10 Catastrophic Ways Financial Advisors Sabotage Their Own SuccessLet's talk about an unpopular topic: self-sabotage.

Since founding The Advisor Coach in 2015, I've had the privilege of watching financial advisors build and sustain tremendous success. I've also witnessed behaviors that shatter goals and dreams. Behaviors are said to be self-sabotaging when they create problems in your daily life and interfere with your goals. When you think of self-sabotage, you probably think of drugs, alcohol, or other self-destructive behaviors. However, it doesn’t have to be that extreme. Financial advisors can sabotage their success in several different ways. Here's what we're going to cover: 1. They Set Their Goals Too LowEver since I created Your First Year As A Financial Advisor, I’ve gotten tons of attention from new financial advisors. These new advisors are often encouraged to set goals for their first year in business. Some of them set huge, lofty goals but, based on my experience, most new financial advisors set the bar too low.

Now, why is this phenomenon especially prevalent among new financial advisors? I have a few hypotheses… The first is that they don’t know what’s possible. They’ve never been in financial services before, so they have no baseline whatsoever. For all intents and purposes, they’re picking a random number. Because they’re just spitballing potential numbers, some advisors appear full of unbridled enthusiasm while others appear afraid to aim high. My second hypothesis is that their goals are influenced by the other financial advisors they meet. When financial advisors hear about how tough it is to succeed or the industry’s high turnover rate, they get nervous. If other financial advisors tell them how they’ll have to “grind it out” for a few years, low goals are merely a product of confirmation bias. This idea is well beyond the scope of this article but I discuss it in more detail here: 7 Reasons Why Most Financial Advisor Sales Training Completely Fails My third hypothesis is that they fear change. This is assuming financial advisors ARE thinking accurately about what’s possible and they DON’T have any negative influences. Because when most people talk about “fearing success,” they’re really talking about fearing change. They’re worried that success will turn them into different people. They’re worried that success will alienate their friends and family members. Because of this deep-rooted fear of change, advisors set low goals to remain in their comfort zone. ALSO READ: How Advisors Can Get Out Of Their Comfort Zone 2. They Associate With Low AchieversThe principle highlighted by motivational speaker Jim Rohn, that we are the average of our five closest friends, has significant implications, especially for financial advisors aiming to grow their clientele and improve their professional standing. The environment in which you immerse yourself, including the people with whom you associate, plays a critical role in shaping your ambitions, attitudes, and ultimately, your achievements.

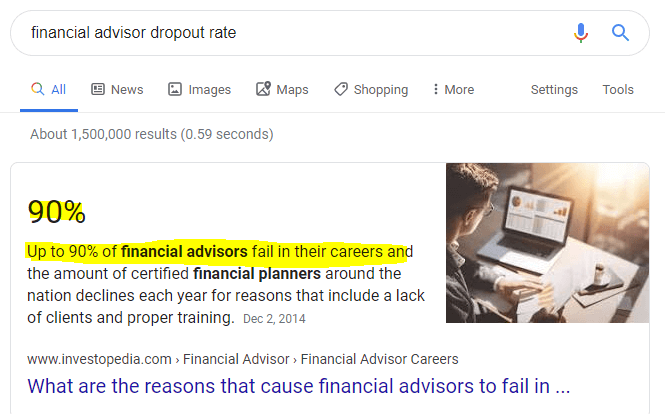

Influence of Your Social Circle Your social circle profoundly impacts your mindset and behaviors. Associating with low achievers can inadvertently set a ceiling on your aspirations. These individuals often accept mediocrity as their fate and might instill a sense of complacency or fear of risk-taking in you. They might question your goals, criticize your ambition, or even ridicule your efforts to improve, not out of malice, but out of their own insecurities or misunderstanding of success. Self-esteem and Decision Making The company you keep can either bolster or undermine your self-esteem. When you spend time with low achievers, their doubts and fears can become your own, leading to indecision or poor decision-making. In contrast, high achievers can elevate your sense of what’s possible, encouraging you to set more ambitious goals and make decisions that align with those higher aspirations. The Crab Mentality The analogy of crabs in a bucket illustrates how individuals in a group can attempt to prevent any single member from progressing beyond the collective. This is a real phenomenon in human behavior as well, where peers may try to hold you back, consciously or subconsciously, to maintain the status quo. Acknowledging this reality allows you to consciously choose your company and create a supportive environment conducive to growth. Personal Growth and Association Choices The transformation from associating with low achievers to mingling with high achievers can be profound, as illustrated by personal experiences like mine. Growing up in an environment with limited aspirations, the shift towards surrounding oneself with ambitious, high-achieving individuals can radically change one’s outlook and life trajectory. High achievers challenge you, inspire you, and impart valuable lessons from their own successes and failures. Cultivating a High-Achiever Network For financial advisors, building a network of high-achieving, motivated peers and mentors can accelerate professional development and client acquisition. This involves actively seeking out individuals who not only excel in their field but also embody the qualities you aspire to develop, such as integrity, diligence, and a forward-thinking mindset. 3. They Quit Too SoonAccording to Investopedia, up to 90% of financial advisors fail in their careers.

This is heartbreaking, especially when people like me work so hard putting together proven marketing and prospecting plans for advisors. Make no bones about it: succeeding as a financial advisor is difficult. It does require hard work and strategic thinking. Yet, it can be done. Thousands of financial advisors have already achieved the success you want to achieve. If you want to replicate their results, you’ve got to replicate what they’ve done. In my experience, most financial advisors tend to be optimists. And there’s nothing wrong with being optimistic unless it takes you away from reality. If the cold, hard reality is that it takes a certain amount of effort to succeed, no amount of positive thinking is going to change that. I’m bringing this up because optimistic financial advisors are the ones who (ironically) tend to get discouraged when the going gets tough. This is because they’re optimistic in the sense that they think everything will be easy for them. When things don’t happen as quickly or as easily as they’d like, they get discouraged. Advisors also sabotage themselves by quitting their marketing campaigns too soon. An advisor might send ONE direct mail piece out ONCE and write it off completely if he doesn’t get any results. He’ll just stop trying because of one “failed” effort… even though a few tests could easily turn his mail campaign into a winner. The same is true with all types of marketing ranging social media, content marketing, email marketing, etc. 4. They Don't Focus On ProductivityAs a financial advisor, your income is closely tied to your productivity. If you can shift from doing $10-per-hour work to $200-per-hour work, you can dramatically increase your bottom line.

Alas, many advisors sabotage themselves by continually working on low-value tasks in their business. I'm talking about tasks such as shuffling paperwork around, doing “research,” and constantly checking email. Newsflash: nobody ever put a dent in the universe by checking email. The most successful financial advisors are the ones who have a relentless focus on becoming more productive. This drive shows up in their business, their personal life, and their bank balance. ALSO READ: 10 Of My Favorite Productivity Tools For Financial Advisors 5. They Don't Develop BoundariesI've lost count of how many advisors I've met who proudly proclaim that they work 60+ hours per week but still “can't afford!” my help. Or the ones who are the first to arrive at the office and the last to leave but still can't crack $250K in personal income.

We live in a toxic “hustle!” culture, and it's permeated among financial advisors. Yet, successful advisors understand that they must set boundaries. Because if they don't, here’s what happens… They work a lot, which means they don't spend time with their families... which leads to a poor personal life... which impacts their work... and the poor work quality means they spend even MORE time at work… which means they spend even LESS time with their families… and so on. It’s a VICIOUS cycle. This form of self-sabotage is especially dangerous because it seems innocuous. Advisors believe they're actually doing a GOOD thing by quickly responding to a prospect's email at 7 p.m. or setting up an initial meeting well into the evening. However, it’s a slippery slope where boundaries get eroded, and burnout can occur. ALSO READ: 7 Tips For Avoiding Burnout As A Financial Advisor 6. They Try To Please EveryoneYou're probably a people-pleaser. So am I. We're all people-pleasers to some extent because wanting to be approved of and accepted is as natural as wanting food and shelter.

However, it’s when you try to please EVERYONE that you encounter problems. Clinical psychologist Dr. Harriet Braiker called it “the disease to please.” Financial advisors who suffer from this disease dread disapproval. As a result, they inoculate themselves against conflict and confrontation. This means they fail to speak up, fail to say what’s on their minds, and fail to allow themselves to be genuine. This is self-sabotaging for many reasons, such as:

Trying to please everyone is rooted in the fear of rejection and the fear of failure. However, the biggest failure is failing to be yourself. The biggest rejection is rejecting yourself. ALSO READ: 5 Ways To Overcome Call Reluctance 7. They Act ImpulsivelyThere are some people who pride themselves on “moving fast!” and taking “massive action!” Whenever I encounter these people, I shake my head in pity.

Because speed doesn’t matter. Even actions don’t matter. RESULTS matter. I don’t give a crap if you take “massive action!” and call fifty leads as soon as you get to the office. If you’re calling the wrong leads, it doesn’t matter. And if you make poor decisions, then being decisive doesn’t matter. Advisors who act impulsively are usually the ones who don’t set goals. The very act of goal-setting is contrary to acting impulsively. Most people tend to jump into tasks that pop up each day without deeply thinking and strategizing about how they’re spending their time. ALSO READ: 7 Actionable Goal Setting Tips For Financial Advisors 8. They Don't Invest In ThemselvesAll serious business owners recognize that it takes investments of time and money to grow a business. Anyone who thinks otherwise is just “playing business” in the same way that a young child plays “doctor” or “house.”

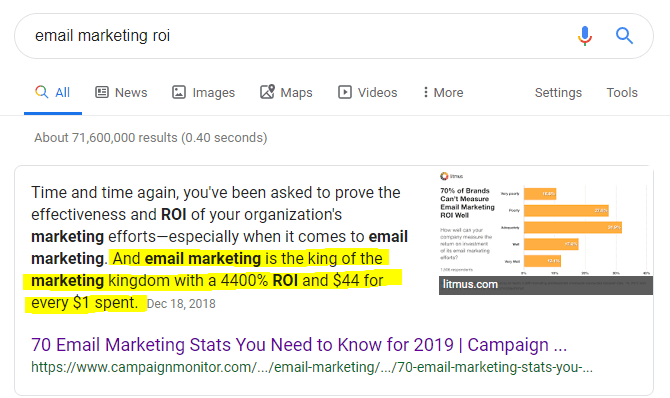

Allow me to explain this using a stock market analogy… When investing in stocks, value investors try to buy stocks that appear underpriced by some form of fundamental analysis. One of the metrics used is the P/E ratio, or the price-to-earnings ratio. For example, a P/E ratio of 10 means the company will pay back 10 times its earnings. Sadly, a lot of people will jump to buy a stock with a low P/E but not invest in themselves when they can get an even lower “P/E ratio.” Case in point: marketing. Financial advisors will gladly pay 10, 15, or even 25 times earnings for stock in someone else’s company instead of investing that same money back into their own businesses, where a dollar spent on marketing could bring two dollars back in a short period of time. By doing this, they’re really saying they have more faith in other people than they have in themselves. Because according to the Investment News 2018 Pricing and Profitability benchmarking survey, the typical advisory firm spends no more than 2% of its revenues on marketing. 2%?? That’s TERRIBLE. Marketing is literally what builds businesses. By not investing in marketing, financial advisors are saying they don’t want to grow. Let’s do another stock market analogy… As someone who works exclusively with financial advisors, it’s hard for me to go a single day without hearing about “the market.” As you (hopefully) know, the most popular benchmark for “the market” is the S&P 500. It’s the measuring stick most people use when they talk about “beating the market.” Let’s say the S&P has an average annualized total return of around 9%. I’m not going to get into a shouting match with anyone about whether or not that number is correct because people can lie with statistics. My point here is that a 9% return is PITIFUL. Because by investing in yourself and your business, you can get a much larger return. For example, a study done by Campaign Monitor found that every $1 spent on email marketing made $44 in return. That’s a 4,400% return on investment… and that’s just ONE example. If you aren’t investing in yourself, you are leaving mountains of money on the table. 9. They Drown Themselves In Self-PityI want you to imagine two financial advisors, Joe and Bob.

Both of them had horrible fathers. I mean, complete and total deadbeats. Now, let’s say Joe goes on to become a massive success. If you ask him how he turned out so well, he might say: “I didn’t want to turn out like my father, so I did everything I could to succeed.” Then, let’s say Bob turns out to be a complete failure. He doesn’t even try. If you ask him why he’s not as successful, he might say: “What else did you expect? Just look at my dad.” Do you see the message here? Both of them had terrible fathers, yet one of them used it as rocket fuel for his success while the other one latched onto it as an excuse. The truth is that YOU are in control of your own destiny. Nobody else. And I could give two financial advisors the exact same proven system… but if one of them has a “woe is me” attitude, that advisor will never succeed. Here’s a list of B.S. excuses I’ve heard from advisors over the years:

The world’s best advisors never wallow in self-pity. They make things happen, regardless of the circumstances. Because they realize that while they can’t control the cards they’re dealt, they CAN control how they play the game. 10. They Get Stuck On The Prospecting TreadmillHere’s one of the best ways to grow a financial services business: build an inbound marketing machine while working on outbound marketing tactics.

For example, you can call prospects and send direct mail pieces during the day while working on your website and email autoresponder at night. You want to get clients TODAY while building a system that will get them for you TOMORROW. Failing to do this is akin to working when you're eighty years old because you didn’t save anything for retirement. If you don’t build an inbound marketing machine, you will ALWAYS be a slave to your business. About The Author...

Hey, I'm James Pollard. I'm the guy behind this website.

I've dedicated my career to empowering financial advisors to unlock their full potential. With a passion for marketing and a knack for cutting through the noise, I provide actionable strategies and insights that help financial advisors build better businesses. I'm also the host of the popular Financial Advisor Marketing podcast. Beyond the mic, I'm constantly sharing my expertise through The James Pollard Inner Circle™ newsletter, which has grown to become one of the most successful communities in the financial advice space. Thanks for stopping by and diving into my world. If you'd like to connect with me on LinkedIn, here is where you can find me. |