FreshBooks vs. QuickBooks Online: Which Is The Better Accounting Software?If you’re a small business looking to switch your accounting system to a cloud-based service, you’ve probably heard of Freshbooks and QuickBooks Online - these two cloud-based software programs are currently fighting to be recognized as the #1 solution for small business accounting.

Both have unique features - and flaws - that can ultimately make or break your book-keeping pipeline. But which one is better suited for your business? I’ve gathered the facts about each service to help you decide which one is a better fit. FreshBooks OverviewFreshBooks markets itself as “Small business accounting software that makes billing painless”. They target this service to self-employed workers as well as agencies, firms and consultancies.

FeaturesInvoicing: With FreshBooks, you can send recurring invoices, automatically add late fees, send payment reminders, and bill for hours worked. You can also customize your invoices, but the software only provides two templates.

Expenses: You can add recurring bills and mark business expenses as billable very quickly with FreshBooks. To streamline expenses, you can connect your bank account to your FreshBooks account and have your expenses be automatically updated - nice! Time Tracking: Use built-in timers to track your time on a project - FreshBooks also provides at-a-glance charts to see how your team is spending their time on each individual project. Project Management: This feature includes cloud-based storage, deliverable management, team permissions and a chat system to help your team boost productivity. Reports: This is where FreshBooks begins to sink - it offers nine types of reports (profit & loss, sales tax summary, accounts aging, invoice details, expense reports, time entry, payments, trial, and general) but doesn’t offer advanced reports frequently used in accounting. Notice that FreshBooks doesn’t offer core accounting services like payroll, advanced accounting reports, accounts payable, and bank reconciliation. This means FreshBooks isn’t a full-fledged accounting software - however, it delivers very well on the features it does have, so let’s not discount this solution just yet. FreshBooks ACH PaymentsACH is an electronic network which allows people to directly transfer funds between bank accounts. One of the most common examples of ACH payments is a direct deposit program between you and your employer. Instead of sending you a paper check, your employer puts the funds directly into your bank account.

Yet, ACH payments are limited to employers and employees because businesses can take advantage of them as well, and FreshBooks makes it easier than ever. FreshBooks recently introduced Automated Clearing House (ACH) payments (also known as bank transfers) to help their U.S. customers get paid twice as fast with a transaction fee of only 1%. If you're someone who routinely sends out large invoices, this feature will be a game-changer for you. Imagine sending a $10,000 invoice and paying up to 3% in fees somewhere else ($300) vs. only $100 with ACH. Not a bad deal, right? ACH offers a more affordable solution that provides the convenience of an online payment without the higher costs. Plus, you don't have to spend time waiting for checks to be approved, signed, printed, and delivered because with ACH, funds are automatically deposited in your bank account. Another reason why ACH is so nice is because it will allow you to offer better quality, better service, and a better overall experience for both you and your customer. You'll be able to make the process as simple and streamlined as possible. So, to make myself clear (because this is a really cool feature)...

The only "downside" is that it's only available in the United States because ACH is a network that connects all financial institutions across the U.S. So, if you want to check out ACH payments in FreshBooks and see what you think, go here: FreshBooks (Now With ACH Payments). And if you have any questions, you can email support@freshbooks, where people are standing by to help you. Pricing ModelFreshBooks has 3 separate pricing tiers: Lite, Plus, and Premium.

Lite: If you have 5 clients or less, you can get the Lite tier for 15$ a month and get access to the basic features (invoicing, time tracking, expenses) Plus: For 25$ per month you get automatic payment reminders, late fees, accounting reports, recurring invoices, and proposals - plus everything included in the Lite tier. This plan works for up to 50 clients. Premium: This tier doesn’t offer extra features, but allows you to scale up to 500 clients for 50$ a month. Note that you can add extra team members for 10$ each regardless of which plan you’re currently using. Each paid team member has access to all the features and has a unique profile, making it helpful to track project management. They also offer a free trial for 30 days, available for all tiers. Ease of UseOne of FreshBooks winning features is its user-friendliness - since cloud-based accounting is mostly used to save time, FreshBooks definitely scores some points in this category since it is easy to pick up and learn.

The software guides first-time users with pop-up arrows and hints to help you find your way around. Most tasks are simple to perform and don’t require multiple steps and screens. Additionally, FreshBooks is accessible on the go with a powerful mobile app that includes all of its features. User ReviewsThe first thing you see when visiting the FreshBooks website is the boastful claim that 97% of customers recommend FreshBooks.

Although you should take this claim with a grain of salt, seeing as it’s from a biased source, it is true that those who decide to stay with FreshBooks love the service. FreshBooks reviews are rarely negative and those who dislike the software usually don’t have a problem against the usability and customer service directly, but mostly complain about the lack of advanced accounting features.

What customers love the most about FreshBooks:

What customers dislike about FreshBooks:

QuickBooks Online OverviewQuickBooks Online is only one of the many QuickBooks’ software available at Intuit - it is essentially their version of cloud-based accounting. Although it is cloud-based, this software is a fully fledged accounting service powerful enough for even larger businesses.

FeaturesIncome and Expenses: With QuickBooks Online, you can import transactions from your bank, credit cards, PayPal, and Square - these automatically get sorted into the appropriate tax categories, saving you time in the long run. They also allow you to pay multiple bills at the same time and create recurring payments.

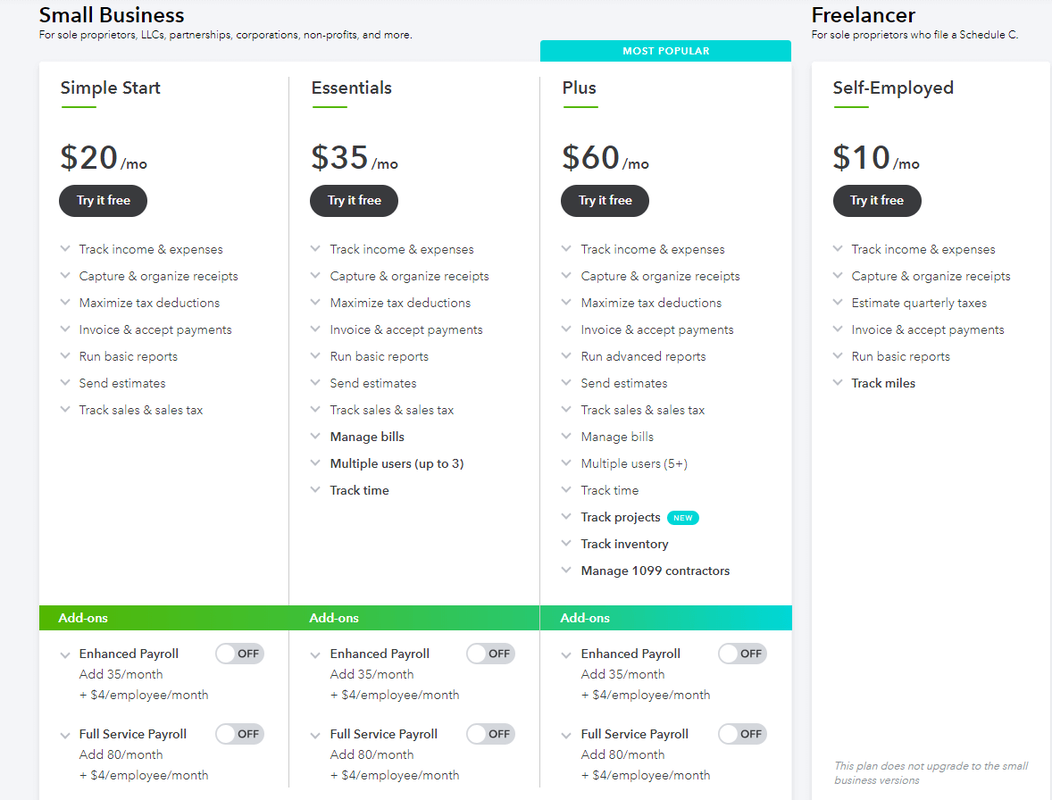

Invoicing and Payments: You can send recurring invoices and send payment reminders as well as customize your invoices with many options. The invoicing feature also integrates with the inventory (but at an extra cost). Inventory: With their inventory feature, you can track your products as well as their costs and get notified when your inventory is low. You can also create purchase orders directly from the software and manage your vendors. Payroll: With automatic tax calculations and free 24-hour direct deposits, payroll with QuickBooks Online is a breeze. Plus, you can file and pay payroll taxes directly from the software. Reports: QuickBooks Online offers advanced reporting features like profit and loss, balance sheets, tax documents, summaries of customer data, inventory reports, and more. Plus, it has a handy drag and drop feature to customize your reports. Time Tracking and Project Management: Not only can you track time and expenses per project (and per employee), QuickBooks Online also shows you how much profit you are making on each individual project. Pricing ModelQuickBooks Online has 3 separate plans: Freelancer, Small Business, and QuickBooks Advanced. The Small Business plan contains 3 tiers: Simple Start, Essentials, and Plus. A free 30-day trial is available as well.

Freelancer: For 10$ a month, you can do the basics like income and expense tracking, invoicing, and basic reporting. Note that this plan cannot upgrade to Small Business plans. Simple Start: For 20$ a month, you get everything from the Freelancer plan, but you can also send estimates and track sales and sales tax. Essentials: This tier costs 35$ and adds bill management plus time tracking. It also allows you up to have up to 3 users. Plus: At 60$ a month, you can track projects, inventory, and manage up to 1099 contractors. QuickBooks Advanced: This tier costs 150$ a month and includes QuickBooks training, a dedicated customer success manager, and allows your team to scale up to 10+ users. Note that this plan is not available for a free trial. Additionally, all Small Business tiers have the following payroll add-ons:

Ease of UseAlthough QuickBooks Online contains a wide variety of advanced features, it comes at the price of user experience. Many users have reported that they have difficulty navigating both the browser version and the mobile app - the latter does not contain all of the features found in the full version and has been found to be quite glitchy on several occasions.

User ReviewsLike FreshBooks, the Intuit website claims that QuickBooks Online is recommended by 98% of its customers.

However, when you take a look at unbiased reviews online, you’ll find many dissatisfied customers complaining about the learning curve and buggy features as well as poor customer service. What customers love the most about QuickBooks Online:

What customers dislike about QuickBooks Online:

Which Is Better?So now that I’ve laid out the features of both options, the big question remains - which one is better?

Well, there’s no easy answer. It really depends on what you’re looking for in your cloud-based accounting software and what your business needs. Feature ComparisonIt’s pretty clear that QuickBooks Online wins over FreshBooks for its number of features. In fact, you could say that FreshBooks is no true accounting software because it lacks so many key components - payroll, accounts payable, inventory management, advanced reports features - that are a key part of bookkeeping for a business.

However, when it comes to project management and mobile features, FreshBooks definitely has an advantage. And not just that - FreshBooks also makes it much easier to mark expenses as billable. All you need to do is check a box, whereas QuickBooks makes you go through several steps and only gives you this option if you’re on the Plus plan. Pricing ComparisonQuickBooks does offer more features, but at a price. Several features that are included in the basic FreshBooks package - such as billable expenses, project management, and bill management - are only available at higher tiers for QuickBooks.

Not only that, but many of these extra features, like payroll, are not included in any of the plans and require an additional fee. However, the same can be said of FreshBooks. With the Lite plan, you have no accounting reports available. For 5$ less, QuickBooks Online’s Freelancer plan allows you to run basic reports. Additionally, each FreshBooks plan is available only for 1 user - each additional user is an extra 10$ - and you’re limited in the number of clients you can register in the software. In fact, FreshBooks’ most expensive plan doesn’t offer any additional features except allow you to have up to 500 clients. User Experience ComparsionWhereas FreshBooks is quite easy to get into and provides an amazing user experience all around, QuickBooks Online runs into some issues here. But with the number of features it contains, users shouldn’t be surprised at its steep learning curve.

Those who take the time to get past the learning curve will eventually benefit in the long run by having access to all the advanced features outlined above, which will allow you to properly analyze your data to understand how your business can become more efficient. However, if you don’t need the advanced features provided by QuickBooks, Freshbooks definitely wins the race for user experience. It does have fewer features, but each one is well executed both on PC and on mobile. Who Is FreshBooks For?Although QuickBooks Online is overall a more robust cloud-based accounting solution, the ease of use and amazing mobile app make FreshBooks a great fit for many businesses. If you fall under the following categories, consider giving FreshBooks a whirl:

Who Is QuickBooks For?If you have any of the following, you should definitely choose QuickBooks Online over FreshBooks or risk missing out on key aspects of a proper accounting pipeline:

The Bottom LineFreshBooks provides an amazing user experience and is great at what it does. Those who use it often have no complaints. However, the company itself states the obvious on their website: it’s not designed for everyone. FreshBooks allows small business owners to save time with a smoother and leaner learning curve.

On the other hand, if you need a clear view of your finances, the reports available with QuickBooks Online will allow you to make efficient adjustments to your business and save both time and money in the long run. If you’re still not convinced about either of these options, why not try them? Both QuickBooks Online and FreshBooks have free 30 day trials (except QuickBooks’ Advanced plan) so you’ve got nothing to lose. Start your free trial of FreshBooks here. |