How Financial Advisors Can Get 3 New Clients In The Next 30 Days...If you’re a financial advisor who wants to get more clients, make sure you read every word of this article…

Because I’m going to outline a few strategies that can help you get three new clients in the next thirty days. Nothing I’m going to share is rocket science, although it will take concerted effort on your part. After all, nothing works unless you do. Why I Wrote This Article...If you don’t know who I am, my name is James Pollard. I’m the founder of TheAdvisorCoach.com (this website) and I’m also the host of the “Financial Advisor Marketing” podcast.

I have more than 100 podcast episodes to help financial advisors become better marketers… I have more than 100 free blog articles to help financial advisors get more clients… And I have an entire suite of paid products (including my prestigious monthly paper-and-ink newsletter) to help financial advisors become better business owners. I’ve realized that the best way to get advisors to do business with me is to give them results in advance. Because when they see that my stuff works, they’re more likely to give me money in exchange for even more results. How’s THAT for transparency? 😆 Now, let’s get started… First, Get This Free Resource...It’s a PDF called “57 Marketing Tips for Financial Advisors” and you get it when you sign up for my email list.

However, do NOT sign up if you can’t handle daily emails. I email every day and I don’t have time for whiners or complainers on my list. Email is one of the most effective marketing strategies I’ve ever discovered and, since I tell financial advisors to email daily, I’m merely practicing what I preach. This free PDF download has information far beyond what I can cover in a single article because it contains more than eighty pages of content. You can download it and read it at your leisure. You can get that here: 57 Marketing Tips For Financial Advisors How Many Clients Are Financial Advisors Getting?Great question. The answer depends on which financial advisors you study.

According to a Broadridge study (Driving Client Acquisition), 43% of growth-focused advisors successfully acquired twenty or more clients in the past year. Only 16% of other advisors onboarded at this rate. What does “growth-focused” mean? Well, Broadridge defines a growth-focused advisor as someone who spends more than $5,000 per year on marketing to aggressively add new clients. In fact, they found that 23% of growth-focused advisors are willing to spend $2,000 or more to acquire a client when compared to only 11% of everyone else. To be specific, the average cost per client acquisition for growth-focused advisors is $1,451, compared to $895 for other advisors. And these advisors are spending their money in four specific areas:

They’re also spending more total dollars, either. Because 24% of growth-focused advisors are spending 7% or more of revenue, compared to 9% of everyone else. Keep these findings in mind as you read this article because it’s based on ACTUAL data from REAL financial advisors. Not some guru’s feelings or vague ideas. 😉 Also realize… Having A Niche Makes Everything Easier...Because it allows you to quickly and easily identify people in your target market. If you’re a financial advisor who serves teachers, you’re going to be able to find them more efficiently than someone who serves “retirees”.

Schwab’s 2020 RIA Benchmarking Study found that firms with both a documented ideal client persona (a niche) and client value proposition attracted 28% more new clients in 2019. Anecdotally, I can tell you that I’ve run split-tests across various marketing mediums (online ads, email, social media, etc.) and have found that calling out a niche in the marketing messages almost always increases conversions. ALSO READ: 5 Best Niches For Financial Advisors Strategy #1: Referral BlitzThis strategy is going to be most effective if you already have an existing business with clients.

The Oechsli Institute asked 403 investors with a minimum of $500K how they would begin looking for a financial advisor. Here’s the breakdown: For respondents over age 65, here’s the breakdown:

For respondents between age 45 and 65, here’s the breakdown:

For respondents under age 45, here’s the breakdown:

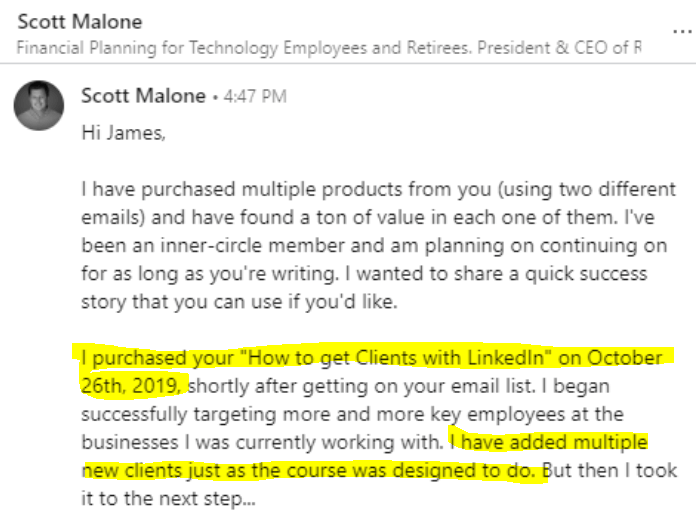

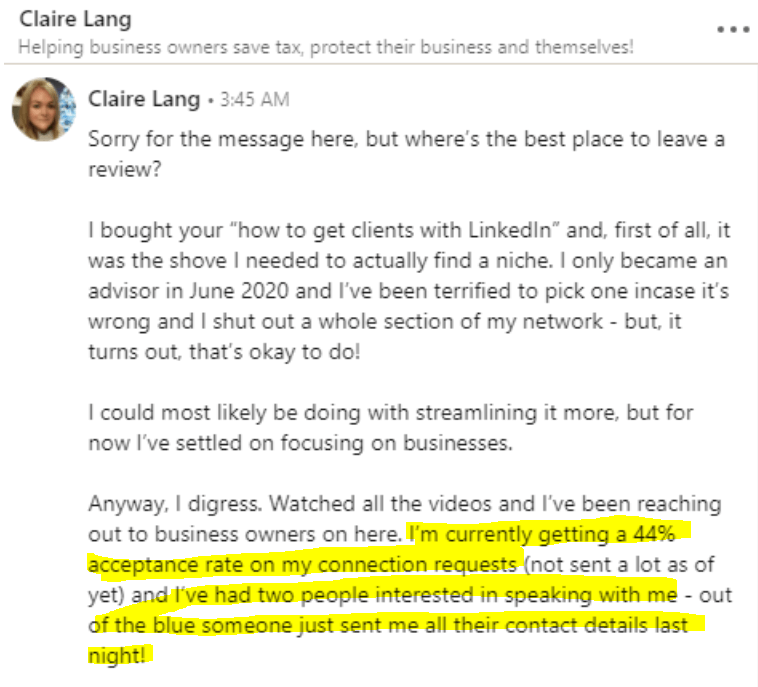

As you can see, most investors in the 45 and up category would ask for a referral. This isn’t a surprise. That’s why I created 51 Referral Marketing Tips for Financial Advisors and it’s why the first strategy you can use to get three new clients in thirty days is the referral blitz. There are tons of referral strategies floating around out there. Many of them revolve around lame advice like “ask early and ask often”. I won’t insult your intelligence by telling you to do that. Instead, I’ll present you with the research… Julie Littlechild (who was a guest on the “Financial Advisor Marketing” podcast) found that 58% of clients say they were motivated to refer in order to help a friend, while 38% said they wanted to help their advisor build the business. What’s the lesson here? Take advantage of both! Littlechild also found that 40% of clients who provided a referral in the last 12 months said they were asked for a referral by their advisor. However, 72% of clients who provided a referral in the last 12 months said they were asked for feedback. Again, take advantage of both. Make sure ALL your existing clients know you’re taking on new clients. You’d be amazed at how many times I’ve heard people tell me they didn’t think their advisors were open for business. Bottom line: if your clients don’t think you’re taking on new clients, they won’t refer. Ever. Get in touch with your clients (through email, phone, handwritten note, etc.) and let them know you’re never too busy to help their friends and family members. Keep track of your outreach in your CRM and set a goal to ask all your clients. Then, ask for feedback. Feedback comes in many forms (online, written, formal, informal, etc.) and each form is beyond the scope of this article, but all feedback creates a sense of partnership and demonstrates your commitment to the relationship. ALSO READ: 7 Client Referral Ideas To Help You Get More Referrals Strategy #2: LinkedIn JackpotLinkedIn is amazing. It’s such a great tool for financial advisors that I created a video training called How To Get Clients With LinkedIn that has gotten feedback like this:

And this...

Your mileage will vary, but you can see that it’s not far-fetched to get three clients in thirty days when you consider that the above advisor had two people reach out to her within a few days of following my advice.

Unfortunately, 99% of LinkedIn advice is total garbage. Not only do traditional LinkedIn approaches fail to get attention and pique interest, but they’re not tailored to financial advisors. This causes them to fall flat. One reason most LinkedIn approaches don’t work for financial advisors is because they fail to acknowledge prospective clients' skepticism. An online survey conducted by Harris Poll on behalf of McAdam found that 71% of Americans say some aspect of talking with a financial advisor scares them. If your LinkedIn strategy doesn’t counteract this skepticism, it’s going to fail. I promise you. So, what’s a financial advisor to do? Simple. Build real relationships with people. 💪 Financial advisors who see the most success with LinkedIn combine a mix of both inbound and outbound marketing strategies. However, if you want to get three new clients in the next thirty days, you’ll have to go heavy on the direct outreach. The first step is to know your numbers. Just as you would never create a budget or savings plan without knowing certain numbers, you should never approach any marketing strategy without a sense of how the numbers are going to work in your favor. Here are some important numbers to know:

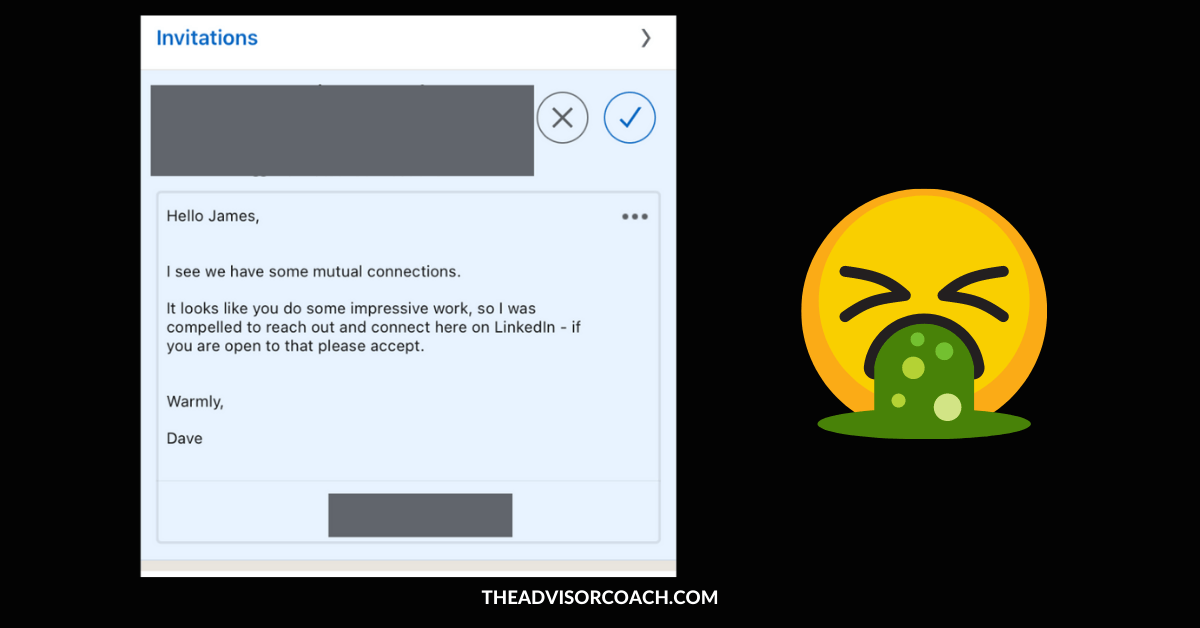

Once you know the answers to these questions, LinkedIn becomes a numbers game. A fun game, at that. A game where you can practically get clients on command. The only limit is how consistent you’re willing to be. But you don’t have to take my word for it. According to Putnam’s Social Advisor Survey, 94% of advisors seeing success use direct messaging capabilities on social platforms. You read that right. Nearly ONE HUNDRED PERCENT of financial advisors getting new clients are doing direct outreach on places like LinkedIn. So, pay attention because… 💡 The success of your direct outreach will be in direct proportion to how personalized you make it. This is the hard truth people don’t want to accept. They’d rather automate everything. Or have some “copy-and-paste” secret. Don’t get me wrong: I love automation. I have automated emails, webinars, workflows, and more. Yet, my conversions started increasing when I included real touches in my marketing. If everyone is zigging, you should zag. This means you should look for connection points with people in your niche. That way you can sprinkle your messages and connection requests with things like:

And so on. This personalized outreach will be FAR more effective than lame requests like these: Here’s a sample breakdown of what your numbers might look like…

You send connection requests to 100 people in your niche. 30 of them accept (I know the lady above had a 44% acceptance rate, but I want to be conservative). 3 agree to meet with you for an initial consultation. 1 becomes a client. Boom. 🎉 Rinse and repeat three times and you’re done. Want to make your direct outreach even more effective? Include a video in your messages. There are tons of video messaging services out there. BombBomb and Loom are two good ones. Here’s an example of a Loom video… Video outreach works well because people know for sure your message wasn’t copied-and-pasted or blasted out to a thousand other people.

If you want to maximize your video’s effectiveness, include your prospective clients’ LinkedIn profiles in the background. Seeing themselves in the video significantly increases the chances that they will click and watch. ALSO READ: 6 Video Marketing Tips For Financial Advisors Strategy #3: Email BonanzaBow down to the king. 👑

I’ve said it many times in my newsletter and on my podcast: email is by far the most effective appointment-setting strategy I’ve ever seen for financial advisors. Again, you don’t have to take my word for it… check out these statistics…

I take pride in giving you real data that’s 100% verifiable. You can do your own research and see that everything I’m telling you is true. Other people love giving you “theories”, but I like facts. “But don’t you need a big email list?” I hear this quite a bit from financial advisors, and the answer is no. You don’t need a big list, especially if you have a niche. Allow me to explain with a story about credit cards… As of 2019, there were 3.3 billion Visa cards and over 2 billion Mastercards circulating in the wild. That’s a lot of credit cards.

But what about American Express? They only had 114 million cards issued. That means there were 29 Visa cards and 17 Mastercards for every ONE American Express. Visa and Mastercard must be dominating, right? Wrong. Because American Express CRUSHES them in total revenue. Amex makes more than Visa and Mastercard COMBINED. As a premium brand, Amex isn’t as concerned with how many cards are issued. Instead, they pay attention to how much money they make from each cardholder. I think that’s a good model for financial advisors to follow. Because instead of wasting a bunch of time, money, and effort trying to build a huge email list, they can focus their resources on finding the right people. To illustrate, which email list do you think will lead to more clients?

I hope that makes sense. Let’s run through some numbers… Campaign Monitor reports that the average open rate for the financial services industry is 24.80% and the average clickthrough rate is 2.70%. This means if you have an email list of 500 people… 124 will open your emails… And 3 will click through to your appointment page. You can see how quickly the math can work in your favor, especially if you’re sending multiple emails. If you want help building your email list, read this article: 4 Things I’ve Learned From Sending 3.2 Million Financial Advisor Emails Here’s how the process works… You write a sequence of five to ten emails. Most financial advisors write emails in one go and then submit them to compliance for approval. Then, you take that sequence, and upload it to an autoresponder service like MailChimp or Constant Contact. An autoresponder ensures that your emails are sent to people on your list in the predetermined sequence you choose. Someone who subscribes today will go through the sequence in the same exact way as someone who subscribes next Tuesday. This is critical because of the mere exposure effect, which is a psychological phenomenon by which people feel a preference for something merely because they’re familiar with it. This means by going through this sequence, your prospective clients will be psychologically wired to prefer you over everyone else. (You can also use the mere exposure effect in other areas of your marketing, such as LinkedIn.) If you want more information about how you can get clients with email marketing, I encourage you to register for this free webinar: 3 Counterintuitive Ways Financial Advisors Can Get More Clients With Email Marketing In that webinar, I give more value for free than most people give in their paid courses. Enjoy. Bottom Line...There you have it - three strategies you can use to get three new clients in the next thirty days, complete with evidence.

If you liked this article, I would appreciate it if you shared it with someone. 😄 About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |