remains private and integral. In layman's terms, it's like putting a letter in an envelope before sending it through the mail. It assures users that their data, be it personal information or credit card numbers, is transmitted securely. An old study by Symantec highlighted the significant impact SSL certificates have on websites, particularly lead generation sites. They noted conversion increases ranging from 18% to a whopping 87% simply by implementing an SSL certificate. These figures are particularly compelling for financial advisors, whose websites primarily function to generate leads. But beyond the numbers, let's delve into why this is crucial for financial advisors:

58% Had Photos And/Or Videos Of Themselves…

It's good to see that, instead of using cheesy stock photography, more than half of these advisors included photos and videos of themselves and their team members.

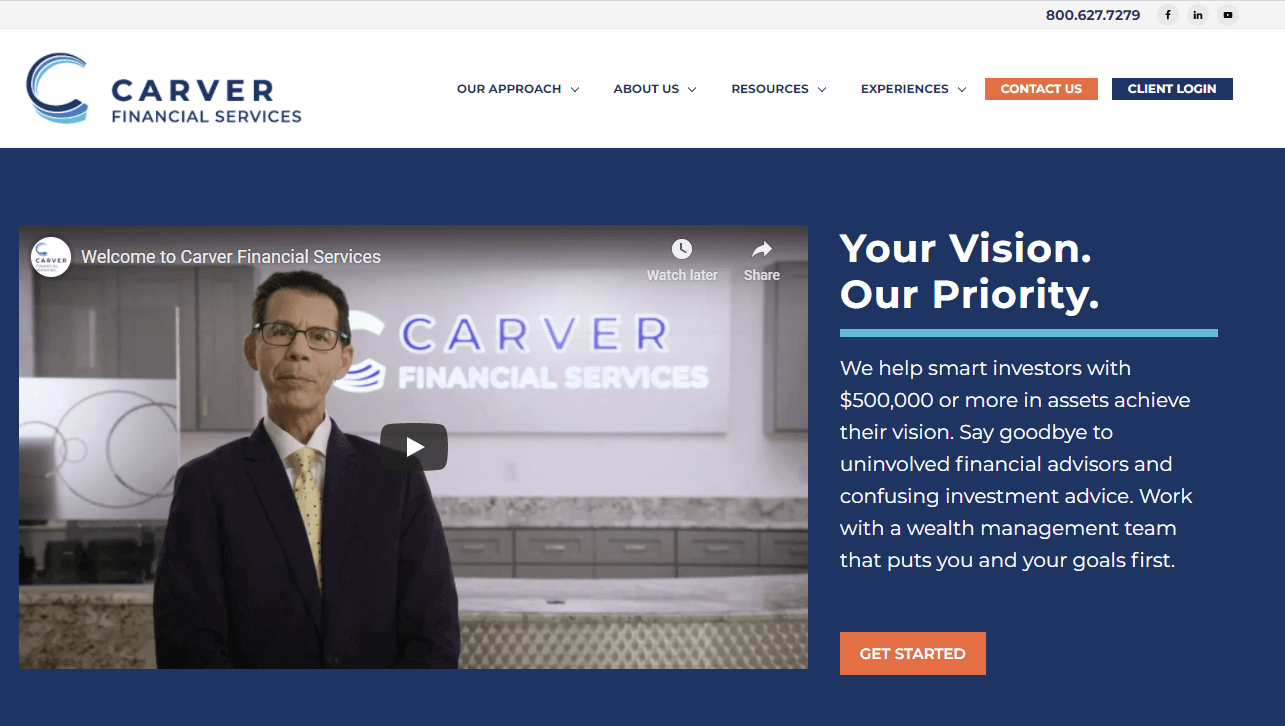

I was also surprised to see how common videos were among the top financial advisor websites. I anticipated seeing mostly photos, but many of these advisors have well-produced, informative videos showing prospective clients who they are and how they can help. The example below comes from Carver Financial Services, which has a wonderful welcome video above the fold on their homepage. If you’re paying attention, you’ll also notice that Carver Financial Services also has:

I love it. 😄 Here are some reasons why photos and/or videos are so important for financial advisor websites:

87% Had Clear Navigation…

I was shocked that this number wasn’t even higher because only 60 out of the 69 websites had a clear navigation bar at the top of their homepages. Having clear navigation is one of the fundamentals of web design.

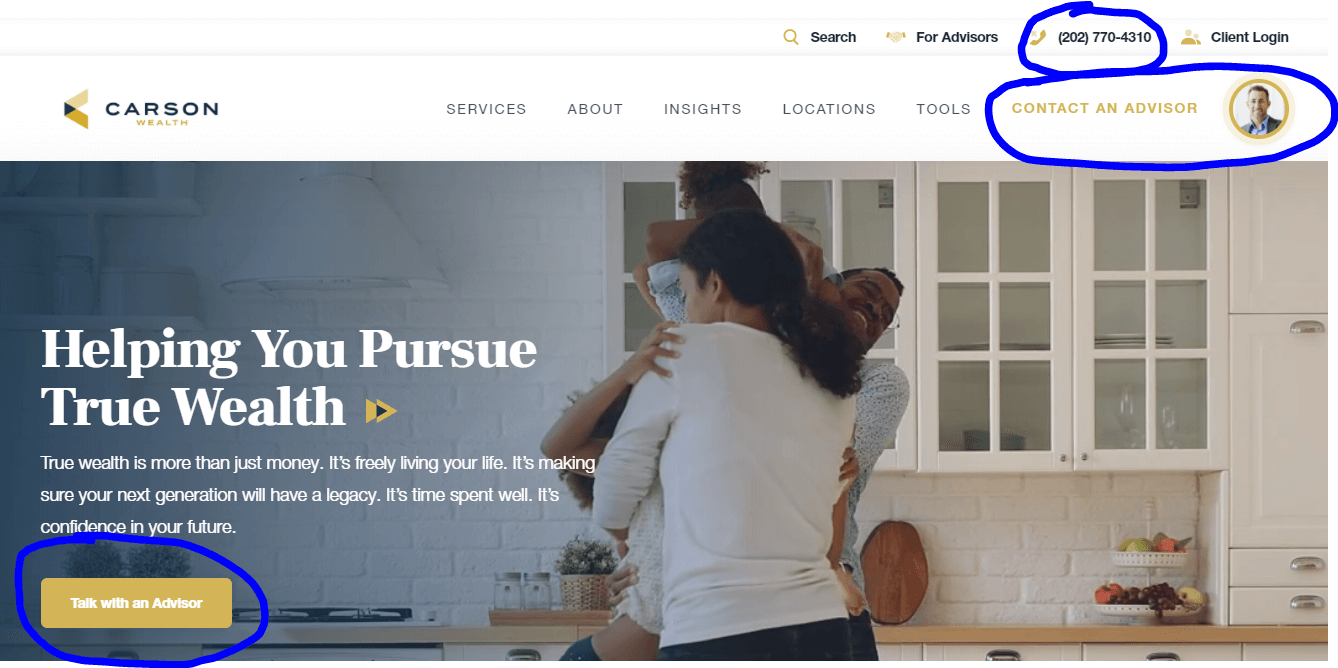

Visitors expect to see this horizontal navigation bar, and not seeing it can be confusing. It sends subliminal cues that the advisor doesn’t know what he or she is doing. An example of a website with clear navigation and clear contact information is Carson Wealth, which you can see below. They also have a clear call-to-action above the fold, which I’m sure is generating leads for them. Having clear navigation is like having a well-organized map in a large, unfamiliar city. It guides visitors through the website, leading them to the information they need without frustration or confusion.

This can be particularly important for older clients or those not as comfortable with digital platforms. If they can easily find the information about services offered, the advisor's credentials, and how to get in contact, they're more likely to feel confident in the advisor's professionalism and ability to manage their financial questions and needs. Speaking of clear contact information… Only 33% Had Contact Information Above The Fold… 😱If you're reading this and you want a “quick win” to improve your website, here’s one for you: make sure your contact information is above the fold.

Give people multiple ways to contact you and put them in front of them as soon as they visit your site. Don’t make people search for it. Sadly, a mere 23 out of the 69 websites met this requirement. This was probably the most shocking finding in this experiment. To be fair, more than 23 websites had contact information on their homepage, but only 23 had the information above the fold. Even worse, most of the ones who did have it only provided one way for people to contact them, which was typically a telephone number. What happens when someone lands on your website at 10 p.m. and knows your office won’t answer? That’s why the solution is to have multiple methods of contact, as illustrated by Capital Investment Advisors below… They have both a phone number and a button to schedule an appointment. 🎉

57% Had Links To Social Media Pages…

In other words, 39 of them had links to social media pages, and 30 of them didn’t.

Most of the social media links were buried in the websites’ footers, but a few showcased their social media profiles loudly and proudly. As I mentioned earlier in the article, getting people to check out your social media profiles is one of the best ways to set more appointments. However, make sure your profiles are up to snuff. According to the same Advisor Value Propositions study I cited earlier, one in three investors has looked at advisors’ personal Facebook pages, and more than half of them decided not to work with the advisor as a result. Other Things I Noticed…

After clicking through dozens of financial advisor websites, I found several things that stood out to me, and I wanted to share them with you.

First, I thought I’d see more podcasts in Barron’s Top 100 because it seems like everyone and their mother is starting a podcast these days. However, I only saw a few. The one I liked the most came from Patti Brennan, which you can see here: ALSO READ: 3 Reasons Why Financial Advisors Should (And Shouldn’t) Start A Podcast

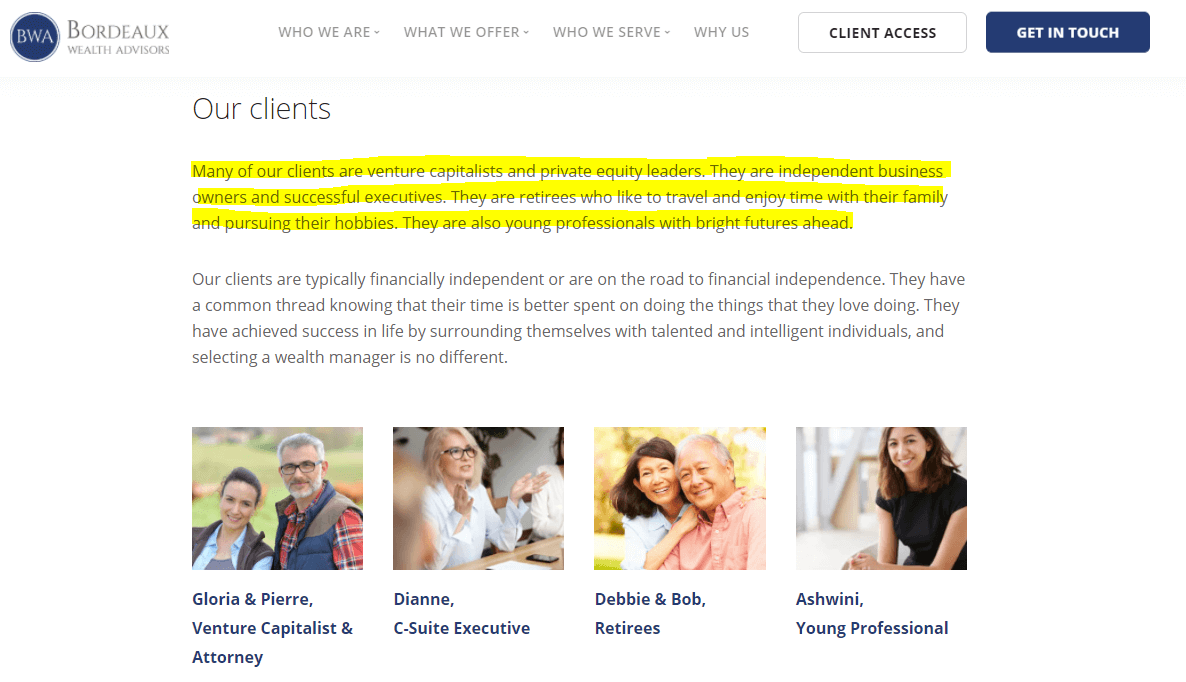

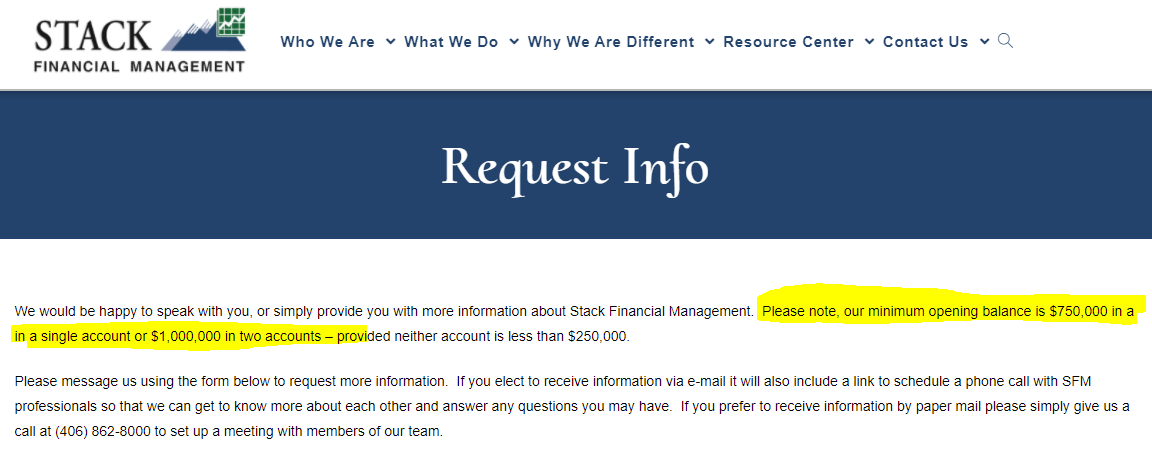

I also enjoyed seeing the financial advisors with niches. According to CEG Worldwide research, 70% of top financial advisors (defined as those earning at least $1 million annually) have niches. I’m a big proponent of niches and I’ve also written extensively about the best niches for financial advisors. Thus, it warmed my heart whenever I saw advisors who had clearly defined who they wanted as clients, such as Bordeaux Wealth Advisors. And just because someone appears to be in your target market doesn’t mean that person is a good fit for your business. Many of the top financial advisors had account minimums (as expected) and I was able to see them plainly presented in places like Stack Financial Management, which you can see below.

Admittedly, those account minimums weren’t presented on the homepage. Instead, they were shown after clicking a “request info” button on the homepage. I love it when advisors make their minimums clear because it saves both the advisor’s and the prospective client’s time if he/she doesn’t meet the requirements.

Another thing I noticed was that several of Barron’s Top 100 independent financial advisors were doing webinars. This is another marketing strategy I’ve seen be effective for advisors who are willing to do the work. If you’re curious about how you can leverage webinars in your business, I encourage you to read this article: 3 Powerful Ways Financial Advisors Can Use Webinars To Get More Clients Look at how Mariner Wealth Advisors highlights their webinars on their site… I also realized…

58% Of Them Were Leveraging Email Marketing 🤯

Why is that statistic mind-blowing?

Because, in my experience, fewer than 20% of independent financial advisors are harnessing the incredible power of email. The fact that advisors on Barron’s Top 100 list are three times as likely to use email marketing should tell you something. I’ve found that many financial advisors realize email is a great appointment-setting tool, but KNOWING and DOING are two different things. Think about it in terms of people who need financial advice. At an intellectual level, most people understand they can’t retire in comfort if they don’t spend less than they make. However, according to a report from GoBankingRates, 42% of Americans have less than $10,000 stashed away for retirement. Which means, at an intellectual level, many advisors may realize…

However, for some reason, they can’t be bothered. They’d rather bang their heads against the wall. Stay stagnant. Suffer. Maybe they secretly hate themselves and don’t believe they deserve success. Who knows? All I know is that email is by far the most effective appointment-setting marketing strategy I’ve ever seen for financial advisors, and I was floored to see so many of Barron’s Top 100 advisors embracing it. 😍 Alright, enough clacking for this article. If this helped you in any way, I would greatly appreciate it if you shared it with a friend or passed it along to a financial advisor who could use it. 🙏 And if you want to learn about email marketing, here’s an article I think you should read… it’s about some things I’ve learned from sending more than 3.2 million financial advisor emails, and how you can build your email list with LinkedIn… 4 Things I’ve Learned From Sending 3.2 Million Financial Advisor Emails… (Plus How You Can Use LinkedIn To Build Your Email List) About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |