What Is The Optimal Number Of Clients For A Financial Advisor? (My Answer May Surprise You...)In this article, I want to answer the question, “What is the optimal number of clients for a financial advisor?”

I don’t feel like writing a fancy intro, so I’ll cut straight to the chase… CONTENTS

How Many Clients Should Financial Advisors Have?Because my business helps financial advisors improve their marketing and get more clients, I spend a lot of time thinking about this subject. I’ve come to the conclusion that not only is it possible to have too few clients, but it’s also possible to have too many clients.

I’ve seen advisors claim to have 400+ clients. It’s impossible. These advisors have 400+ customers. A customer is someone who uses you for transactions. A client, on the other hand, is someone who seeks your advice and builds a relationship with you. If you find yourself with hundreds and hundreds of so-called “clients,” you are more than likely a mere transaction facilitator. My wife’s financial advisor is a perfect example of this. Back when she was contributing to her Roth IRA, she would call her financial advisor once per year and write a check to fund her Roth. (Yes, she would call HIM. He never called her. That alone should tell you something.) The only “value” this advisor provides is facilitating the transaction. Guess how many “clients” her advisor says he has? Hundreds. Oh, and guess who is getting fired pretty soon? That advisor. 😆 There’s even something called “Dunbar’s number,” which is a suggested cognitive limit to the number of people with whom one can maintain stable social relationships (aka real relationships, not social media ones). That number, first proposed by British anthropologist Robin Dunbar, is estimated to be around 150. Dunbar and his colleagues examined anthropological and contemporary data about group sizes and found remarkable consistency around this number. It held true for early hunter-gatherer societies, as well as offices, communities, factories, 11th Century English villages, and even Christmas card lists. Knowing this, we can establish an upper limit for the number of meaningful contacts financial advisors can have within their businesses. However, I’ve found the ideal number of clients to be much lower than 150. In fact, there are two laws that have shaped my view of how many clients a financial advisor should have, and they are… #1. The Law Of Diminishing ReturnsThe law of diminishing returns is an economic theory that predicts that after some optimal level of capacity is reached, adding an additional factor of production will result in smaller increases in output.

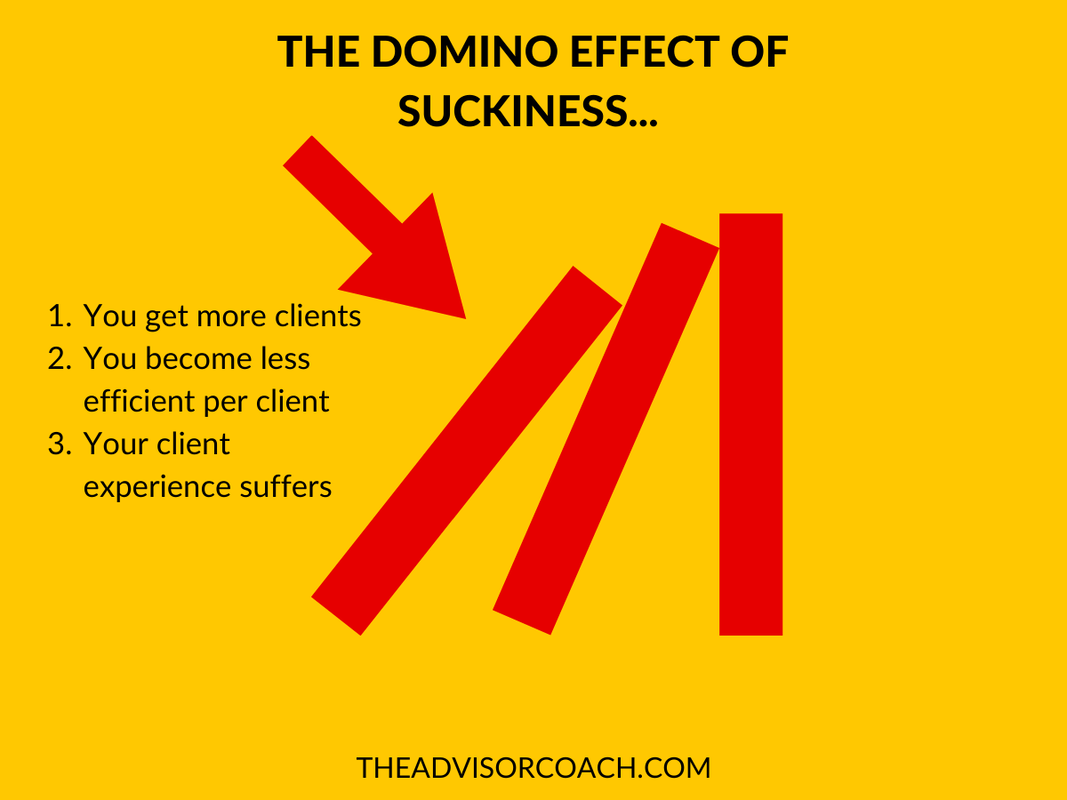

Imagine a widget-making factory. There exists a number of employees who can operate the company at its optimal level. Adding more employees past this magic number will cause the factory to become less efficient in its widget-making capabilities. Applying this law to financial services, it's easy to see how you become less efficient per client as you add more clients, holding everything else constant. If you become less efficient per client, this means your client service isn’t as good, which means the client experience isn’t as good, leading to a domino effect of suckiness. This is a huge problem.

The law of diminishing returns poses a significant challenge for financial advisors seeking to expand their client base. At first, adding new clients to a financial advisory practice typically results in increased revenue and business growth. However, there's a tipping point beyond which taking on additional clients can begin to harm the advisor’s effectiveness and the overall client experience. As financial advisors take on more clients, they invariably spread themselves thinner. Time, the most crucial resource for providing personalized financial advice, becomes increasingly scarce. When this happens, the quality of service each client receives starts to decline. Instead of offering tailored, thoughtful financial guidance, advisors may find themselves resorting to generic advice that doesn’t fully meet individual client needs. This reduction in service quality can lead to dissatisfaction among clients, potentially harming the advisor's reputation and leading to a loss of business over time. Moreover, the personal connection that is vital to building trust between advisors and their clients starts to erode as client numbers grow beyond manageable levels. Financial advising is built on understanding personal goals, fears, and circumstances. When advisors have too many clients, they can no longer provide the same level of personal attention, leading to a less personalized service. Clients may feel like just another number, which is particularly damaging in an industry where trust and personal connection are paramount. A study was even done by Qualtrics (“The Financial Advisor Client Experience Report”) which found that 10% of clients said they switched financial advisors in the past ten years because of poor customer service. Another 10% said they switched advisors due to a lack of personalized attention. So, clients want more attention from their financial advisors. Plus, research done by Frederick Reichheld of Bain & Company found that increasing retention rates by 5% increases profits by 25% to 95%. This means finding the optimal number of clients can create a true win-win scenario: happier clients and more profit in your business. Additionally, the operational aspects of managing a large number of clients can become overwhelming, leading to operational inefficiencies and errors. Mistakes in managing investments, miscommunication, and delays in responding to client inquiries can all increase as advisors exceed their optimal client capacity. These operational challenges not only stress the advisor but can also lead to client dissatisfaction and regulatory issues. To escape this domino effect of suckiness, you must embrace… #2. The Law Of 80/20It’s difficult for me to overstate how powerful this law can be if used correctly.

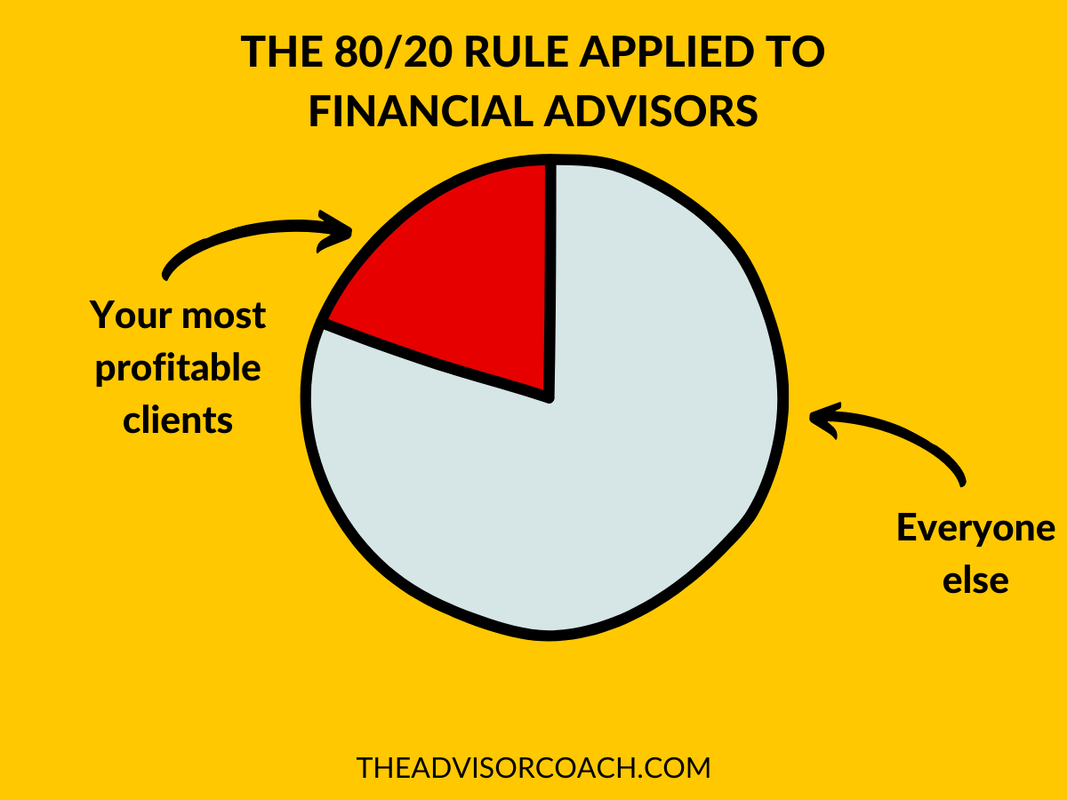

The 80/20 rule, also known as the Pareto Principle, states that roughly 80% of the effects come from 20% of the causes. You can find many examples in business, such as:

And so on. For financial advisors, the most important application of the 80/20 rule is this: A large percentage of your profit comes from a small percentage of clients. Your numbers may vary. Seventy percent of your revenue may come from 30% of your clients. You may even have 5% of your clients account for 95% of your revenue. You won’t know for sure until you evaluate your business, but when you do, you’ll likely find something similar. It is because of this law that financial advisors can eliminate a large percentage of their client base and still be okay. Let’s walk through a fictional example using a financial advisor named Bob… Bob has 125 clients, and his total yearly profit is $337,500. This means that each client is worth, on average, $2,700 in profit. But that’s AVERAGE! Upon further examination, Bob makes a remarkable discovery… The top 25 of his clients account for $270,000 of his profit, while the remaining 100 clients contribute a grand total of $67,500. Again, your numbers may vary. However, I’d bet dollars to donuts that if you picked apart your business based on revenue generated per client, you’d find the following things:

Your mission should be to rid yourself of the small percentage of clients who cost you money. After that, you can chip away at the clients who generate the smallest amount of profit. If that seems simple, it’s because it IS simple. Don’t let your mental hang-ups and emotional attachment get in the way. Remember the domino effect of suckiness? You will become more efficient per client if you have fewer clients, which means you will provide better service to your best clients, which is a GREAT thing. Now, What Is The ACTUAL Number?Like many things in life, it depends.

If pressed for a number, I will tell you to aim for no more than 100 clients because this appears to be the upper threshold of which you can provide stellar service while still performing all the other functions necessary to run and grow your business, assuming you’re working 9-5 each weekday. Still, 100 clients may be too many if your goal is to operate a smaller lifestyle practice. If you only want to work three or four days per week, 50 clients may be your upper limit. Either way, obeying the two laws discussed above will force you to continue to level up your business and nurture your highest-value clients. If you continue dropping your bottom percentage of clients and adding to the top, you will have no choice but to grow. With better use of technology (such as having a solid CRM), you can probably service more clients. However, the long-term effects of building relationships with your clients - as well as providing spectacular service - cannot be denied. A more important number to know is your average value per client. Because which would you rather have?

Option A generates $200,000 per year while option B generates $250,000 per year with fewer clients. Does this happen overnight? Of course not. If an advisor sets a goal to reach 100 clients and gets two new clients per month on average, it still takes over four years to reach that goal (and that’s with no turnover). ALSO READ: 7 Actionable Goal Setting Tips For Financial Advisors Knowing Your "Number" Is Incredibly Freeing...As a financial advisor, you likely encourage your clients to know their “number” when it comes to retirement. This is the number they need to retire comfortably and never run out of money.

Your “number” will be how many clients you want to have, and knowing this number allows you to reverse-engineer your marketing processes to get a rough idea of what it’s going to take to achieve that number. After all, marketing is math. That may seem painfully obvious to some people, but I’m consistently amazed by how many advisors still don’t “get” it. The name of the game is to put one unit in (time, money, energy, etc.) and get more than one unit back. You do that by knowing your numbers. Just like you would never create a budget or savings plan without knowing certain numbers, you should never approach any marketing strategy without some sense of how the numbers are going to work in your favor. Let’s use LinkedIn as an example…here are some important numbers to know…

Once you know the answers to these questions, LinkedIn becomes a numbers game. A fun game, at that. 😎 A game where you can practically get clients on command. The only limit is how consistent you’re willing to be. Let’s use inbound marketing as another example. Imagine you build out a content marketing machine and…

If you want 100 clients, you can reverse-engineer the math to figure out that you need 33,333 visitors to your “contact us” page in order to reach your goal. This may seem daunting at first, but keep in mind that this is a career goal and it won’t happen overnight. Although, if you continue building your marketing machine and pay attention to your numbers, it can happen sooner than you think. ALSO READ: 9 Awesome Content Marketing Tips For Financial Advisors About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |