Why I Love Northwestern Mutual Financial Advisors: A Confession...Hello - if you’ve never heard of me before, my name is James Pollard. I’m known as the guy who helps financial advisors get more clients.

I’m extremely proud of the work I’ve done over the years to help advisors. I’ve built a sizeable email list, a good-sized podcast audience, and a nice subscriber base with my Inner Circle newsletter. I don’t tell you that to brag about me. In fact, I’m telling you these things to brag about other people. Specifically, Northwestern Mutual financial advisors. Why them? Well, I was going through my email list a few nights ago and I noticed a LOT of Northwestern Mutual email addresses… and they seemed to be more active than financial advisors from other companies. Hmmm… I decided to do some digging. I went back to my email archives and found lots of questions from Northwestern Mutual financial advisors. There’s something about their culture which fosters learning, investing in yourself, and continuous self-improvement. It was great to see. Why Northwestern Mutual Is A Great CompanyNorthwestern Mutual has earned the highest financial strength rating awarded to any U.S. life insurer by all the major rating agencies. This is one of the first things people look for when choosing an insurance company, mainly so they can sleep well at night.

Yet, sheer financial strength isn’t the only thing making this company shine - it’s the people within. After all, a company is only as strong as the people in it, and Northwestern Mutual has been putting its clients first since day one. On their website, I found a cool story about how in 1859, an ox and a passenger train collided in Wisconsin. Two of Northwestern Mutual’s policy owners were killed in the wreck. The claims totaled $3,500. The problem? The two-year-old company only had $2,000 cash on hand. So, President Samuel S. Daggett and his fellow trustees PERSONALLY borrowed the money to settle claims. What an amazing story… and it goes to illustrate how much this company cares about its clients, a culture that is still going strong today.

I’ve been fortunate enough to witness firsthand the genuine, respect, love, and support their financial advisors have for their clients. Because while I’m the one helping financial advisors, the financial advisors are the ones helping their clients. It’s a beautiful thing to watch. Some of the negative reviews about Northwestern Mutual talk about how the financial advisors push whole life insurance policies. However, the financial advisors I’ve encountered are careful to make sure it’s a good fit because whole life honestly isn’t a good fit for some people. And if your financial advisor tries to smash a square peg into a round hole, you should run away as quickly as possible. My Advice For Northwestern Mutual Financial AdvisorsBecause I have such a large following of Northwestern Mutual financial advisors, I decided to create this piece of content geared specifically for them.

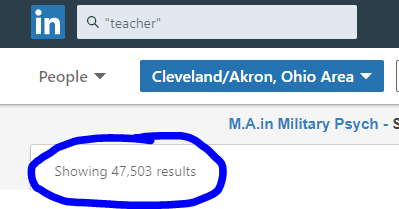

Some of the advisors have told me that Northwestern sends them leads they get from the company website. I don’t know if that’s true or not, but if it is, I would recommend finding some other way to generate leads because there likely isn’t a large amount of traffic funneling back to the individual advisor. Also, other advisors have told me about how they run a free financial analysis for their clients each year. I think this is a great idea and it’s a wonderful service to offer to clients. One of the most things all financial advisors can do - not just Northwestern Mutual’s - is to keep in touch with their clients. After all, one of the biggest reasons people leave their financial advisors is because of a lack of communication. If you’re a financial advisor and you aren’t staying in touch with people after they become clients, you’re doing them (and you) a disservice. If you’re interested in learning more about client retention, I encourage you to check out How To Keep Your Clients. Shameless plug, I know… but it’s a unique resource that’s all about keeping your clients. :-) One thing I wish I could tell all Northwestern Mutual financial advisors is to focus on a niche. Don’t get roped into this idea of selling to your family and friends. You will lose a lot of friends, especially if they aren’t a good fit for your services. I know some “experts” and “gurus” talk about leveraging your “power base” but don’t do it. Selling to your friends and family can be a slippery slope. Because on one hand, they want you to succeed. Yet, they hate to say no, so if they’re not interested they will likely string you along with good intentions because they don’t know how to reject you, their friend, without hurting your feelings. Look at it from the friend’s point of view. You call him up and ask to take him out to lunch or coffee so you can “catch up”. Maybe you even offer to pay. Then, when you get there, you ask him if he’s given any thought to securing his financial future… Say what…?? Also, don’t get suckered into this idea of selling to anyone with a pulse. When you hone in on a niche, you get a clear view of what you need to do to get more clients. For example, one advisor I know has built his business around helping teachers insure themselves and plan for retirement. This advisor is finding his clients and reaching out to them almost exclusively with LinkedIn. When you think about this, it's really a brilliant strategy because he can search for "teachers" on LinkedIn and find people right at his fingertips. Plus, because his headline explains that he specializes in working with them, any teachers who view his profile will see right away that he serves them specifically. Another advisor from Cleveland, Ohio also specialized in working with teachers. However, he emailed me and told me that he couldn't find anyone in that niche. (That alone is an important lesson in attitude... one advisor has a "can do" attitude and the other one has a "can't do" attitude... which one do you think will succeed?) Anyway, I went over to LinkedIn, typed in "teacher" and then refined my search to Cleveland. Guess what I found? 47,503 results. Yes... more than 47 THOUSAND people have the keyword "teacher" in their profile... all in this advisor's location. So, the idea that you can't find your target market is one of the biggest myths out there. And let's assume I'm 90% wrong. That would mean there's only 4,700 teachers who are active on LinkedIn in this guy's geographic area. Let's assume you only turn 1% of THOSE people into clients. That's still 47 new clients. That's nothing to sneeze at and it's a fantastic way to build your business over the long-term. Reality Check...I recently had a conversation with a young financial advisor (not a Northwestern Mutual financial advisor) who told me he was tired of the vague, “build your own success” jargon that’s prevalent in the industry.

I agree with him. Why? Because “personal development” can’t be measured. If you’re serious about growing your book of business and getting more clients, you already understand how important it is to have specific, measurable results. If you’re going to get into the industry, steer clear of the people who will do nothing but try to “inspire!” and “motivate!” you. Instead, focus on the people who can deliver real, tangible results. ALSO READ: 10 Things I Wish All Entry-Level Financial Advisors Knew "Aren't Financial Advisors Just Glorified Salespeople?"Simply blowing off financial advisors as mere salespeople is a bit of an exaggeration. Yes, they get compensated by selling stuff (whether it’s a product, their time, their expertise, etc.) but I would argue that most advisors truly act in the best interest of their clients and are putting them in a substantially better position.

In other words, they’re making a positive impact in the world. Besides, everything is selling. Even receptionists are salespeople to a degree. When you visit a company and are greeted with a warm smile, that receptionist is “selling” you on the idea that the company is a great one to do business with. Everyone has to get paid somewhere. The key is transparency. If you get paid a commission from selling a product, be transparent about it. People don’t have a problem doing business with people who earn commissions - if that was the case, real estate agents wouldn’t exist. People have a problem doing business with people who shy away from clearly explaining how they get compensated when they’re asked. Being A Northwestern Mutual Financial Advisor Teaches You Valuable SkillsNorthwestern Mutual financial advisors have told me that their job has helped them develop two valuable skills…

The first one is the ability to have a face-to-face meeting. Because financial advisors often talk about uncomfortable topics, these meetings can be difficult for some. However, with the proper training, a proven system, and some good ol’ fashioned experience, they get easier. The second skill is the ability to be a self-starter. That means being a Northwestern Mutual financial advisor isn’t for everyone. A self-starter is someone motivated and ambitious enough to do things without being pushed. The best financial advisors are the ones who take initiative and build their business without anyone breathing down their neck. They know what they want and they’re willing to go after it with boundless determination. |