Is Wealthfront Worth It? Review From A Finance Nerd...This post may contain affiliate links.

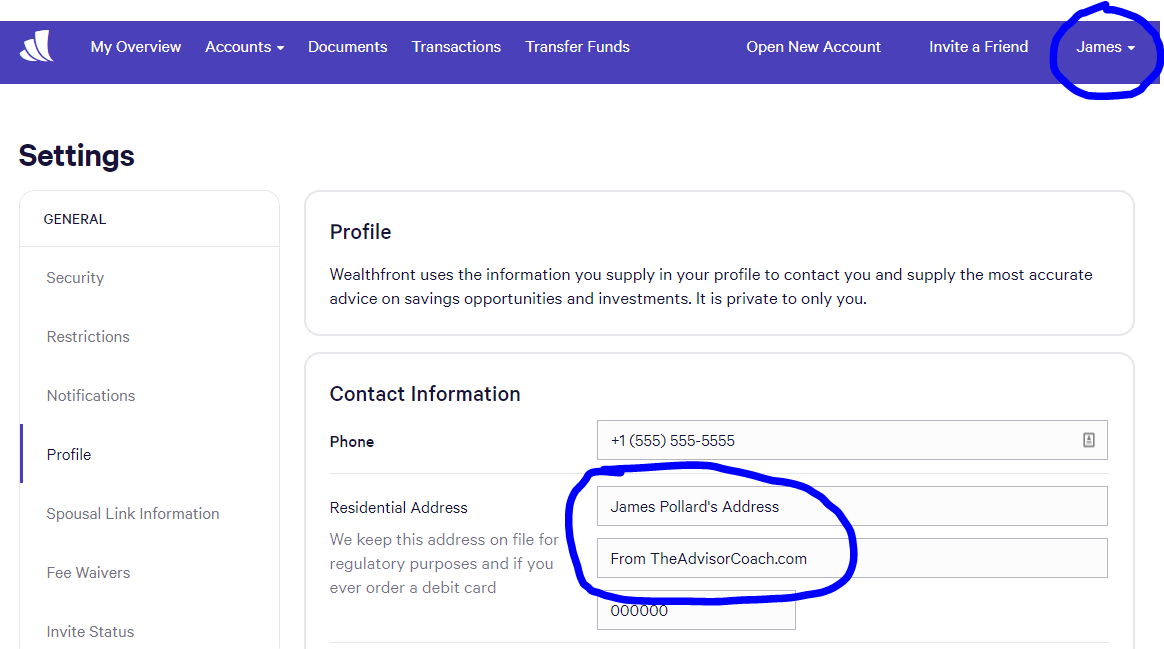

If you’ve been researching Wealthfront but can’t figure out if it’s right for you, then this article will help point you in the right direction… But first, let me explain who I am and why should you listen to me. After all, you probably found this article through a Google search. Maybe you’ve already read several articles by so-called “personal finance” websites that only exist to push credit card offers in your face. This isn’t that sort of website. My name is James Pollard, and I run a business consultancy for financial advisors. This means I am LITERALLY the financial advisor’s advisor. 🤯 I also PERSONALLY use Wealthfront. Which means I’m not recommending one thing and doing something else with my own money. Here’s proof… I went into my Wealthfront account and modified my settings to show you that I legitimately use the service. I’m not just another “personal finance” blogger writing articles about things I never use.

Now, let’s get into the nitty-gritty of Wealthfront… Is Wealthfront Worth The Fee?It’s important to make the distinction between the Wealthfront CASH account and the Wealthfront INVESTMENT account because I will be discussing both in this article.

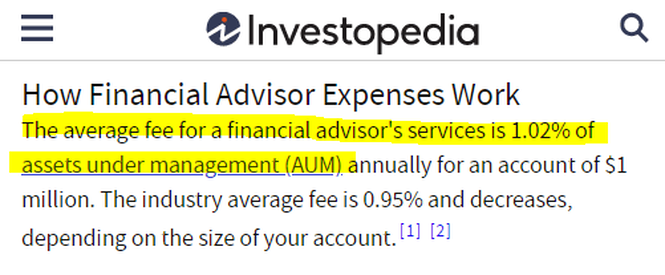

A Wealthfront cash account has no fees whatsoever. It’s like a regular checking account you’d open at your neighborhood bank, complete with a debit card, account number, routing number, etc. A Wealthfront investment account has an annual advisory fee of 0.25% on all assets under management deducted monthly. This means if you have $100,000 invested with them, they will charge $250 per year. (Of course, if you open an investment account through this affiliate link, you can get $5,000 managed for free. 😎) Compare that to what your average financial advisor will charge you: according to Investopedia, the average fee for a financial advisor’s services is 1.02% of assets under management. This means if you have $100,000 invested with them (so we’re comparing apples-to-apples), you will be charged $1,020 per year, on average. So, if you’re comparing Wealthfront vs. a traditional financial advisor based on fees alone, Wealthfront wins hands-down. Of course, there have been studies (such as Vanguard’s Advisor’s Alpha) which found that good financial advisors can add up to 3% per year to your return. This means financial advisors CAN make you more money than they charge. However, there’s a big downside…

Account minimums. You see, most traditional financial advisors won’t take you on as a client unless you meet their account minimums, which typically range from $100,000 to $500,000 (or more, those who specialize in wealthy individuals). I don’t blame financial advisors for having account minimums because they have to make money too, and they have to have a significantly large portion of money to manage to make it a win-win scenario for them and their clients. Because of this, Wealthfront is a viable option for people who don’t meet those steep account minimums. The minimum amount of money required to open a Wealthfront account is $500. Is Wealthfront Good For Beginners?In a word, yes.

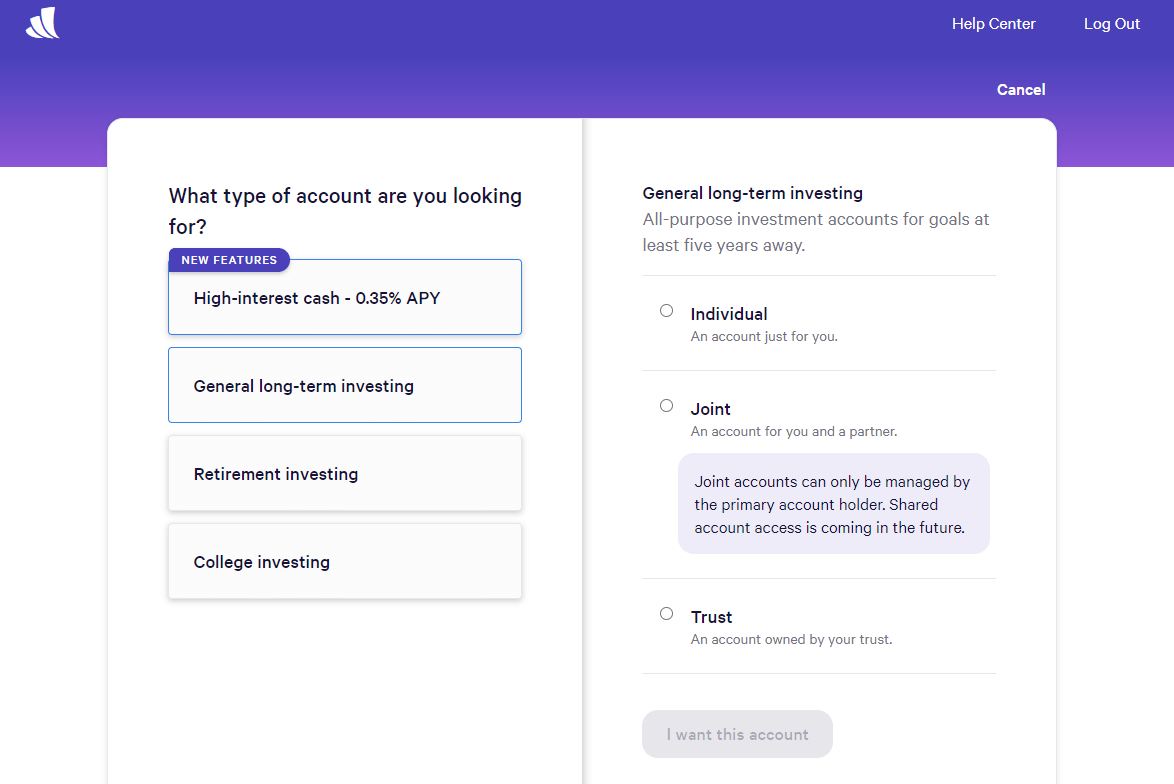

Wealthfront has been designed from the ground-up to make the process of opening and funding an investment account as easy as possible. It took me less than ten minutes to open my account. The first step is choosing the type of account you’d like to open. For the purposes of this example, I will assume you’re opening an individual investment account, although they have options for joint investment accounts, Roth IRAs, traditional IRAs, 529 plans, and so on. Once you select the type of account you want to open, Wealthfront will begin a questionnaire designed to assign what’s called a “risk score”. This is an amazing way for Wealthfront to determine the proper allocation of investments for you.

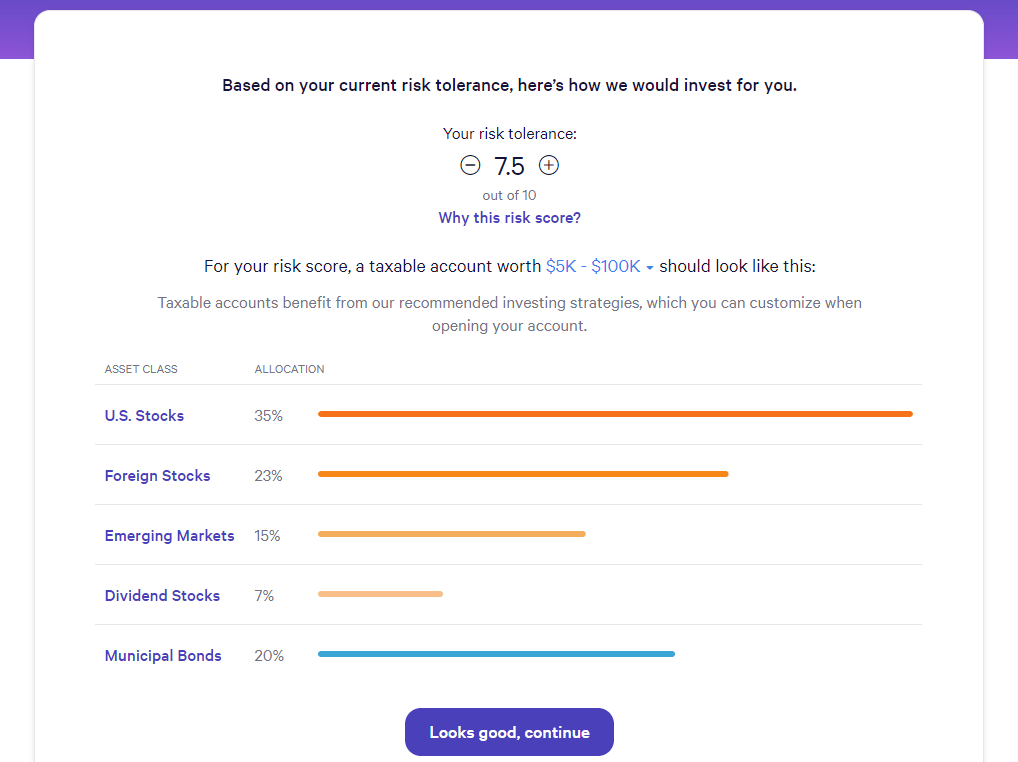

Their risk scores range from 0.5 to 10.0. Someone with a low risk score would primarily be invested in bonds, while someone with a high risk score would be invested more heavily into stocks and emerging markets. The reason your risk score is critical is because behavioral economics research shows individuals consistently overstate their true risk tolerance, which leads to buying and selling at the worst time. Having the right asset allocation based on your risk appetite increases the likelihood that you’ll stay invested for the long-term. Here’s a look at my own risk score within Wealthfront and my recommended portfolio… Wealthfront also emails its clients periodically to see if anything in their financial profile has changed that may affect their risk tolerance. For instance, getting married, having children, or changing jobs can all affect an investor’s risk score.

Wealthfront allows clients to adjust their assigned risk score once every 30 days, in the event they want a more or less conservative allocation. They restrict it to once every 30 days because they don’t believe it should be used as a market-timing tool. Remember, staying invested = good. Trying to time the market = bad. What Are Wealthfront's Historical Returns?This is one of the most common questions people ask about Wealthfront and, before I answer, let me be clear…

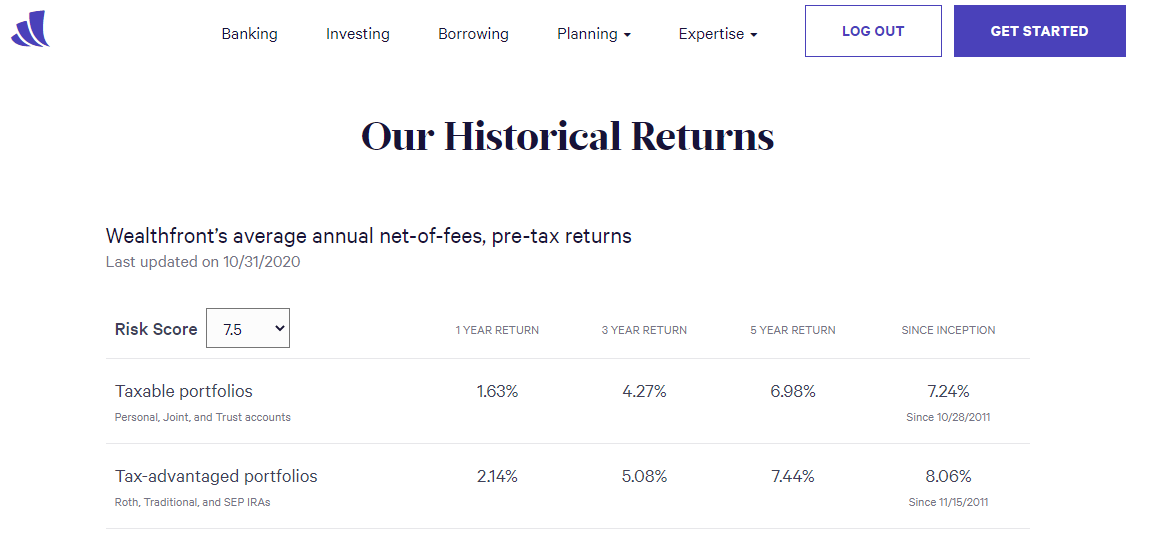

🗣️ PAST PERFORMANCE IS NOT AN INDICATOR OF FUTURE PERFORMANCE. 🗣️ Got it? Good. Now, Wealthfront’s historical returns depend on your risk score. If you are invested heavily in U.S. stocks and emerging markets, your returns will be different from someone who is invested primarily in municipal bonds. So, I am going to use my own risk score of 7.5 and show you the historical returns displayed on Wealthfront’s website… As you can see, someone with a risk score of 7.5 in a taxable account like mine has enjoyed an average annual net-of-fees, pre-tax return of 7.24% since inception.

You might not be impressed with this if you’ve been brainwashed into thinking you should dump everything into an S&P 500 Index Fund. The S&P 500 Index originally began in 1926 as the “composite index” composed of only 90 stocks and, according to historical data, it averaged an annual return of approximately 10% from its inception through 2018. However, when you invest in nothing but the S&P 500, you assume S&P 500 risk. That’s why it’s more important to consider your risk-adjusted return and why Wealthfront’s careful consideration of risk tolerance is so important. Besides, the evidence shows that average investors underperform the broad markets anyway. Each year Dalbar publishes its Quantitative Analysis of Investor Behavior (which you can Google if you don’t believe me) and they find that investors consistently sabotage themselves. For example, the S&P 500 dropped 6.24% in 2018. Yet, according to Dalbar’s research, the average investor lost 9.42%. 😨 This occurs because when markets rise, investors are often confident. They might increase the amount they’re investing every month. Then, when markets drop, many investors become fearful and sell when they shouldn’t. In my opinion, this is because average investors are assuming more risk than they can handle. Wealthfront solves this problem. So, let their algorithms do the hard work for you. Create your account, set up a dollar amount to invest every month, and do not change it. Wealthfront's "Secret Weapon"... 🤑The historical returns discussed above are only part of the bigger picture because Wealthfront is focused on maximizing your after-tax returns. And THIS is where Wealthfront really shines.

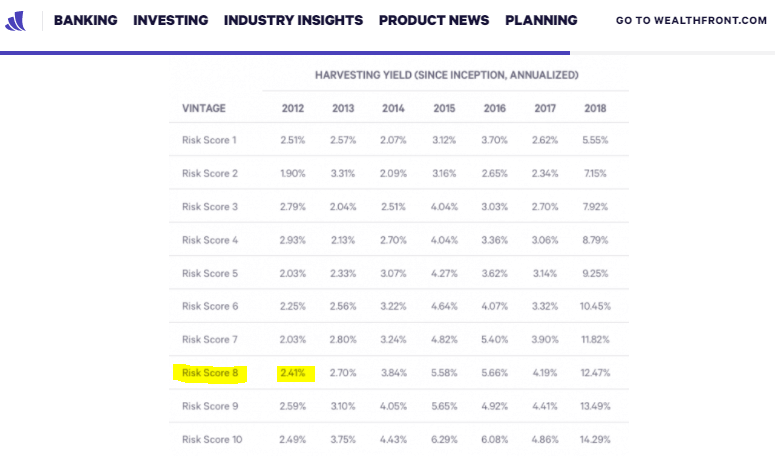

Tax-loss harvesting takes advantage of movements in the markets to capture investment losses, which can reduce your tax bill and leave you with more money to invest. When an investment in your Wealthfront portfolio drops in value, Wealthfront automatically sells that ETF at a loss that you can use to offset ordinary income or investment gains, which can lower your overall tax bill. The beauty of this strategy is that when Wealthfront sells an ETF at a loss, they replace it with another highly correlated ETF. This means the risk and return profile of your portfolio remains unchanged, even as tax-loss harvesting generates tax savings. Growing my portfolio AND generating tax savings at the same time! Whew, is it getting hot in here or is it just me? 😍 According to Wealthfront, clients who started with them in 2012 with a risk score of 8 portfolios benefitted from an average annual harvesting yield equal to 2.41% of their portfolio values. This is more than they charge in fees. You can see the value of their tax-loss harvesting service below… I have been following Wealthfront since approximately 2015 and this is one area where they have dominated other robo-advisors and investment services. As of the time of this writing, no other automated financial advisor publishes its tax-loss harvesting results. That should tell you something.

Even If You Don't Open An Investment Account, Do This...Open a cash account.

Seriously, go do it right now. Cash management accounts, or cash accounts, are hybrids of checking and savings accounts and are typically offered by nonbank financial service providers (such as Wealthfront, which technically isn’t a bank). Because it can combine the best of both a checking and savings account, Wealthfront’s cash account can deliver amazing benefits such as:

The cash account also has FDIC coverage up to $1 million instead of the typical $250,000. This is because Wealthfront sweeps customers’ cash balances into multiple third-party banks. Since Wealthfront uses more than one bank, they have more coverage.

And the best part of Wealthfront’s cash account? In my opinion, it’s the ability to use what they call “Self-Driving Money™”. This is Wealthfront’s vision for helping people achieve their financial goals. Their ultimate goal is to have their software top off customers’ emergency funds, pay all their bills, and invest the rest. It’s legitimately some of the most groundbreaking financial technology I’ve ever seen. Here’s a video discussing it in more detail… Right now I use a function in Wealthfront called “Autopilot”, which automatically transfers excess cash in my account to my investment account. So, if you’re the type of person who constantly finds yourself with too much cash in your checking account (a great problem to have), this feature can ensure you’re regularly investing.

How's Their Customer Service?The best type of customer service is the customer service you never have to use.

I say that because I’ve never had to contact their support team. EVER. For anything. Both Wealthfront’s app and website are intuitive and easy to use. After I was blown away with their features, I encouraged my wife and one of her friends to create accounts and neither of them had any trouble, either. In one of his many podcast interviews, Wealthfront CEO Andy Rachleff bragged about how the company only has a handful of customer service representatives, even though they manage tens of billions of dollars. They’re able to keep their staff small BECAUSE everything else is so good. Put another way, there’s rarely any need for people to contact them. Yet, if you need to get in touch with them, you can always call them or shoot them a message through the website/app. The Bottom Line...Wealthfront is changing the world of personal finance. Their investment accounts - complete with risk score questionnaires and daily tax-loss harvesting - are among the best I’ve ever seen. They’re also some of the lowest-cost providers on the market today, and if you want to get your first $5,000 managed free, make sure you use this link: Wealthfront: Banking, Automated Investing & Free Planning.

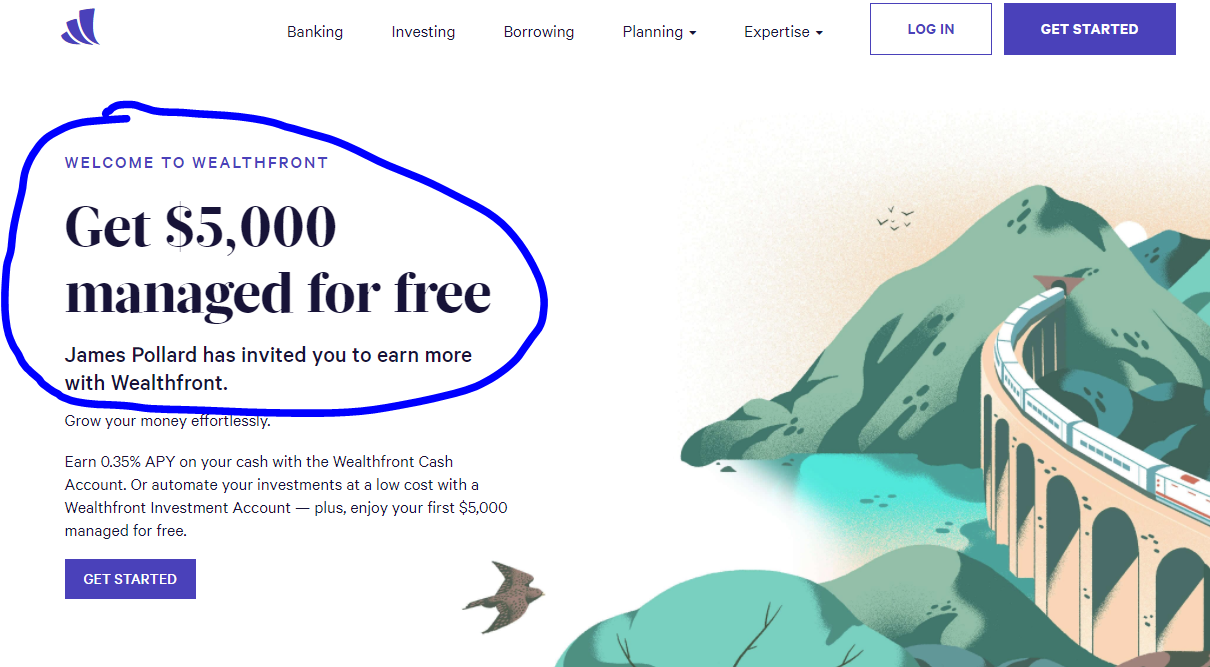

And even if you don’t invest with them, at least check out their awesome cash account. P.S. If you use any of the links above, you’ll be taken to a page that looks like the photo below, showing you that I have personally invited you to get $5,000 managed for free. You’re welcome. 😜 |