5 Financial Advisor Follow-Up Tips (That Won't Annoy Prospective Clients)Following up as a financial advisor can be tricky.

How can you follow up with a prospect without being pushy, needy, or annoying? It’s a tough question, and it’s one that must be answered, especially when you consider the facts about follow-up, such as:

One of the biggest “quick wins” I can give financial advisors when helping them grow their businesses is to improve their follow-up. Since most financial advisors are leaving money on the table, it’s an easy way for me to add to their bottom line. Here are some of my favorite follow-up tips for financial advisors… 1. Cultivate Outcome IndependenceThere is a difference between following up and being needy. Sadly, some financial advisors think any follow-up whatsoever is needy. This isn't the case.

Eliminating neediness from your follow-up often requires a big shift in mindset. You need to understand that you're not following up because your prospect “needs” what you offer. You're merely putting yourself out there as a resource. If your prospects want to work with you, that's great. If they don't want to work with you, just move on. Sometimes financial advisors will encounter prospects who have unrealistic expectations about retiring early, can't budget whatsoever, or consistently make bad financial decisions. These are the people who truly “need” a financial advisor's help. However, if these prospects firmly refuse the help being offered, the advisor should move on and focus his or her efforts on prospects who see the value. In that sense, you're following up until you get a firm “yes or no” commitment from your prospect. Because until that happens, you don’t know for sure if your prospect is refusing your help. When you chase something, it’s because you have a deep emotional attachment to that thing. This can be good in some situations but it kills a financial advisor’s follow-up. So, what’s the solution? Cultivate outcome independence. You should NOT be emotionally invested in whether or not someone works with you. At its core, the cause of neediness is fear, one of our strongest emotions. The fear of uncertainty. The fear of loss. The fear of rejection. Once you get rid of this emotional attachment, you will begin to find people drawn to you like moths to a porch light. I’m a prime example of this - I used to be needy because, deep down in my heart, I knew that I could help financial advisors with their marketing. Whenever I approached an advisor, I did so from a place of neediness. As soon as I cultivated outcome independence, advisors began flocking to me. Now, I will tell people NOT to buy if I don’t think they're a good fit because I’ve vanquished this emotional attachment. I’m at the point now where I will straight-up tell skeptical prospects to avoid purchasing my products. Who are you more likely to buy from? Someone who is clearly desperate to make a sale and is pressuring you to do so… or someone who is polite and personable but clearly doesn’t give a rat’s hat about the sale because he or she doesn’t need the money?

Let's delve deeper into why outcome independence is so essential to successful financial advisor follow-up. Outcome independence...

2. Operate From An Abundance MindsetThis is closely related to cultivating outcome independence because when you have an abundance mindset, you have options.

That’s why a great way for financial advisors to become outcome independent is to get their financial houses in order first. This is critical because you’re in the business of dispensing financial advice. How in the world can you call yourself a financial advisor and make poor financial decisions? I’m not saying you have to be Warren Buffett in order to help people with their money, but you should at least have solid footing. You should have the ability to flat-out refuse a prospect and not worry about the lost income. If you can’t do that, you are operating from a scarcity mindset. At some level, prospecting IS a numbers game. The key is to get the numbers to work in your favor. Indulge me for a second: how would you feel if you had 1,000 prospects lined up at your door, all ready to work with you? Would you still feel needy? Would you feel discouraged if any one (or fifty) rejected you? Probably not. Which means a large part of becoming a follow-up machine is to focus on the top of your funnel. You want to have a big pipeline. Yet, financial advisors often pride themselves on being rainmakers and “closers.” But “closing” is overrated. Because you could be the best closer in the world, but if nobody is in front of you, it doesn’t matter. And I’ve found that a mediocre closer with a full pipeline can beat the pants off a great closer with an anemic pipeline. All else being equal, which would you rather have: 100 prospects with a 30% closing rate or 20 prospects with a 70% closing rate? I’ll take the first one, all day every day. ALSO READ: How To Make Six Figures As A Financial Advisor 3. Use Multiple Messages Across Multiple MediumsTwo of the biggest mistakes financial advisors make when following up are:

If you want more effective follow-up, use various messages across multiple mediums. Don’t just call over and over or send the same email again. I’velost count of how many people have tried to follow up with me by saying dumb stuff like:

You should have a REASON for following up. Something new. Instead of reaching out to your prospect and “touching base” (ugh, just threw up again), how about you reach out and share an interesting article you found? Or a video you recorded specifically for him or her? Yes, it takes more effort to do this… but if you want to stand out from everyone else, you've got to put in the effort. You could even set up a Google Alert for your prospects’ names or business names to be notified whenever they get mentioned online. You can follow up by pointing out you saw the mention and wanted to comment on it by congratulating them or offering some type of insight. As far as switching up the medium, there are so many different ways to follow up:

And that’s just the tip of the iceberg. You could use all seven of these follow-up methods and get beyond the critical fifth follow-up, where 50% of all conversions happen. 4. Systematize Your Follow-UpFollowing up with prospects becomes a lot easier when you have a system in place that clearly defines what you’re going to do and how you’re going to do it.

In my experience, the best way to do this is to integrate a follow-up sequence (complete with reminders, if necessary) into your CRM. One awesome thing about using a CRM is that you can take notes on your conversations so you don’t forget. You can also use your notes to tailor your follow-up. If a prospect mentions going on vacation in the next two weeks, you can follow up afterward and ask how it went. If a prospect mentions his or her birthday on a certain date, you can make a note of it and send a birthday card. This isn’t complicated stuff, and it makes following up much easier. Having a CRM also lets you track your follow-up sequence so you know exactly where you stand. Once you realize that the majority of conversions happen after the fifth contact, you can set up your workflow to guarantee a minimum of five contacts per prospect. Once you reach that critical five, you can make a judgment call as to whether the prospect is worth the additional effort. A clearly defined system looks like this: you can log in to your CRM and see that you’ve called Mr. Prospect, sent him a direct mail piece, and emailed him. You now know that in three more days you will call him again with a specific reason, and if he doesn’t answer that call, invite him to your seminar in three weeks. There’s no guessing, no wondering, and no “hoping!” ALSO READ: Is This The Best CRM For Financial Advisors? A system could be as simple as sending out a newsletter and then, when prospects call you, asking this question: “Are you interested in scheduling a time to sit down and talk about your financial situation?” That’s it. A system doesn’t have to be complicated. In fact, one of my favorite systems involves using an email autoresponder to automatically send emails to interested prospects. Of course, you should integrate other forms of follow-up (remember, vary your mediums), but this is an effortless way to stay in touch. 5. Know When It's Time To Abandon ShipThere’s a point in time at which it doesn’t make sense to keep following up. Based on the data, this is typically after 12 various touches - calls, outreach on social media, notes, mail, etc.

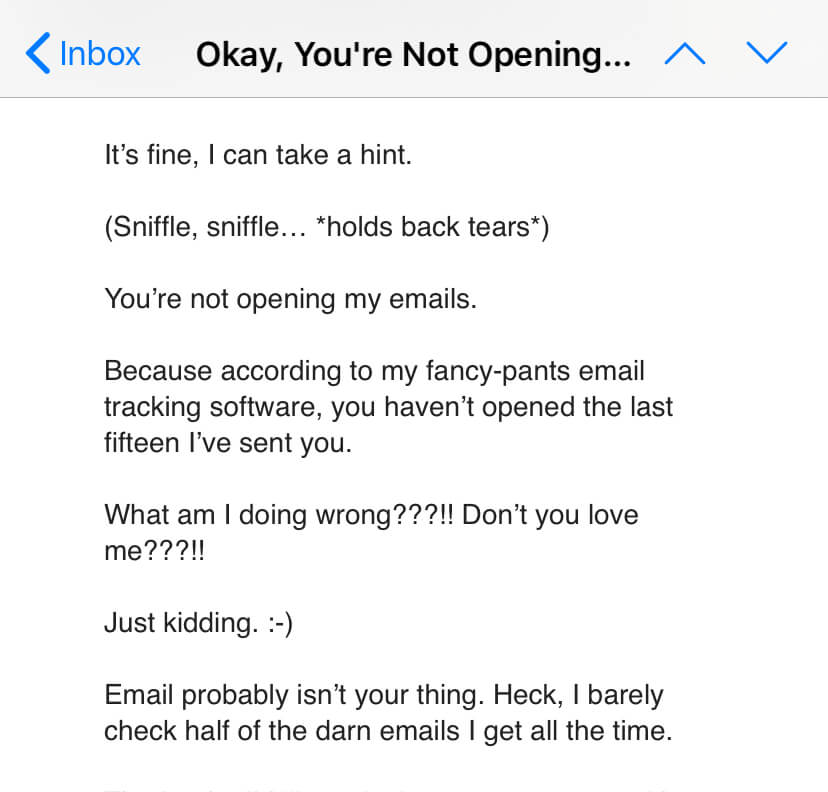

If someone doesn’t get back to you after a dozen tries, the data indicates that your time is better spent elsewhere. In my own business, I scrub email subscribers who haven’t opened the last twenty emails I’ve sent. I figure if they haven’t opened the last twenty, they’re not going to open the next one. You don’t have to do twenty - that’s just an arbitrary number I picked. Yet, before I do, I send one last email. My “Hail Mary”, if you will, to see if I get any opens. Here’s an example: A common last-ditch follow-up effort is called the “breakup” email. It’s inspired by an old-school sales technique where a rep would reach out and ask for permission to close a prospect's file. It goes something like this:

“I’ve tried to get in touch with you, and I hate to keep bugging you. If and when you’d like to discuss your retirement planning, let me know. For now, I’m closing your request for help. You can still get in touch with me at 555-5555 or by responding back.” There’s no neediness in this email. It’s firm and completely outcome-independent. It also creates some urgency to respond. A good chunk of people will say they’re no longer interested… but that’s a good thing. Because it means you can remove them from your pipeline and move on. You can spend your time finding people who are interested in working with you. Indeed, the strategy of persistent follow-up is fundamental in financial advising; however, there exists a pivotal moment where it becomes crucial for financial advisors to reassess their efforts and potentially call it quits with certain prospects. This discernment is not about giving up easily but about recognizing when your time and resources could be better allocated. Here's an expanded view on why and how financial advisors should sometimes move on from constant follow-ups:

ALSO READ: 15 Financial Advisor Prospecting Tips That Work About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |