How To Become A Virtual Financial Advisor (And Have Your Clients Thank You For It)I have a confession to make: I’ve never met my financial advisor in person. 😱

I’ve also never met my accountants in person… or my insurance agents… or many of the people who work for me. They’re 100% virtual, and we conduct our business over the phone, email and Zoom calls. But it’s not just me — the financial services industry is quickly going virtual, with many advisors getting creative to serve more clients than ever before. Interested in something specific about virtual financial advisors? Jump ahead to: Interested in something specific about virtual financial advisors? Jump ahead to:

What Is A Virtual Financial Advisor?A virtual business is one that uses electronic means to conduct business as opposed to a traditional brick-and-mortar business, which relies on face-to-face interactions.

For financial advisors, this means being location-independent. If you're a virtual advisor, you can work anywhere you want, as long as there's a stable internet connection. How? Very easily. You can conduct meetings primarily by video chat and handle other client communications via email and telephone. However, being a virtual advisor is so much more than just hosting a Zoom meeting or boosting a Facebook post. Just like in an in-person business, your goal is to deliver exceptional service to your clients. The only thing you're doing by going virtual is swapping out the office conference table for one that floats in cyberspace. Plus, there'll be plenty of occasions to work and meet with clients face-to-face. Why Being Virtual Is Good For Financial Advisors...Traditional financial advisor business models require a physical office presence. This means that advisors must build their lives around the office. They must be there to meet with clients, build an infrastructure around the location, and manage it as well. In other words, advisors are forced to shape their lives around their businesses.

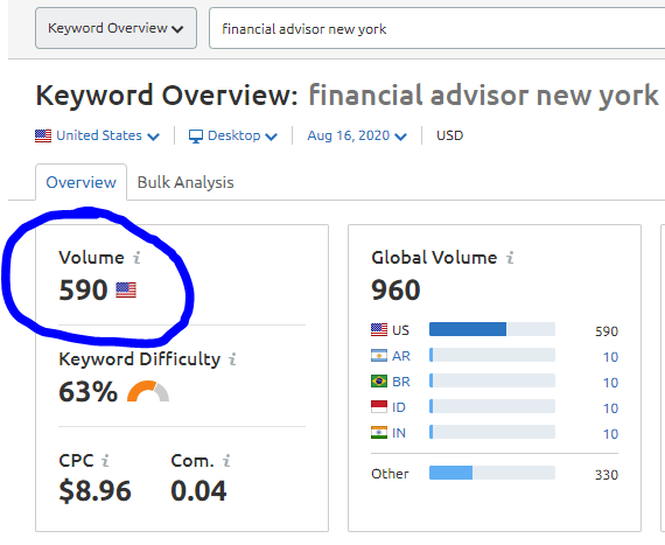

Working virtually breaks that tether. Virtual financial advisors can build their businesses around their lives. In turn, they become happier, more productive, and better servants to their clients. ALSO READ: 5 Priceless Tips For Financial Advisors Who Want A “Lifestyle” Practice Plus, financial advisors are becoming more specialized. According to CEG Worldwide research, 70% of top financial advisors (defined as those earning $1 million or more annually) focus on a particular niche. In order to reach their niches, financial advisors need to be able to find and communicate with people in various locations. For example, if you’re a financial advisor who specializes in working with dentists, a virtual business can be your best friend. Because instead of being tied to your local area, you can market your services to a wider pool of prospective clients. Let’s say you’re a financial advisor in New York. The search term “financial advisor New York” gets a mere 590 searches per month. Yeah, that’s it. And according to U.S. News, there are 734 firms in New York with 21,602 advisors. Do the math on that one.

If you’re in a small town or state with a low population, you fare even worse. “Financial advisor Wyoming” gets ten searches per month. Now, I know that search stats aren’t everything, but they are a good proxy for how much demand is in an area. If there are 590 searches per month for New York and 10 per month for Wyoming, it’s easy to see that there’s more demand in New York. I don’t know about you, but I would rather put myself in a position to win, rather than depending on the low demand in my local area. When you only work in person, you limit yourself to your geographic area and people will only travel so far to see you. You unnecessarily limit yourself. Why A Virtual Financial Advisor Is Good For Clients...Virtual financial advisors can enhance their unique value propositions. For starters, the sheer convenience and comfort of being able to meet with an advisor from the comfort of one's home cannot be overstated.

This arrangement reduces the stress associated with financial planning by allowing clients to engage in these discussions within their own familiar and relaxed environment. The removal of geographic constraints empowers clients to select their financial advisor based on compatibility and shared financial goals rather than proximity, leading to more personalized and satisfactory advisory relationships. Furthermore, virtual consultations save clients both time and resources, as there is no need for travel. This is particularly advantageous for high-income earners who highly value their time; they no longer need to take time off work, find childcare, or travel across town for meetings. Virtual advisors respect and understand this value, tailoring their services to the busy schedules of their clients, offering flexibility and availability that traditional in-person meetings cannot. This includes accommodating clients across different time zones, such as an advisor on the West Coast scheduling meetings in the late afternoon to suit clients on the East Coast after their work hours. Additionally, the virtual business model fosters long-term relationships between advisors and clients. Clients appreciate the continuity of service when they move, knowing they can retain their trusted financial advisor regardless of their physical location. This stability is crucial for effective long-term financial planning and contributes to better client retention rates. Lastly, the ability to offer personalized service on the client's terms is a significant advantage of being virtual. Advisors can extend their hours beyond the typical nine-to-five, providing after-hours consultations and being available for urgent matters, which enhances the overall value and appeal of their services. While this may mean adapting to a more flexible schedule, the payoff in client satisfaction and loyalty is substantial. Anecdotes, such as the one about the advisor who enjoys more personal freedom and hasn't used an alarm clock in years, highlight the benefits that can extend to both clients and advisors, emphasizing the mutual advantages of the virtual model. "But Are Clients REALLY Okay With A Virtual Advisor?"Let's get one thing straight: I am NOT saying that everyone prefers virtual financial advisors. Many people still want to meet in person. However, the trend is clear.

According to the McKinsey Affluent Consumer Insight Survey, 59% of people under 60 were somewhat comfortable, comfortable, or very comfortable working with a virtual financial advisor. That number bumps up to 67% for people under 50. Oh, and guess what? That survey was done BACK IN 2014! 🤯 Considering how the adoption of video conferencing software significantly ramped up in 2020, those numbers are undoubtedly higher now. As you can see, the virtual shift was already happening — the events of 2020 just proved that it works and cemented its place in this industry as well as many others. Plus, look at all the other ways we’ve already gone virtual: We date online, buy movie tickets, go to the doctor, order groceries, and all sorts of products, manage our banking, make new friends, and much more. Of course, your clients are OK with a virtual financial advisor. If you set up the infrastructure of your virtual financial advisor business correctly and market it with the right messaging and branding, you can have amazing client relationships. Besides that, you can make more money, work less, have a better work-life balance, and even gain more clients — all without a physical office. Anecdotally, I’ve noticed that HNW and UHNW investors are willing to search for the right financial advisor for their situations. They do NOT make major life decisions by throwing darts on a map. Traits Of Successful Virtual Financial AdvisorsI’ve had the pleasure of working with several virtual financial advisors who subscribe to my Inner Circle newsletter, as well as working with various advisors over the years and paying attention to the trends. I’ve noticed these traits among successful virtual advisors…

🔑 CuriositySuccessful virtual advisors want to learn and try new things. They also have a willingness to embrace new technology and keep an open mind about where the industry is headed. Part of that curiosity means you dare to challenge the status quo to find what works for your business and ideal clients. If you can’t, you’ll go out of business. And it can happen quicker than you think.

After all, the last thing you want is to be the kind of advisor who sticks their head in the sand and ignores the tsunami coming their way. 🔑 AdaptabilityYou’ll have a lasting virtual career if you’re the type of person who creates backup plans for everything. Remember: Technology malfunctions on occasion.

For example, video conference links can break, appointments may not import correctly, or a software update may trip you up. However, I’ve found you don’t need to be tech savvy to succeed as a virtual financial advisor as long as you’re adaptable. This could be as simple as replacing Zoom with another software on the fly or as complicated as migrating to a new CRM — as long as you’re flexible, you can make it work. With a willingness to evolve, learn and have an open mind, you’ll go farther than most of your peers. The key is not to glide on your previous successes and let yourself get too lazy to find new methods and techniques to increase your bottom line. You have to get out there and be the change you want to see. 🔑 Superior Communication AbilitiesThis is important, because many body language cues get lost in digital translation. Yes, Zoom lets people see you via webcam, but we all know it’s not the same. Financial advisors with finely honed listening and communication skills are better equipped to succeed in a virtual world.

🔑 A REASON To Work VirtuallyFriedrich Nietzsche once quipped, “He who has a why to live can bear almost any how.” I’ve found the same to be true for virtual financial advisors.

The ones who make the most of it have a genuine reason for working virtually. Maybe they want to spend more time with their children, perhaps they have multiple homes or vacation a lot; who knows? My point is that, with a strong “why” driving their virtual practice, these financial advisors find ways to work harder and smarter within their businesses. 🔑 A (Human!) Online PresencePart of being a virtual advisor is having a robust digital footprint. If you're not online where potential clients can easily find you, you'll miss out on tons of opportunities.

For social media, the key to success is authenticity. “But how can I be authentic on 10 different platforms, James?” Well, that’s because you don’t need every single social media network, padawan. Especially when you’re just starting out as a virtual financial advisor, don’t overwhelm yourself with the digital marketing process — it doesn’t have to be complicated or expensive. Instead, start with free tools. Then, use your “why” as motivation to better understand where your clients hang out online so you can focus on growing an audience there. The key is to go where your people are, then create authentic content that caters to their needs. Because ‘authentic’ is the operative word, outsourcing your content needs will hurt you more than it helps. People want to work with human beings, so your online presence and the content you share should show prospects who you are and how much you care. I mean, you don’t outsource yourself for networking events, right? Exactly, so aim to have genuine conversations with prospects online — and because it’s social media, you need to find your voice, be present (i.e., don’t be a lurker) and post new content regularly. By the way, the content we’re talking about here shouldn’t have anything to do with rates of return and solicitations or how much your services cost. I’ve seen studies that show people are less likely to work with you if you hound them about money. Instead, teach them useful information without asking for anything in return, share details about your life and lead with value. If you do this right, clients will beat down your door. How You Can Get Started Working Remotely...You don’t have to go 100% virtual right away. You can still accommodate physician meetings for clients who want to meet you in person for one reason or another.

Enter: the hybrid approach. A hybrid approach allows you to work virtually for most or part of the time, while meeting face-to-face for specific meetings. Does this require a physical office location? Nope. Because you can meet in public spaces (such as a coffee shop or restaurant), your home, or the clients’ homes. Tools For Running A Remote Business...This is by no means an exhaustive list. It’s meant to get the gears in your head spinning about how you’re going to go virtual…

"The Cloud" = King Of Virtual Businesses 👑Cloud-based technology is the future. If you intend to build a location-independent business, you’ll need to make the cloud your friend.

The cloud allows you to access all the tech and tools you need, from any device, no matter where you are. It also eliminates the risks associated with having your own physical server. You’ll no longer be a victim of disasters, should they strike your geographic location, because your information will be stored on a company’s network of servers (typically Google, Apple, Amazon, etc.) which usually have more than one location as a backup. There are many cloud-based storage options on the market, including:

Virtual Meeting SoftwareThere are also many video conferencing options on the market, such as:

The most popular, by far, is Zoom. As of February 2020, Zoom had 12.92 million monthly active users. It’s also easy to use. All you have to do is share your meeting link with your client (and make it password-protected, if you want additional security) and have your client click to join. NOTE: While Zoom is awesome for client meetings, I don’t recommend it for marketing webinars because it requires people to download it if they don’t already have it. This kills conversions. If you want my advice on creating great webinars, read 3 Powerful Ways Financial Advisors Can Use Webinars To Get More Clients Client Reporting SoftwareAll financial advisors need to be able to create investment and performance reports for clients. Blueleaf is a good one for virtual financial advisors because it gives clients access to an online portal. They can log in and see everything themselves.

This means clients won’t have to call or email you to see how their portfolio is doing. 😄 Another good choice is eMoney. Their client portal is a popular choice among financial advisors and has a clean user interface. You can’t go wrong with either one. Scheduling ToolEvery financial advisor should be using a scheduling tool. No exceptions.

It’s not 2003 anymore. We don’t need to play phone and email tag to figure out the best time for a meeting. With a scheduling tool, you can send over a link to your calendar and have people schedule meetings that work for them. Oh, and don’t worry: these tools allow you to block out your unavailable times and automatically blocks out time when someone books. They’ve done all the hard work for you. Take your pick from the top scheduling tools available:

I also created a short video showing you some of my favorite features within Acuity and why I think it’s the best scheduling tool for financial advisors. If you want to watch it, here it is: Acuity Scheduling | Awesome Scheduler For Financial Advisors Virtual AssistantIf running a virtual business is your goal, a virtual assistant can be a lifesaver for you. This is especially true if you’re interested in building a lifestyle practice, which reduces the need for full-time employees. Virtual assistants are the happy medium between no employees and full-time employees. Plus, they can help you grow…

For example, if you outsourced five hours of paperwork and administrative tasks each week, you would reclaim twenty to twenty-five hours of extra time each month to focus on higher value tasks, such as marketing and prospecting. Here are some of the things you can outsource to an assistant:

I even did a podcast episode with Danielle Cuomo, founder of Virtual Assist USA, about how financial advisors can leverage virtual assistants within their businesses. If you’re interested, search for my show (“Financial Advisor Marketing”) wherever you listen to podcasts. The title of that episode is “How Financial Advisors Can Leverage Virtual Assistants”. I’m very creative with these titles, I know. 😎 I hope this article helps you. If you know a financial advisor who is interested in going virtual, feel free to share this article. About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |