5 Tips For How To Sell Insurance Over The PhoneIn the insurance industry, traditional face-to-face meetings are slowly dying.

It doesn’t matter if you sell general liability insurance, auto insurance, term insurance, whole life insurance, or any other type of insurance. Consumers are shifting their preferences to buying online and over the phone. Who can blame them? The telephone is an incredible time-saver. Think about it – I can literally take something out of my pocket and talk to someone a thousand miles away in less than thirty seconds. If I need an answer, I can get it instantly. The most valuable asset we possess is our time. Fundamental buying behaviors have changed over the last few decades to make time one of the most important factors of making a purchase. That means that if you can’t serve people over the phone (and online), you’re getting left behind. For the purposes of this post, I will focus on selling life insurance over the phone and showing you how to get more life insurance clients, but the ideas and concepts can be applied across multiple types of insurance. What You Need to Start Selling Insurance Over the PhoneYears ago, you had no choice but to sell life insurance face-to-face and door-to-door. But because of the internet, consumers now have the ability to find you online and build a relationship with you. The best thing about selling insurance today is that it doesn’t take much money to get started, but there are a few operating costs you should consider:

When you’re selling life insurance over the phone, you need to be able to give quotes as quickly as possible. This does NOT mean that you sell only on price, but when people get on a call with you, they want to hear a specific number before they hang up. If you’re one of the old-school types who doesn’t believe in giving prices over the phone, good luck. Because people want to hear a specific price, you should have the field underwriting guide, questionnaires, and software ready to go. You don’t want to be fumbling around while you’re on the phone. Good insurance customer service skills revolve around being smooth, quick, and accurate. As a licensed insurance agent, you already know that one of the best skills you can develop is the ability to sell over the phone. Here are some tips to sharpen that skill: 1. Embrace The Role Of An Advisor.When selling over the phone, you must establish credibility, authority, and expertise. Buying life insurance is a big decision, so with everything else being equal, prospects will buy from someone they feel is a trustworthy expert.

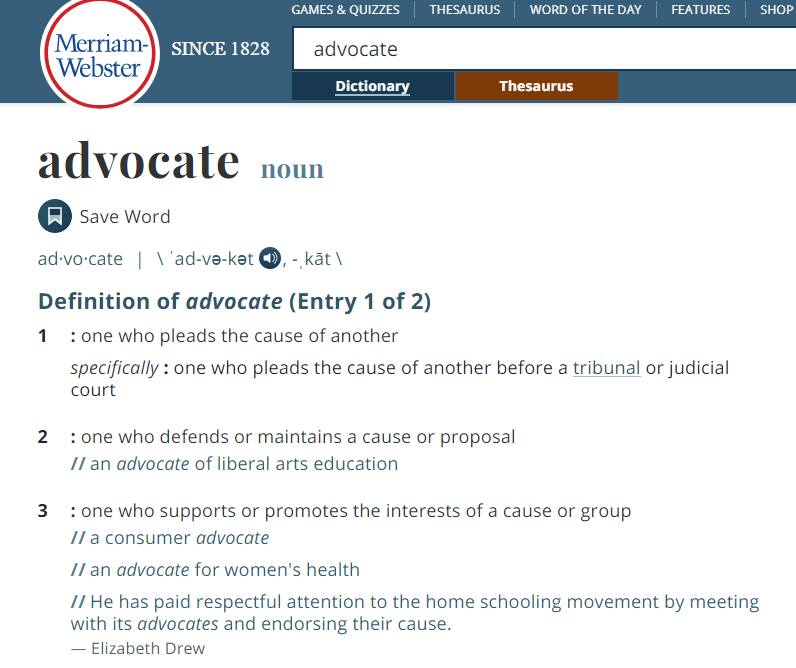

The secret to building rapport is to embrace the role of an advisor. Building rapport is not about being nice or talking about golf for ten minutes. It’s about being a credible, authoritative, trustworthy expert. This is also what will get your clients to send referrals your way. Keeping this idea in the back of your mind will also help you to keep control of every call. Prospects will try to rush you off the phone – if you get hurried, they will lose respect for you. Besides, most people don’t know the complexities of underwriting and insurance. It is your responsibility to help them along the way. This is one of the most powerful tips I can give someone who wants to learn how to sell life insurance effectively. I do a lot of work with financial advisors, and one of the things I try to hammer home is that they should position themselves as advocates for their clients. This is backed by data, too. Vanguard Research did a study called “Trust and financial advice” back in 2017, which found that the single biggest driver of advisor trustworthiness was whether the advisor acts as an advocate for his/her clients (and prospective clients, by extension). So, how can you become an advocate for clients and prospective clients? According to Merriam-Website, the word “advocate” has several definitions, which I’ll share below: Think of how the term “advocate” is used. A lawyer can be an advocate for his or her client in the courtroom. A lobbyist can be an advocate for a special interests group. A social worker can be an advocate for children. In every case, there is a specific group for which the other person is advocating, and the other person knows it.

Lesson: let your clients and prospective clients know you are an advocate for them. 2. Don't Ask "Did I Catch You At A Bad Time?"This cheesy line is recommended by several old-school sales books.

The theory behind it is that people like to say “no”, so they can feel in control. Asking, “Did I catch you at a bad time?” is a way for people to stay in control. However, it doesn’t work. A company called Gong analyzed 90,380 cold calls and discovered that opening a cold call with “Did I catch you at a bad time” makes you 40% LESS LIKELY to book a meeting. Specifically, cold calls with that line had a terrible 0.9% success rate. What should you ask instead? “How have you been?” In their analysis, Gong found that cold calls with that question had a 10.1%. That’s a massive 11.2X better than “Did I catch you at a bad time?”. You might be thinking that “How have you been?” implies there was a previous interaction. Yet, this isn’t the case. All the analyzed cold calls were solely first interactions. This line works so well because it’s a pattern interrupt. It stops prospects from thinking about something else and gets them to focus on you. 3. Give The Reason For Your Call.Another incredible finding from Gong is that opening your call with your reason for calling increases your success rate by 2.1X.

People want reasons for things, even if they’re not particularly strong reasons. I’ve applied this concept to my marketing for years. For example, I’ve been able to out-convert many people’s landing pages by adding a simple reason why people should convert. This is fairly simple. Your call opening should look something like this: “Hi, Bill. This is James Pollard calling from The Advisor Coach. How have you been? Bill, the reason for my call is…” 4. Follow Up.Back when I was doing one-on-one coaching with financial advisors, I was able to give them a “quick win” by improving their follow-up processes.

A marketer named Robert Clay did some research and found that only 2% of sales occur after the first contact. The other 98% will do business with you only after a certain level of trust has been established. Follow-up builds that trust. Clay also discovered that 80% of sales require at least five follow-up attempts, yet 44% of salespeople give up after the first attempt. What a shame! If you want to learn some of my best follow-up tips, read this article: Follow-Up Tips (That Won’t Annoy Prospects) 5. Use Multiple Marketing Strategies.This is the crux of my marketing philosophy. If you’re a regular listener to my Financial Advisor Marketing podcast, you’ve heard me talk about this dozens of times.

In virtually 100% of the cases, adding an additional marketing strategy to a financial advisor’s prospecting mix has increased revenue. Again, this isn’t my original thinking. Many companies have found that implementing a multi-channel marketing strategy has increased revenue. One company, Agora (a billion-dollar publishing company), documented that customers acquired through multi-channel marketing are five times more valuable to them over time than customers acquired through one channel. Some sales trainers call this “combo prospecting”, and here’s what it looks like:

If your prospect doesn’t respond to that cadence, you can follow up with another phone call, a direct mail piece, a handwritten note, or something else. The point is to get in front of people in multiple ways. 6. Handle ObjectionsWhen you’re selling insurance over the phone, you should listen more than you talk, because it gives people a chance to raise concerns. When they do, it is a great sign. People will not waste their time objecting to something they have no interest in. In a general sense, objections are buying signals.

This does NOT mean that objections are a good thing because they aren’t. All an objection means is that the person is considering your offer. You should be prepared for objections and learn how to handle them. Too many insurance agents try to wing it. The secret to handling objections is to prepare in advance. You are in complete control when you’re prepared and you will totally lose control if you’re unprepared. Here are some of the most common objections you’ll encounter when selling insurance over the phone: That’s too expensive. Make sure that you’re looking at the company that will view their application most favorably, and let them know that it’s unlikely they’ll find a better rate for the amount of coverage they want. Ask them this: “What’s more important to you – term length or the amount of the policy?” By altering either of these, you can lower the rate. Sometimes “too expensive” is just a smokescreen. By asking that question, you can gauge their interest. If they don’t give you any other buying signals, chances are nothing you say will get them to buy. However, if they ARE interested, you can use that question to find a middle ground that gives them the coverage they can actually afford. I need to think about it. Whenever people tell you this, they’re really saying that they don’t have enough information to feel comfortable making a decision. Just ask point-blank: “What do you need to think about?” Try to figure out what the person is uncomfortable with or what isn’t clear in the process. If you’re getting the “need to think about it” objection frequently, take a look at how you’re explaining things earlier in the call. Life insurance isn’t something you “need to think about”. I need to talk to my spouse. This is similar to the “need to think about it” objection in the sense that it means the person isn’t ready to make a commitment. He/she either doesn’t have enough information or isn’t going to buy at all. In cases like these, try to submit the application anyway. Say: “Why don’t we submit the application and get the ball rolling? If, for whatever reason, your spouse objects, we can always withdraw the application.” I’m not interested. Shocker! I’ve never met a person (besides agencies and agents) that is passionately interested in life insurance. It’s a boring product and it’s a product you purchase and hope you never have to use, but you have to have it. Steamroll right through this objection, ESPECIALLY if it’s coming from an inbound lead. These people came to your website and filled out a form, so they’re obviously interested. Don’t be fooled. It may be uncomfortable to keep talking, but understand that if people stay on the phone with you, they ARE interested. ALSO READ: How To Overcome Objections As A Financial Advisor (The Right And Wrong Way) The Biggest Mistake Agents Make When Selling InsuranceOne-call closes are nice, but they don’t happen often. All life insurance agents want to get an instant “yes” when they’re selling over the phone, but it doesn’t happen much. Most sales need some form of follow-up. Good follow-up is another life insurance sales tip which is often repeated but rarely implemented. 😎

It’s sad to see an insurance agent get told, “It’s not a good time for me right now – can you call back next month?” and then never follow up. It’s absolutely crucial that you follow up with people who have expressed interest. Set a reminder in your CRM and contact them at a better time. Understand that on the first contact, they don’t know you. There’s no relationship and not much background information, so don’t be surprised if they don’t want to commit to a big purchase right away. But if you follow up and stay in touch, they will get to know you and build a relationship. That way, when they are ready to purchase, you’ll be the first person that comes to mind. Having a good CRM and follow-up system will transform the way you do business. It’s an awesome feeling to be able to sit down in the morning and have leads to contact who asked you to follow up with them. They also require less work than completely new leads. NOTE: If you want to incorporate email into your marketing mix, I recommend Drip, who I use for my own personal email marketing automation. You can check out my review of Drip here. Selling Over the Phone Works 👍Selling over the phone works so well because it enables you to become more efficient. You can cover a LOT of ground over the phone, letting you engage with more accounts and build a larger pipeline.

Even though you’re limited to just verbal cues (no body language), the most important benefit of selling over the phone is the time savings. You can use that time to help more people and make more money. Have any questions about selling insurance over the phone or any other part of financial services marketing? Reach out to me! ALSO READ: 7 Horrible Insurance Marketing Ideas P.S. If you're a financial advisor who wants to get more clients from LinkedIn, make sure you check out How to Get Clients With LinkedIn: How Financial Advisors Can Set Appointments and Convert Prospects With LinkedIn |